Question: it's the second time posting it please help me answer correctly according to the question. I need it asap, please. thank you The following transactions

it's the second time posting it please help me answer correctly according to the question. I need it asap, please. thank you

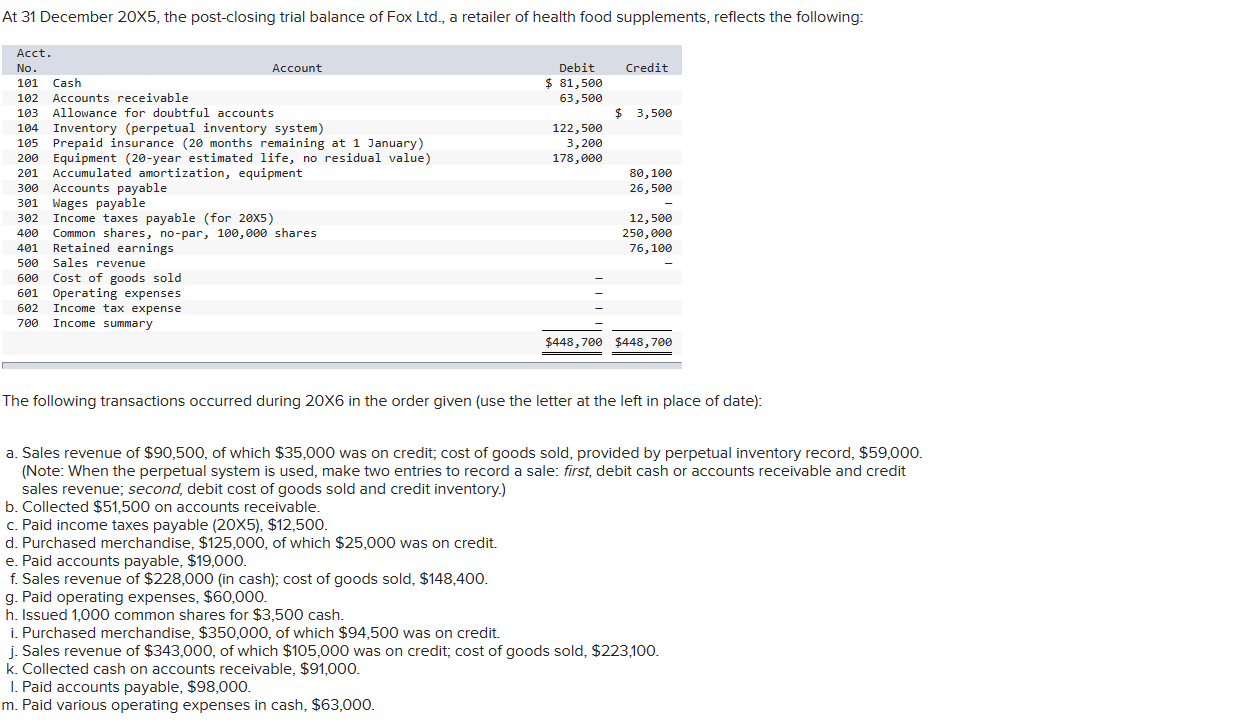

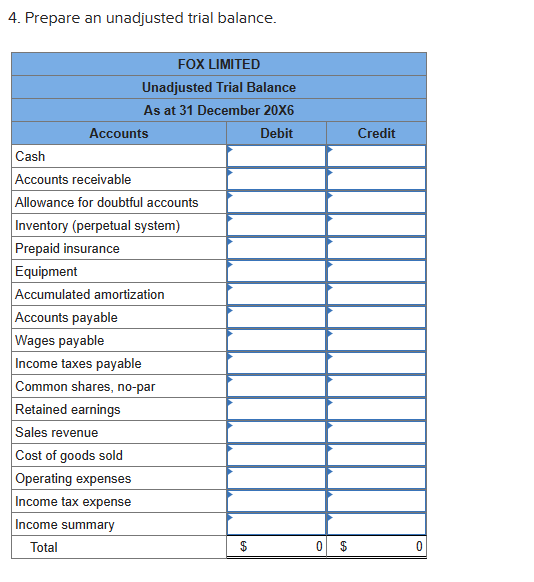

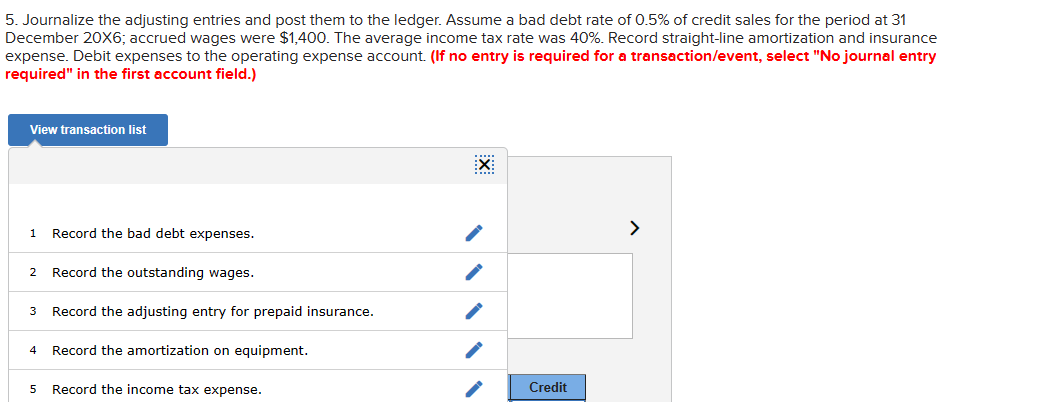

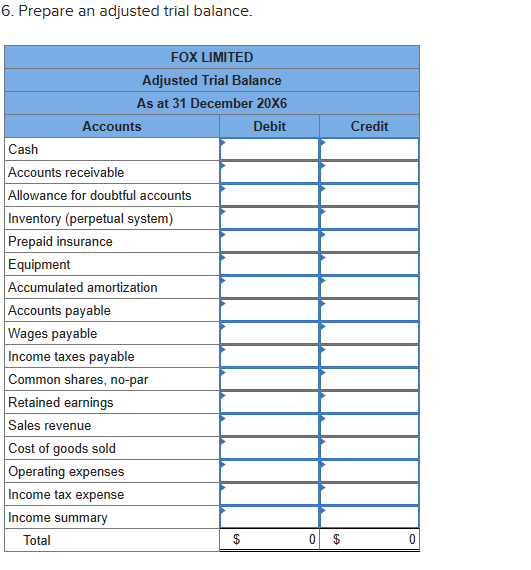

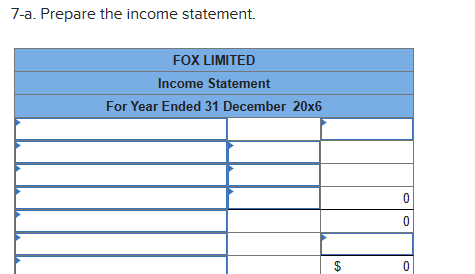

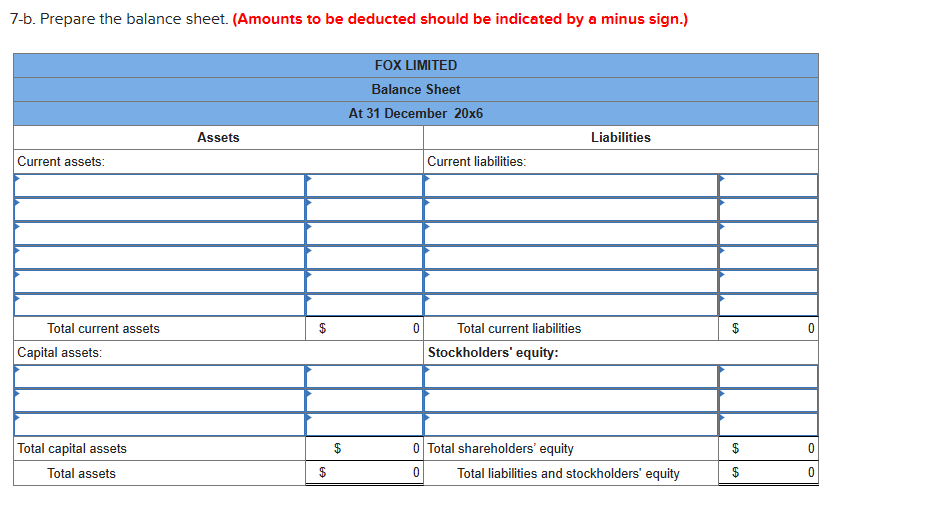

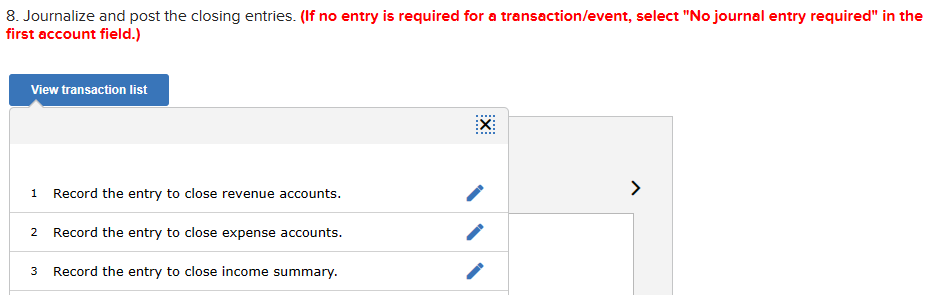

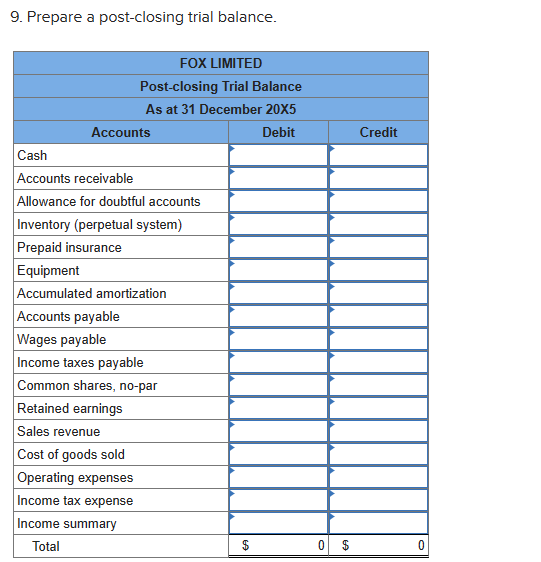

The following transactions occurred during 206 in the order given (use the letter at the left in place of date): a. Sales revenue of $90,500, of which $35,000 was on credit; cost of goods sold, provided by perpetual inventory record, $59,000. (Note: When the perpetual system is used, make two entries to record a sale: first, debit cash or accounts receivable and credit sales revenue; second, debit cost of goods sold and credit inventory.) b. Collected $51,500 on accounts receivable. c. Paid income taxes payable (205),$12,500. d. Purchased merchandise, $125,000, of which $25,000 was on credit. e. Paid accounts payable, $19,000. f. Sales revenue of $228,000 (in cash); cost of goods sold, $148,400. g. Paid operating expenses, $60,000. h. Issued 1,000 common shares for $3,500 cash. i. Purchased merchandise, $350,000, of which $94,500 was on credit. j. Sales revenue of $343,000, of which $105,000 was on credit; cost of goods sold, $223,100. k. Collected cash on accounts receivable, $91,000. I. Paid accounts payable, $98,000. m. Paid various operating expenses in cash, $63,000. 4 Prenare an nadiugted trial halance 5. Journalize the adjusting entries and post them to the ledger. Assume a bad debt rate of 0.5% of credit sales for the period at 31 December 20X6; accrued wages were $1,400. The average income tax rate was 40%. Record straight-line amortization and insurance expense. Debit expenses to the operating expense account. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 6. Prepare an adjusted trial balance. 7-a. Prepare the income statement. 7-b. Prepare the balance sheet. (Amounts to be deducted should be indicated by a minus sign.) 8. Journalize and post the closing entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) \begin{tabular}{|l|} \hline 1 Record the entry to close revenue accounts. \\ \hline 2 Record the entry to close expense accounts. \\ \hline 3 Record the entry to close income summary. \end{tabular} 9. Prepare a post-closing trial balance. The following transactions occurred during 206 in the order given (use the letter at the left in place of date): a. Sales revenue of $90,500, of which $35,000 was on credit; cost of goods sold, provided by perpetual inventory record, $59,000. (Note: When the perpetual system is used, make two entries to record a sale: first, debit cash or accounts receivable and credit sales revenue; second, debit cost of goods sold and credit inventory.) b. Collected $51,500 on accounts receivable. c. Paid income taxes payable (205),$12,500. d. Purchased merchandise, $125,000, of which $25,000 was on credit. e. Paid accounts payable, $19,000. f. Sales revenue of $228,000 (in cash); cost of goods sold, $148,400. g. Paid operating expenses, $60,000. h. Issued 1,000 common shares for $3,500 cash. i. Purchased merchandise, $350,000, of which $94,500 was on credit. j. Sales revenue of $343,000, of which $105,000 was on credit; cost of goods sold, $223,100. k. Collected cash on accounts receivable, $91,000. I. Paid accounts payable, $98,000. m. Paid various operating expenses in cash, $63,000. 4 Prenare an nadiugted trial halance 5. Journalize the adjusting entries and post them to the ledger. Assume a bad debt rate of 0.5% of credit sales for the period at 31 December 20X6; accrued wages were $1,400. The average income tax rate was 40%. Record straight-line amortization and insurance expense. Debit expenses to the operating expense account. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 6. Prepare an adjusted trial balance. 7-a. Prepare the income statement. 7-b. Prepare the balance sheet. (Amounts to be deducted should be indicated by a minus sign.) 8. Journalize and post the closing entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) \begin{tabular}{|l|} \hline 1 Record the entry to close revenue accounts. \\ \hline 2 Record the entry to close expense accounts. \\ \hline 3 Record the entry to close income summary. \end{tabular} 9. Prepare a post-closing trial balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts