Question: I've seen this answered but it is always using Excel. How do I solve this WITHOUT Excel or any kind of computer program? 12. Aaron

I've seen this answered but it is always using Excel. How do I solve this WITHOUT Excel or any kind of computer program?

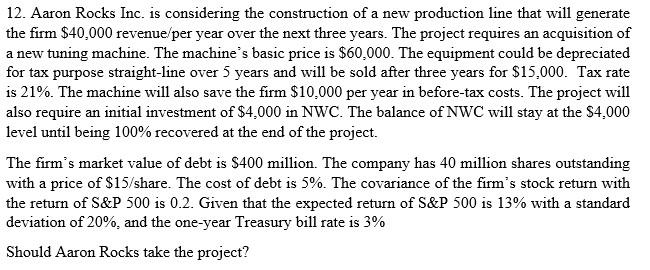

12. Aaron Rocks Inc. is considering the construction of a new production line that will generate the firm $40,000 revenue/per year over the next three years. The project requires an acquisition of a new tuning machine. The machine's basic price is $60,000. The equipment could be depreciated for tax purpose straight-line over 5 years and will be sold after three years for $15,000. Tax rate is 21%. The machine will also save the firm $10,000 per year in before-tax costs. The project will also require an initial investment of $4,000 in NWC. The balance of NWC will stay at the $4.000 level until being 100% recovered at the end of the project. The firm's market value of debt is $400 million. The company has 40 million shares outstanding with a price of $15/share. The cost of debt is 5%. The covariance of the firm's stock return with the return of S&P 500 is 0.2. Given that the expected return of S&P 500 is 13% with a standard deviation of 20%, and the one-year Treasury bill rate is 3% Should Aaron Rocks take the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts