Question: Jack, a geologist, had been debating for years whether or not to venture out on his own and operate his own business. He had developed

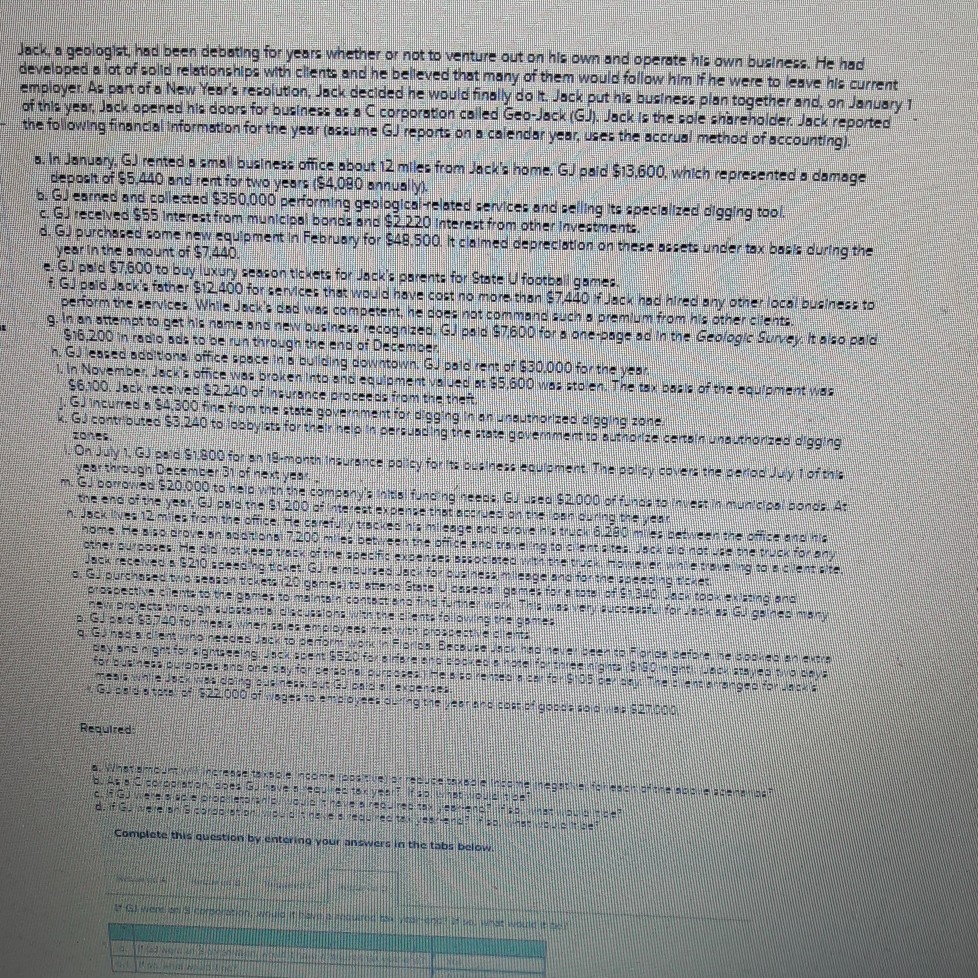

Jack, a geologist, had been debating for years whether or not to venture out on his own and operate his own business. He had developed a lot of solid relationships with clients and he belleved that many of them would follow him if he were to leave his current employer. As part of a New Year's resolution, Jack decided he would finally do L Jack put his business plan together and, on January 1 of this year, Jack opened his doors for business as a C corporation coled Geo-Jack (GJ). Jack is the sole shareholder Jack reported the following financial nformation for the year (assume GJ reports on a ca endar year, uses the accrual method of accounting). 3. In January, G. rented a small business office about 12 miles from Jack's home. GJ paid $13,600, which represented . damage deposit of $5.440 and rent for two years ($4,080 annually b. GI earnes and collected $350,000 performing geological-elated services and selling its specialized digging tool c. GI received $55 Interest from municipal bones and $2.220 Interest from other Investment. d. GJ purchased some new equipment in February for $48.500. It claimed depreciation on these assets under tax basis during the year in the amount of $7,440. e. G) pad $7.600 to buy luxury season tickets for Jack's parents for State U football games. i. G. paid Jack's father $12.400 for services that would have cost no more than 97.440ack had hired any other local business to perform the services. While Jack's cd was competent, he does not command auch s premium from his other cients. g. In an attempt to get his name and new business recognized. C) pato 97600 for a one-page ad in the Geologie Survey it oso pald $16.200 in recloses to be run through the end of Decemos h. Guessed co tons office space in a building downtown. GJ paid rent of $30,000 for the yeon 1. In November Jack's office was broken into and equipment va ued at $5.600 wes sto en Tee tar basis of the coulement was $6.00. Jack received $2 240 of Insurance proceeds from the theat 1. Gli incurred . $4.300 fine from the state government for ogging in an authorized 199 290A k. Go cont buted $3.240 to doby ste for their en persubeing the state govem ment to auto 3e cartola unauthorized ogging zones On July 1 G 230 $1800 for an 18-month insurance potey for is csiness coulementine Policy coves the coveo uy of this yearthrough Desemeer 31 of neys med borroves $20.000 to reo with the company's is june ng neees. GJ-20 $2.000 of funds to invest in mundo bonds. Az the end of the year. GJ paistne S 200 interest expenses otaceresentene LAM in Jockie: 12 miles from the office e coraidytaczechnicas endierova haruch 6.2 inies between the orice one ni home. Hesso drote an soat ons 7200 mes beteen the office and traveling to cart 12.56 MELE CU Foam other purposes. He do not keep track of the specific penze: 3:00. thach chwarang to be lentate scareceres a $210 aseee ng Ecket G.SMBuses Jace for ous ne mange and for the based in me De purchased the son takes 20 goes to strene Store Wash games free of $240. En ocasing and prospectie eients to the one to maintain contenene forte THE BEST ne projectough subts associats wing the Seas DE $3.40 formes. When 23 es employees in POCEL aghas santo neces SCR to perform on Fires Becburske, Raen sarebbe an awer bevesne gantzen 55. Det $520 FESTEGGIACH fo: 052: Snoe sy for DUHEERE SE ATASAN messing usus baie GEZE Get $22000 of Esto no es el lag nasaran ses gobec 927.000 Required Where come GARSOALAN Beton se: Guest hverse diferente de Complete this question by entering your answers in the tabs below. WC Bend Jack, a geologist, had been debating for years whether or not to venture out on his own and operate his own business. He had developed a lot of solid relationships with clients and he belleved that many of them would follow him if he were to leave his current employer. As part of a New Year's resolution, Jack decided he would finally do L Jack put his business plan together and, on January 1 of this year, Jack opened his doors for business as a C corporation coled Geo-Jack (GJ). Jack is the sole shareholder Jack reported the following financial nformation for the year (assume GJ reports on a ca endar year, uses the accrual method of accounting). 3. In January, G. rented a small business office about 12 miles from Jack's home. GJ paid $13,600, which represented . damage deposit of $5.440 and rent for two years ($4,080 annually b. GI earnes and collected $350,000 performing geological-elated services and selling its specialized digging tool c. GI received $55 Interest from municipal bones and $2.220 Interest from other Investment. d. GJ purchased some new equipment in February for $48.500. It claimed depreciation on these assets under tax basis during the year in the amount of $7,440. e. G) pad $7.600 to buy luxury season tickets for Jack's parents for State U football games. i. G. paid Jack's father $12.400 for services that would have cost no more than 97.440ack had hired any other local business to perform the services. While Jack's cd was competent, he does not command auch s premium from his other cients. g. In an attempt to get his name and new business recognized. C) pato 97600 for a one-page ad in the Geologie Survey it oso pald $16.200 in recloses to be run through the end of Decemos h. Guessed co tons office space in a building downtown. GJ paid rent of $30,000 for the yeon 1. In November Jack's office was broken into and equipment va ued at $5.600 wes sto en Tee tar basis of the coulement was $6.00. Jack received $2 240 of Insurance proceeds from the theat 1. Gli incurred . $4.300 fine from the state government for ogging in an authorized 199 290A k. Go cont buted $3.240 to doby ste for their en persubeing the state govem ment to auto 3e cartola unauthorized ogging zones On July 1 G 230 $1800 for an 18-month insurance potey for is csiness coulementine Policy coves the coveo uy of this yearthrough Desemeer 31 of neys med borroves $20.000 to reo with the company's is june ng neees. GJ-20 $2.000 of funds to invest in mundo bonds. Az the end of the year. GJ paistne S 200 interest expenses otaceresentene LAM in Jockie: 12 miles from the office e coraidytaczechnicas endierova haruch 6.2 inies between the orice one ni home. Hesso drote an soat ons 7200 mes beteen the office and traveling to cart 12.56 MELE CU Foam other purposes. He do not keep track of the specific penze: 3:00. thach chwarang to be lentate scareceres a $210 aseee ng Ecket G.SMBuses Jace for ous ne mange and for the based in me De purchased the son takes 20 goes to strene Store Wash games free of $240. En ocasing and prospectie eients to the one to maintain contenene forte THE BEST ne projectough subts associats wing the Seas DE $3.40 formes. When 23 es employees in POCEL aghas santo neces SCR to perform on Fires Becburske, Raen sarebbe an awer bevesne gantzen 55. Det $520 FESTEGGIACH fo: 052: Snoe sy for DUHEERE SE ATASAN messing usus baie GEZE Get $22000 of Esto no es el lag nasaran ses gobec 927.000 Required Where come GARSOALAN Beton se: Guest hverse diferente de Complete this question by entering your answers in the tabs below. WC Bend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts