j) Assume that one of these portfolio's is the Market Portfolio and all portfolios, except Portfolio...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

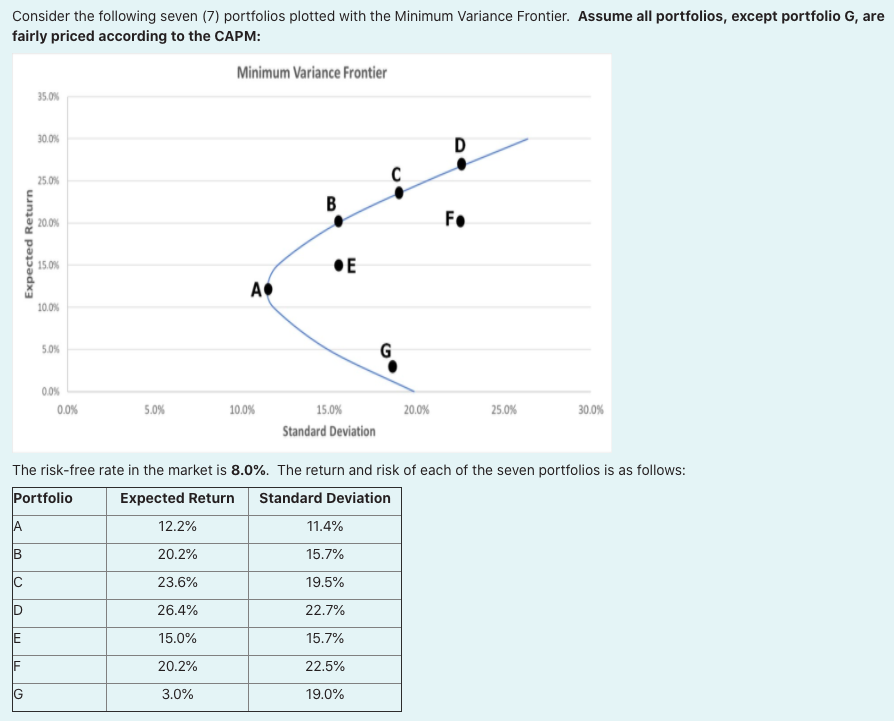

j) Assume that one of these portfolio's is the Market Portfolio and all portfolios, except Portfolio G, are fairly priced according to the CAPM. Derive the Treynor Measure for these fairly priced assets and explain why they are equal. (1.5 marks) Enter your answer to 3 decimal places en if your answer is 04577 enter as 0.158 Consider the following seven (7) portfolios plotted with the Minimum Variance Frontier. Assume all portfolios, except portfolio G, are fairly priced according to the CAPM: A B C D E IF Expected Return G 35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% 0.0% 5.0% Minimum Variance Frontier 12.2% 20.2% 23.6% 26.4% 15.0% 20.2% 3.0% A 10.0% B E 15.0% Standard Deviation C 11.4% 15.7% 19.5% 22.7% 15.7% 22.5% 19.0% G 20.0% D The risk-free rate in the market is 8.0%. The return and risk of each of the seven portfolios is as follows: Portfolio Expected Return Standard Deviation Fo 25.0% 30.0% j) Assume that one of these portfolio's is the Market Portfolio and all portfolios, except Portfolio G, are fairly priced according to the CAPM. Derive the Treynor Measure for these fairly priced assets and explain why they are equal. (1.5 marks) Enter your answer to 3 decimal places en if your answer is 04577 enter as 0.158 Consider the following seven (7) portfolios plotted with the Minimum Variance Frontier. Assume all portfolios, except portfolio G, are fairly priced according to the CAPM: A B C D E IF Expected Return G 35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% 0.0% 5.0% Minimum Variance Frontier 12.2% 20.2% 23.6% 26.4% 15.0% 20.2% 3.0% A 10.0% B E 15.0% Standard Deviation C 11.4% 15.7% 19.5% 22.7% 15.7% 22.5% 19.0% G 20.0% D The risk-free rate in the market is 8.0%. The return and risk of each of the seven portfolios is as follows: Portfolio Expected Return Standard Deviation Fo 25.0% 30.0%

Expert Answer:

Answer rating: 100% (QA)

Absolutely Heres the solution for Treynor Measure of fairly priced assets Treynor Measure for Fairly Priced Assets When all portfolios except Portfolio G are fairly priced according to the CAPM it imp... View the full answer

Related Book For

Posted Date:

Students also viewed these finance questions

-

can someone solve this Modern workstations typically have memory systems that incorporate two or three levels of caching. Explain why they are designed like this. [4 marks] In order to investigate...

-

) Consider integer division of one two's-complement binary number by another. Programming languages may vary in the result when one argument is negative. What differing conventions might they be...

-

The balance sheet data for Alans Lightworks, Corp., at August 31, 2012, and September 30, 2012, follow: Requirement 1. The following are three independent assumptions about the business during...

-

Discus the Ten Strategies of a World-Class Computer Security Incident Response Team, Research and find at least three (3) more recommendations needed to organize, fund and introduce a CSIRT. Research...

-

Based on the data presented in Exercise 6-26, journalize Bitone Co.s entries for (a) The purchase, (b) The return of the merchandise for credit, and (c) The payment of the invoice within the discount...

-

In April 2023, an article in the Economist discussed Apples plans to increase the number of iPhones manufactured in India. According to the article, Apple is scrambling to avoid having all its apples...

-

At the end of 2012, Sawyer Company is conducting an impairment test and needs to develop a fair value estimate for machinery used in its manufacturing operations. Given the nature of Sawyer??s...

-

1. In the given reaction, XYZ3 2. 3. 4. 5. X+Y+3Z If one mole of each of X and Y with 0.05 mol of Z gives compound XYZ3. (Given: Atomic masses of X, Y and Z are 10, 20 and 30 amu, respectively.) The...

-

1. How will you characterize Tupperwares distribution strategy in relation to the theoretical models? 2. What are the advantages and disadvantages of Tupperwares distribution model? 3. How do you...

-

Evaluate the line integral f (1x - y) dx + (x + y) dy, where C = C UC, here C: + y = 4 and C: x + y = 1.

-

In the language L((a+b)(a+b+0 + 1 )*) abb01 is a valid string. True False

-

In a grammar G = (V.T. P. S), in production A a, a is in (VUT). True False

-

In which Consensus Algorithm,the coins are 'burned'? a . . PoS b . . PoW c . . PoB d . . PoC

-

Which one of the following is true for form data in Node.js ? ? 1 1 point REQ.BODY contains data submitted using the GET method. REQ.QUERY contains data submitted using POST. You need to require...

-

(7) Knuth class of a tableau T is defined by KT determine the size of KT and also determine KT. = {w such that P(w) = T}. For T = 1345 26

-

Plastic bags at food stores have become ubiquitous. Often recycling advocates point to plastic bags as the prototype of wastage and pollution, as stuff that clogs up our landfills. In retaliation,...

-

Quadrilateral EFGH is a kite. Find mG. E H <105 G 50 F

-

Assuming that you do the analysis in Problem 8 with both firm value and operating income, what are the reasons for the differences you might find in the results, using each? When would you use one...

-

Consider again the project described in Problem 1 (assume that the depreciation reverts to a straight line). Assume that 40% of the initial investment for the project will be financed with debt, with...

-

You are examining the viability of a capital investment in which your firm is interested. The project will require an initial investment of $500,000 and the projected revenues are $400,000 a year for...

-

Donna Corporation manufactures custom cabinets for kitchens. It uses a normalcosting system with two direct-cost categoriesdirect materials and direct manufacturing laborand one indirect-cost pool,...

-

Donna Corporation manufactures custom cabinets for kitchens. It uses a normalcosting system with two direct-cost categoriesdirect materials and direct manufacturing laborand one indirect-cost pool,...

-

Donna Corporation manufactures custom cabinets for kitchens. It uses a normalcosting system with two direct-cost categoriesdirect materials and direct manufacturing laborand one indirect-cost pool,...

Study smarter with the SolutionInn App