Question: IV. Preparing a pension work sheet. (15 points) The accountant for Nashville Corporation has developed the following information for the company's defined benefit pension plan

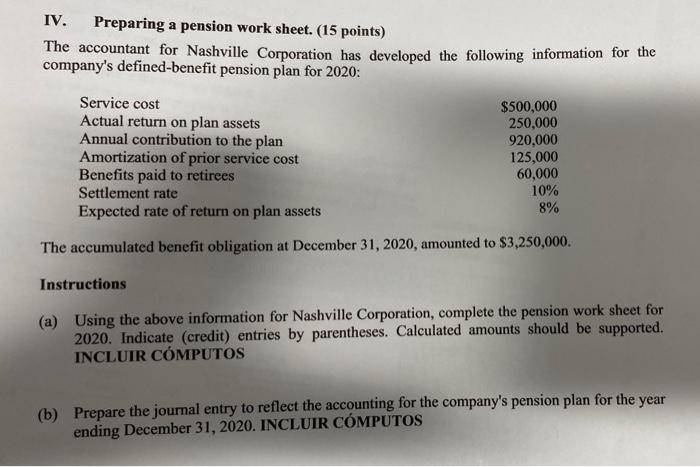

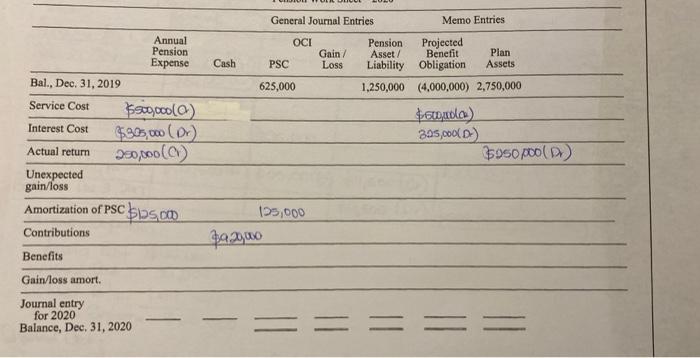

IV. Preparing a pension work sheet. (15 points) The accountant for Nashville Corporation has developed the following information for the company's defined benefit pension plan for 2020: Service cost $500,000 Actual return on plan assets 250,000 Annual contribution to the plan 920,000 Amortization of prior service cost 125,000 Benefits paid to retirees 60,000 Settlement rate 10% Expected rate of return on plan assets 8% The accumulated benefit obligation at December 31, 2020, amounted to $3,250,000. Instructions (a) Using the above information for Nashville Corporation, complete the pension work sheet for 2020. Indicate (credit) entries by parentheses. Calculated amounts should be supported. INCLUIR CMPUTOS (b) Prepare the journal entry to reflect the accounting for the company's pension plan for the year ending December 31, 2020. INCLUIR CMPUTOS General Journal Entries Memo Entries Gain/ Loss Pension Projected Asset/ Benefit Plan Liability Obligation Assets 1,250,000 (4,000,000) 2,750,000 ) 205,000(D) $950 pool) Annual OCI Pension Expense Cash PSC Bal., Dec 31, 2019 625,000 Service Cost $80,000(0) Interest Cost $305,000 (D) Actual return 390,000() Unexpected gain/loss Amortization of PSC 55.00 105,000 Contributions Benefits Gain/loss amort. Journal entry for 2020 Balance, Dec 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts