Question: ive asked for help on this question with different numbers twice, both have been wrong, please help and explain the steps, will give thumbs up

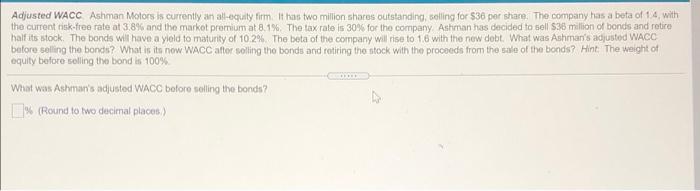

Adjusted WACC Ashman Motors is currently an all-equity firm. It has two million shares outstanding, selling for S36 per share. The company has a bota of 14, with the current risk free rate at 3.8% and the market premium at 8.1%. The tax rate is 30% for the company Ashman has decided to sell S36 million of bonds and retice half its stock. The bonds will have a yield to maturity of 10,2% The beta of the company will rise to 16 with the new debt. What was Ashman's adjusted WACO balore selling the bondi? What is ito now WACC attor solling the bonds and retiring the stock with the proceeds from the sale of the bonds? Hint. The weight of equity before selling the bond is 100% What was Ashman's adjusted WACC boforo rolling the bonds % (Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts