Question: It's saying that the answer is still missing something so can someone please assist me with figuring it out, thank you. Required information Exercise 7-24

It's saying that the answer is still missing something so can someone please assist me with figuring it out, thank you.

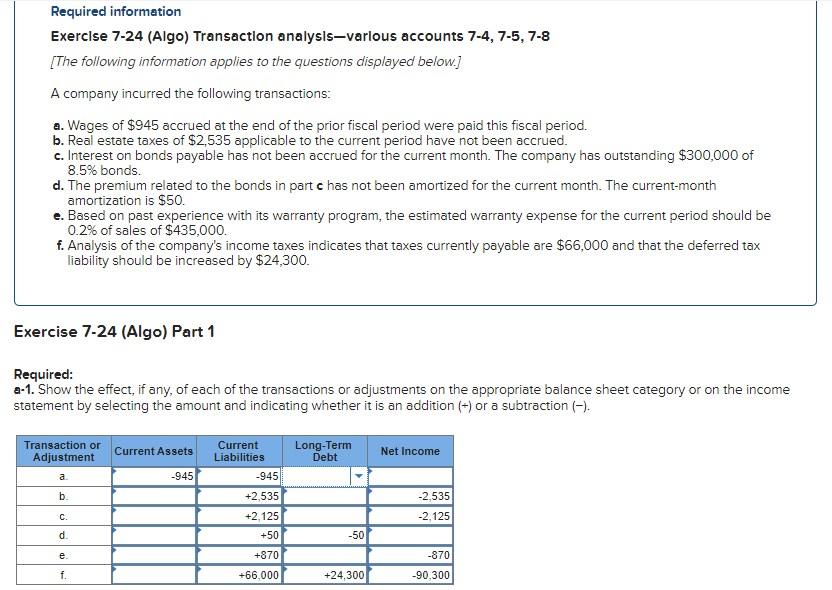

Required information Exercise 7-24 (Algo) Transaction analysls-varlous accounts 7-4, 7-5, 7-8 [The following information applies to the questions displayed below.] A company incurred the following transactions: a. Wages of $945 accrued at the end of the prior fiscal period were paid this fiscal period. b. Real estate taxes of $2,535 applicable to the current period have not been accrued. c. Interest on bonds payable has not been accrued for the current month. The company has outstanding $300,000 of 8.5% bonds. d. The premium related to the bonds in part c has not been amortized for the current month. The current-month amortization is $50. e. Based on past experience with its warranty program, the estimated warranty expense for the current period should be 0.2% of sales of $435,000. f. Analysis of the company's income taxes indicates that taxes currently payable are $66,000 and that the deferred tax liability should be increased by $24,300. Exercise 7-24 (Algo) Part 1 Requirec: 1-1. Show the effect, if any, of each of the transactions or adjustments on the appropriate balance sheet category or on the income tatement by selecting the amount and indicating whether it is an addition (+) or a subtraction ()

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts