Question: its not given Ultra Co. Dividends per share (DPS) Dividend payout ratio Market risk premium Stock price using DDM model Number of shares outstanding Total

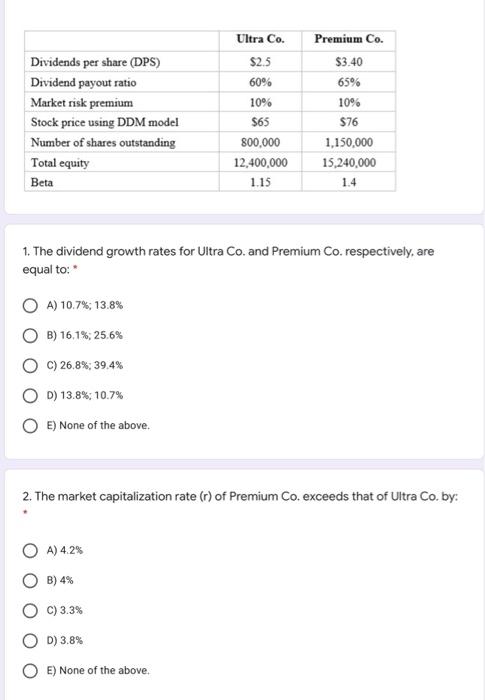

Ultra Co. Dividends per share (DPS) Dividend payout ratio Market risk premium Stock price using DDM model Number of shares outstanding Total equity Beta $2.5 60% 10% $65 800,000 12,400,000 1.15 Premium Co. $3.40 65% 10% $76 1,150,000 15,240,000 1.4 1. The dividend growth rates for Ultra Co. and Premium Co. respectively, are equal to: A) 10.7%; 13.8% B) 16,1%, 25.6% C) 26.8%; 39.4% D) 13.8%; 10.7% OE) None of the above. 2. The market capitalization rate (r) of Premium Co.exceeds that of Ultra Co. by: A) 4.2% B) 4% C) 3.3% D) 3.8% E) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts