Question: it's the second time posting it please help me answer correctly. I need it asap, please. thank you Shirt Shack Ltd. is a retail store

it's the second time posting it please help me answer correctly. I need it asap, please. thank you

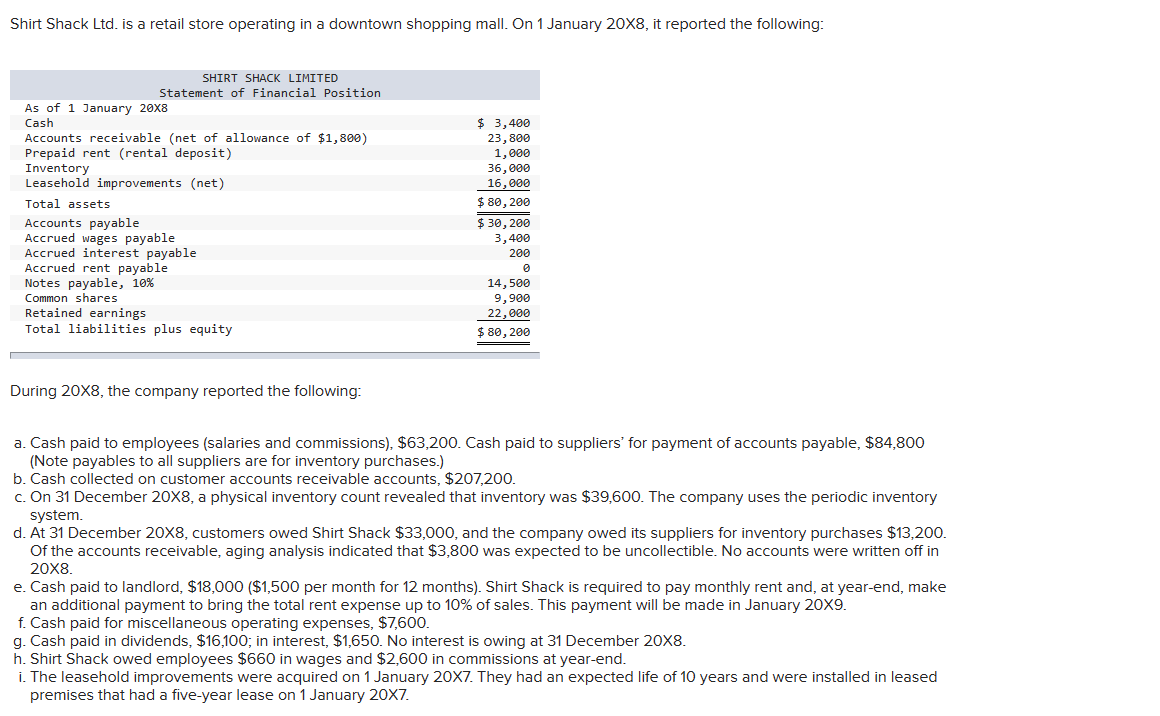

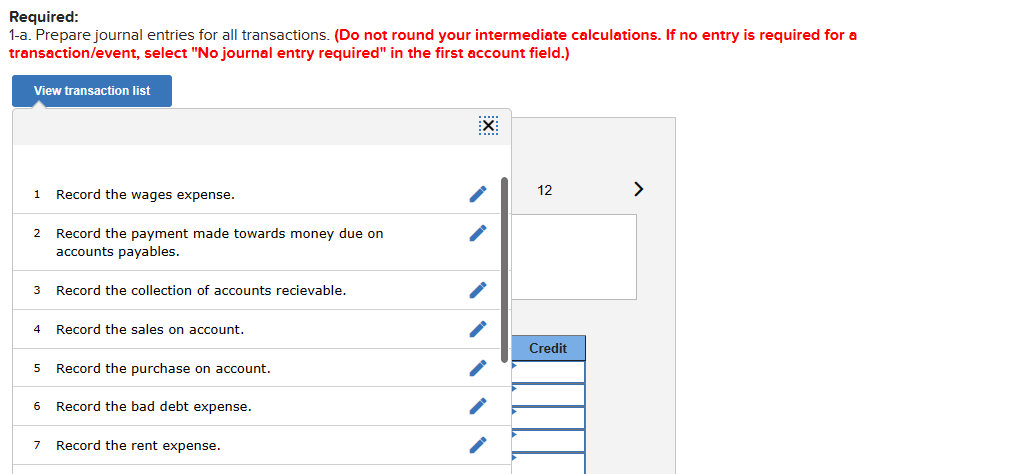

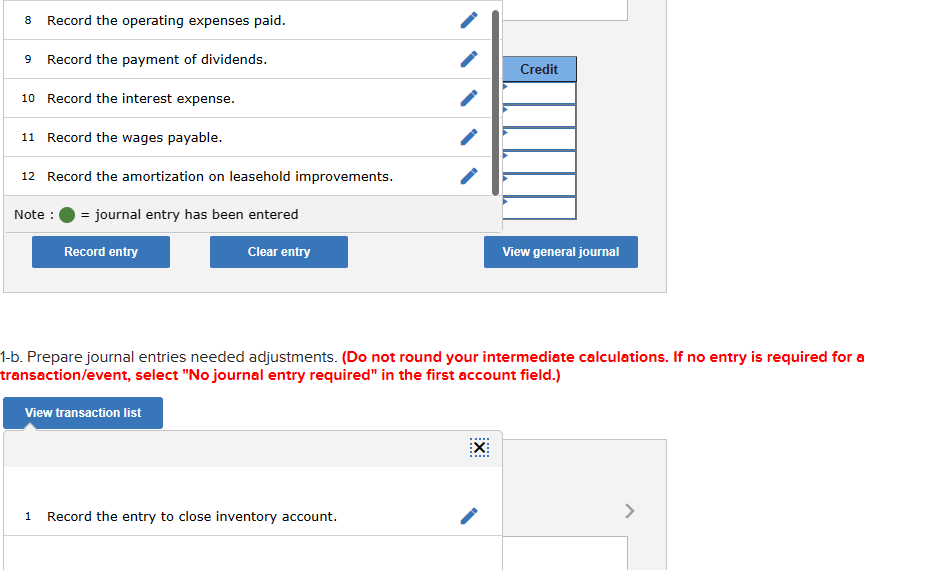

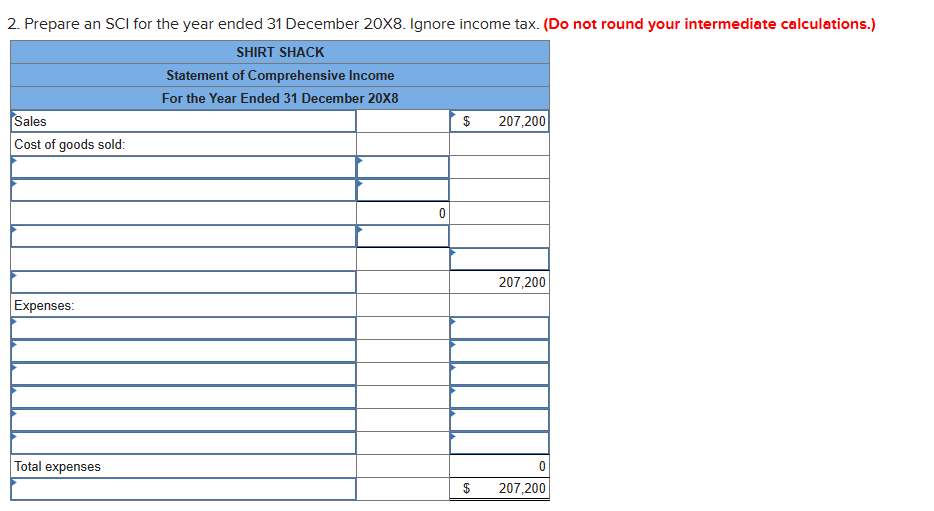

Shirt Shack Ltd. is a retail store operating in a downtown shopping mall. On 1 January 208, it reported the following: During 208, the company reported the following: a. Cash paid to employees (salaries and commissions), $63,200. Cash paid to suppliers' for payment of accounts payable, $84,800 (Note payables to all suppliers are for inventory purchases.) b. Cash collected on customer accounts receivable accounts, $207,200. c. On 31 December 208, a physical inventory count revealed that inventory was $39,600. The company uses the periodic inventory system. d. At 31 December 208, customers owed Shirt Shack $33,000, and the company owed its suppliers for inventory purchases $13,200. Of the accounts receivable, aging analysis indicated that $3,800 was expected to be uncollectible. No accounts were written off in 208. e. Cash paid to landlord, $18,000 ( $1,500 per month for 12 months). Shirt Shack is required to pay monthly rent and, at year-end, make an additional payment to bring the total rent expense up to 10% of sales. This payment will be made in January 209. f. Cash paid for miscellaneous operating expenses, $7,600. g. Cash paid in dividends, $16,100; in interest, $1,650. No interest is owing at 31 December 208. h. Shirt Shack owed employees $660 in wages and $2,600 in commissions at year-end. i. The leasehold improvements were acquired on 1 January 20X7. They had an expected life of 10 years and were installed in leased premises that had a five-year lease on 1 January 207. Required: 1-a. Prepare journal entries for all transactions. (Do not round your intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 12 Record the amortization on leasehold improvements. Note: O journal entry has been entered -b. Prepare journal entries needed adjustments. (Do not round your intermediate calculations. If no entry is required for a ransaction/event, select "No journal entry required" in the first account field.) 2. Prepare an SCI for the year ended 31 December 20X8. Ignore income tax. (Do not round your intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts