Question: I've tried this problem like four times but I keep getting something wrong and I'm not quite sure what it is. Here is the problem:

I've tried this problem like four times but I keep getting something wrong and I'm not quite sure what it is.

Here is the problem:

In 2020, Adam, your brother in law, has the following items below. Adam is not sure how much tax refund that he will receive so he asks you, an accounting student to help him with estimating his tax refund. Use the tax calculation spreadsheet to help Adam figure out his refund for 2020.

i. Salary: $70k

ii. Income from his Airbnb rental: $10k

iii. Tax withheld in 2020 (Prepayment): $15,400

iv. Adam has a total itemized deduction of $200 (from his Goodwills donation)

Adam is married and has 1 child who is qualified for a $2000 child tax credit. Adams wife (your sister) is a stay at home mom and do not have any source of income in 2020.

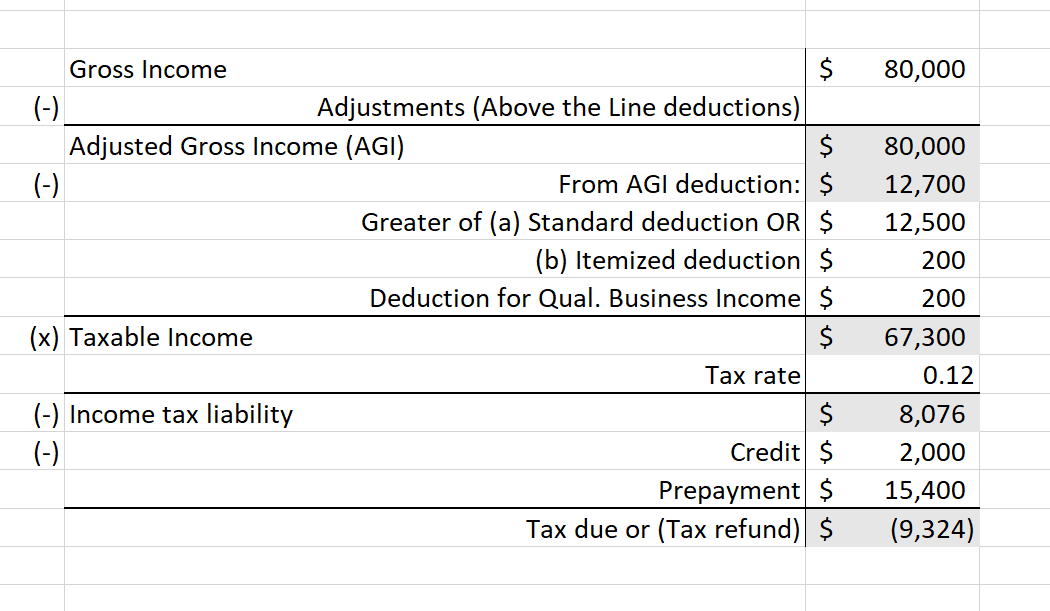

This is what I have entered into my Excel calculation sheet:

Here's the Excel template before inputting anything:

Here's the Excel template before inputting anything:

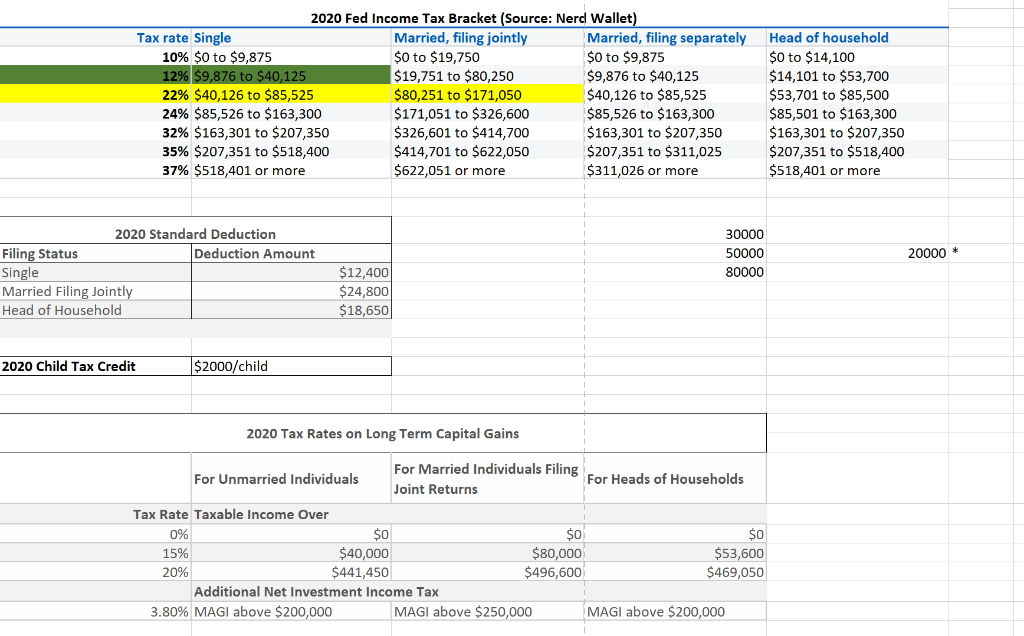

Edit: This is the only information that I have about the tax rates:

If you could show your calculations and explain where I went wrong, that would be great.

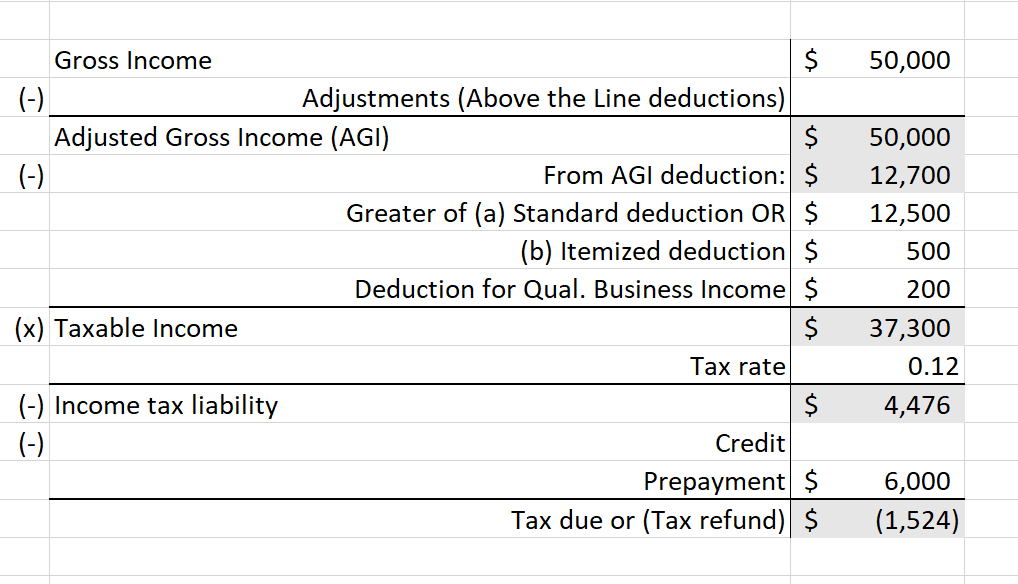

80,000 80,000 12,700 12,500 200 Gross Income $ (-) Adjustments (Above the Line deductions) Adjusted Gross Income (AGI) $ (-) From AGI deduction: $ Greater of (a) Standard deduction OR $ (b) Itemized deduction $ Deduction for Qual. Business Income $ (x) Taxable Income $ Tax rate (-) Income tax liability $ (-) Credit $ Prepayment $ Tax due or (Tax refund) $ 200 67,300 0.12 8,076 2,000 15,400 (9,324) 50,000 Gross Income $ (-) Adjustments (Above the Line deductions) Adjusted Gross Income (AGI) $ (-) From AGI deduction: $ Greater of (a) Standard deduction OR $ (b) Itemized deduction $ Deduction for Qual. Business Income $ (x) Taxable Income $ Tax rate (-) Income tax liability $ (-) Credit Prepayment $ Tax due or (Tax refund) $ 50,000 12,700 12,500 500 200 37,300 0.12 4,476 6,000 (1,524) 2020 Fed Income Tax Bracket (Source: Nerd Wallet) Tax rate Single Married, filing jointly Married, filing separately 10% $0 to $9,875 $0 to $19,750 $0 to $9,875 12% $9,876 to $40,125 $19,751 to $80,250 $9,876 to $40,125 22% $40,126 to $85,525 $80,251 to $171,050 $40,126 to $85,525 24% $85,526 to $163,300 $171,051 to $326,600 $85,526 to $163,300 32% $163,301 to $207,350 $326,601 to $414,700 $ 163,301 to $207,350 35% $207,351 to $518,400 $414,701 to $622,050 $207,351 to $311,025 37% $518,401 or more $622,051 or more $311,026 or more Head of household $0 to $14,100 $14,101 to $53,700 $53,701 to $85,500 $85,501 to $163,300 $163,301 to $207,350 $207,351 to $518,400 $518,401 or more 2020 Standard Deduction Filing Status Deduction Amount Single Married Filing Jointly Head of Household 30000 50000 80000 20000 * $12,400 $24,800 $18,650 2020 Child Tax Credit $2000/child 2020 Tax Rates on Long Term Capital Gains For Married Individuals Filing For Unmarried Individuals For Heads of Households Joint Returns Tax Rate Taxable income Over 0% $0 $0 $0 15% $40,000 $80,000 $53,600 20% $441,450 $496,600 $469,050 Additional Net Investment Income Tax 3.80% MAGI above $200,000 MAGI above $250,000 MAGI above $200,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts