Question: It's urgent. Also please provide solutions Please use the methods indicated below to analyze this two investment projects. Project 1 Time (year) CF 0 -10,000

It's urgent. Also please provide solutions

It's urgent. Also please provide solutions

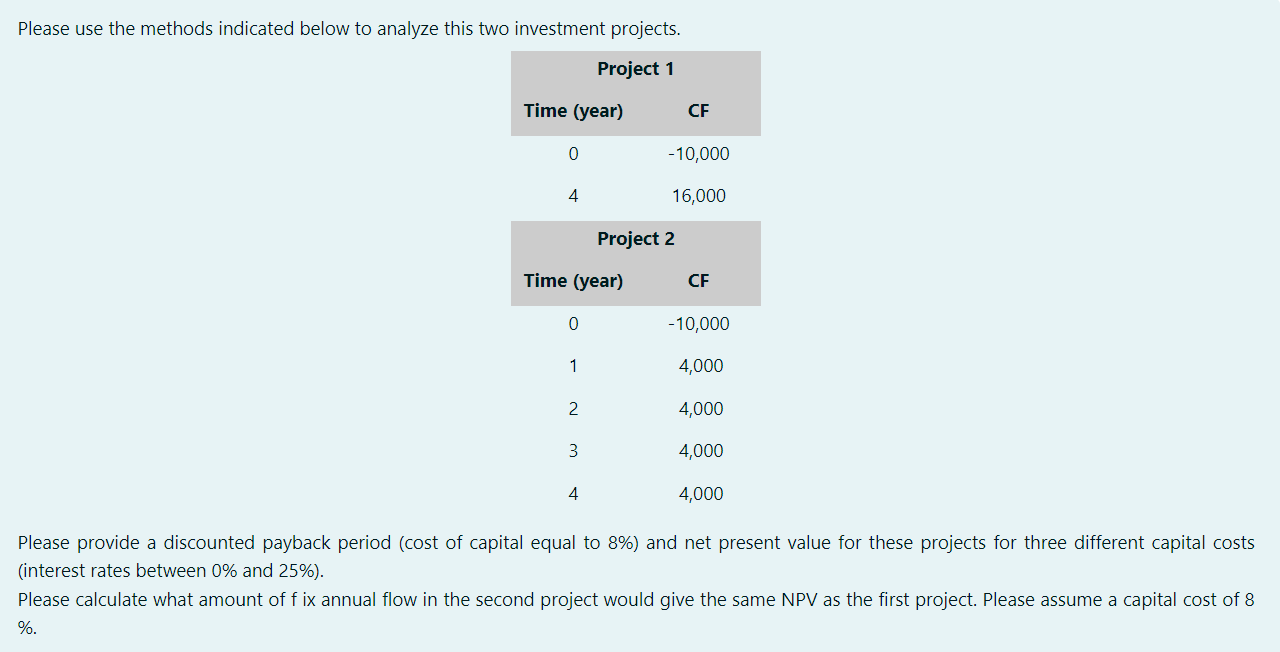

Please use the methods indicated below to analyze this two investment projects. Project 1 Time (year) CF 0 -10,000 4 16,000 Project 2 Time (year) CF 0 -10,000 1 4,000 2 4,000 3 4,000 4 4,000 Please provide a discounted payback period (cost of capital equal to 8%) and net present value for these projects for three different capital costs interest rates between 0% and 25%). Please calculate what amount of fix annual flow in the second project would give the same NPV as the first project. Please assume a capital cost of 8 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts