Question: Its stock beta is 1.40, while the 5. The Wraith Food Company is an all equity financed firm. risk-free rate is 2% and the

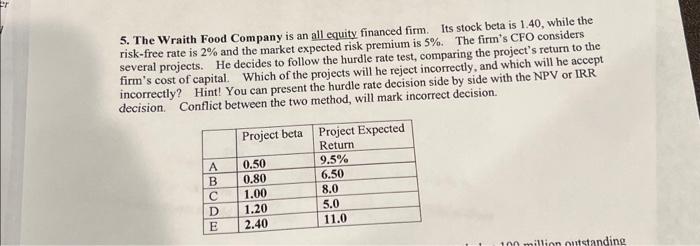

Its stock beta is 1.40, while the 5. The Wraith Food Company is an all equity financed firm. risk-free rate is 2% and the market expected risk premium is 5%. The firm's CFO considers several projects. He decides to follow the hurdle rate test, comparing the project's return to the firm's cost of capital. Which of the projects will he reject incorrectly, and which will he accept incorrectly? Hint! You can present the hurdle rate decision side by side with the NPV or IRR decision. Conflict between the two method, will mark incorrect decision. Project beta A B D E 0.50 0.80 1.00 1.20 2.40 Project Expected Return 9.5% 6.50 8.0 5.0 11.0 00 million outstanding

Step by Step Solution

3.54 Rating (171 Votes )

There are 3 Steps involved in it

To determine which projects the CFO of Wraith Food ... View full answer

Get step-by-step solutions from verified subject matter experts