Question: I've submitted 3 different questions for this same problem: The Cuba Project Santiago Old Car Parts (SOCP) is considering a new venture (or project) that

I've submitted 3 different questions for this same problem:

The Cuba Project

Santiago Old Car Parts (SOCP) is considering a new venture (or project) that hopes to take advantage of the opening of business investment in Cuba. Using proprietary software, CNC milling machines, and the latest technology in 3D printing, the firm can design and fabricate affordable car parts for old, classic cars that have no other sources of parts.

The market study has been completed and the interns have made the following forecasts for the project.

? Initial investment:

o SOCP has found a production site and will purchase the equipment to support the

project. The equipment, including shipping and installation is expected to cost (t=0) $

7,398,000.

o The investment in Inventory needed for the project is expected to be $575,000 with an

expected increase in Accounts Payable of $259,000.

o The equipment falls into the IRS 5-year class life using the MACRS depreciation method

with the 1?2 year convention. The IRS depreciation table is:

Year Depreciation (% of depreciable basis

1 20.00%

2 32.00%

3 19.20%

4 11.52%

5 11.52%

6 5.76%

- ?The program (project) is planned to continue for 9 years. At the end of the project the equipment will be salvaged (sold). The forecasts predict that the equipment can be sold then for $265,000.

- ?The Net Operating Working Capital (Inventory and Accounts Payable) is expected to be liquidated at the end of the project (Year 9).

- ?The project is expected to operate as a new division and the projection for new sales revenues is:

-Estimated sales in year 1:$1,750,000

-Sales are expected to grow by

? 25% in year 2,

? 20% in year 3,

? 15% per year in years 4 and 5, and then

? 5% per year thereafter.

-? Production cost forecasts are:

o Fixedcosts:$200,000peryear.

o Annual variable costs: 45% of revenue.

-? SOCP has a marginal tax rate (T) of 34%.

- ?The firm's beta is 1.43,

- ?The risk free rate of return (rrf) = 3.05%,

- ?The market risk premium (rm - rrf) = 4.25%,

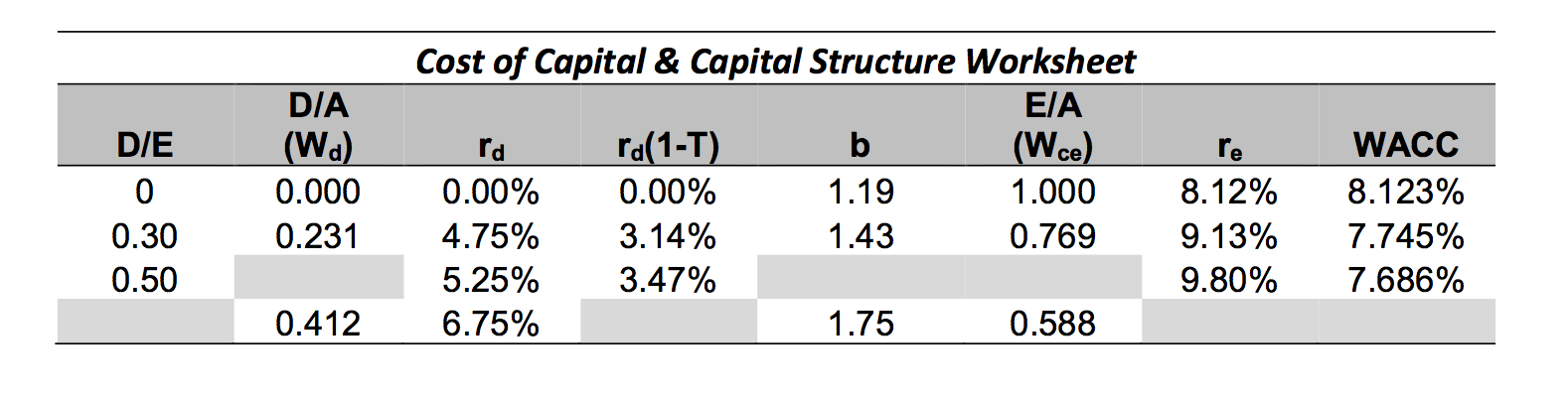

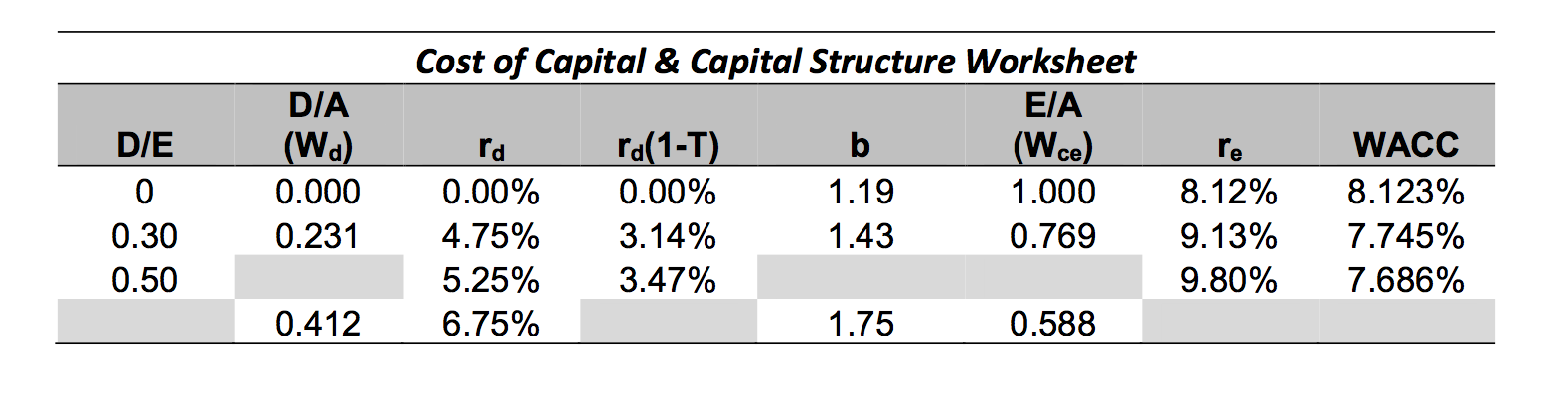

- ?The firm's analysts have partially prepared information for SOCP's cost of capital at various

levels of debt and equity:

Cost of Capital & Capital Structure Worksheet (See chart at bottom)

? Where:

o rd = before tax cost of debt,

o rd(1-T) = after tax cost of debt,

o b=beta,

o re = cost of common equity,

o Wd = Weight of debt,

o Wce = Weight of common equity,

- ?SOCP has the following levels of debt and common equity (market values):

- o Debt: $250,000,000 o Equity: $833,333,333 o Total Capital: $1,083,333,333

- ?SOCP's management utilizes risk adjusted hurdle rates for evaluating capital budgeting projects. All potential projects are classified using a five level classification system:

Risk Level Class Hurdle Rate

A Low risk WACC - 2

B Below average risk WACC - 1

C Normal risk Equal to the WACC

D Above average risk WACC + 1

E High risk WACC + 2

?

The Cuba project is considered to be "High risk".

Given all of the information provided in this case:

(Show your work, calculations, and explain your answers well)

- ?What is the firm's current Weighted Average Cost of Capital (WACC) at its current capital structure.

- ?Capital Structure theory addresses finding a firm's optimal capital structure. How do you determine the optimal capital structure?

- ?What is the SOCP's optimal capital structure (Complete the Cost of Capital & Capital Structure worksheet)?

- ?Define Hurdle rate. Based on SOCP'scurrentcapital structure, what is the appropriate Hurdle Rate for the Cuba project?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts