Question: Ja mis US based MNC whose foreign subsidiary had pretax income of $50.000,all after tax income is available in the form of dividends to the

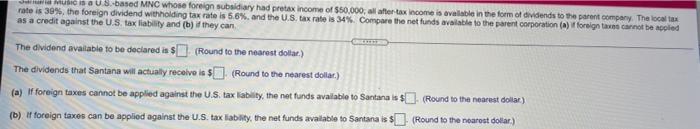

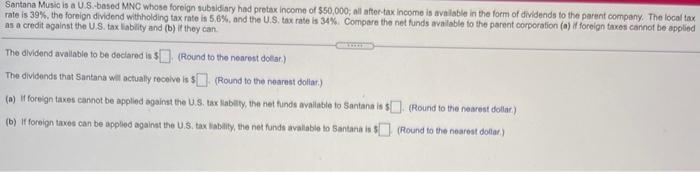

Ja mis US based MNC whose foreign subsidiary had pretax income of $50.000,all after tax income is available in the form of dividends to the parent company. The local tax rate is 30%, the foreign dividend withholding tax rate is 5.6%, and the U.S. tax rate is 34% Compare the net funds available to the parent corporation () foreign cannot be applied as a credit against the U.S. tax liability and (b) they can The dividend available to be declared is (Round to the nearest dollar) The dividends that Santana will actually receive is $ (Round to the nearest dollar.) (a) If foreign taxes cannot be applied against the U.S. tax liability, the net funds available to Santana is $(Round to the nearest dollar) (b) if foreign taxes can be applied against the U.S. tax lawty, the net funds available to Santana is $(Round to the nearest dollar) Santana Music is a US-based MNC whose foreign subsidiary had pretax income of $50,000; all after-tax income is available in the form of dividends to the parent company. The local tax rate is 39%, the foreion dividend withholding tax rate is 5,8%, and the U.S. tax rate is 34%. Compare the net funds available to the parent corporation (a) foreign taxon cannot be applied as a credit against the U.S. tax liability and (b) if they can The dividend available to be declared is (Round to the nearest dollar) The dividends that Santara wit actually receive is $) (Round to the nearest doitar) (a) if foreign taxes cannot be applied against the U.S. tax Habilly, the net funds available to Santana is $(Round to the nearest dolar) (b) It foreign taxes can be applied against the U.S. taxablity, the net funds available to Santana is 5 (Round to the nearest dotat)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts