Question: Its problem no. 6 under More Practice Problems in the lecture notes for Valuation of Stocks and Bonds. 1. MKT VS. BOOK WEIGHT i. Bonds

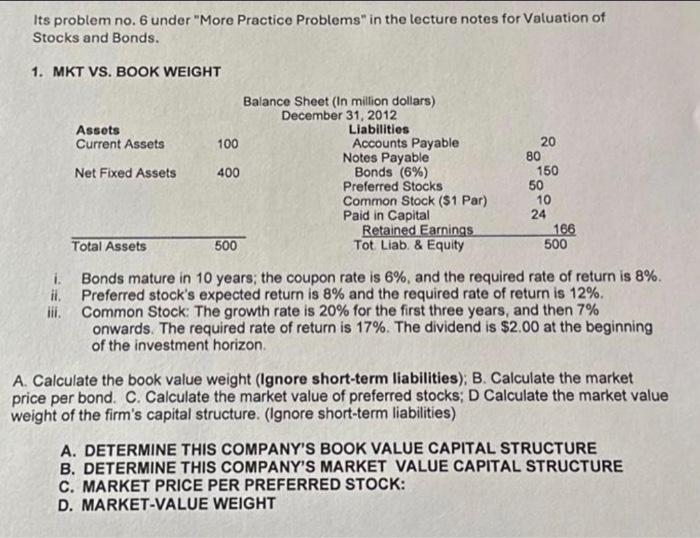

Its problem no. 6 under "More Practice Problems" in the lecture notes for Valuation of Stocks and Bonds. 1. MKT VS. BOOK WEIGHT i. Bonds mature in 10 years; the coupon rate is 6%, and the required rate of return is 8%. ii. Preferred stock's expected return is 8% and the required rate of return is 12%. iii. Common Stock: The growth rate is 20% for the first three years, and then 7% onwards. The required rate of return is 17%. The dividend is $2.00 at the beginning of the investment horizon. A. Calculate the book value weight (Ignore short-term liabilities); B. Calculate the market price per bond. C. Calculate the market value of preferred stocks; D Calculate the market value weight of the firm's capital structure. (Ignore short-term liabilities) A. DETERMINE THIS COMPANY'S BOOK VALUE CAPITAL STRUCTURE B. DETERMINE THIS COMPANY'S MARKET VALUE CAPITAL STRUCTURE C. MARKET PRICE PER PREFERRED STOCK: D. MARKET-VALUE WEIGHT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts