Question: Jack Hammer invests in a stock that will pay dividends of $3.15 at the end of the first year; $3.60 at the end of the

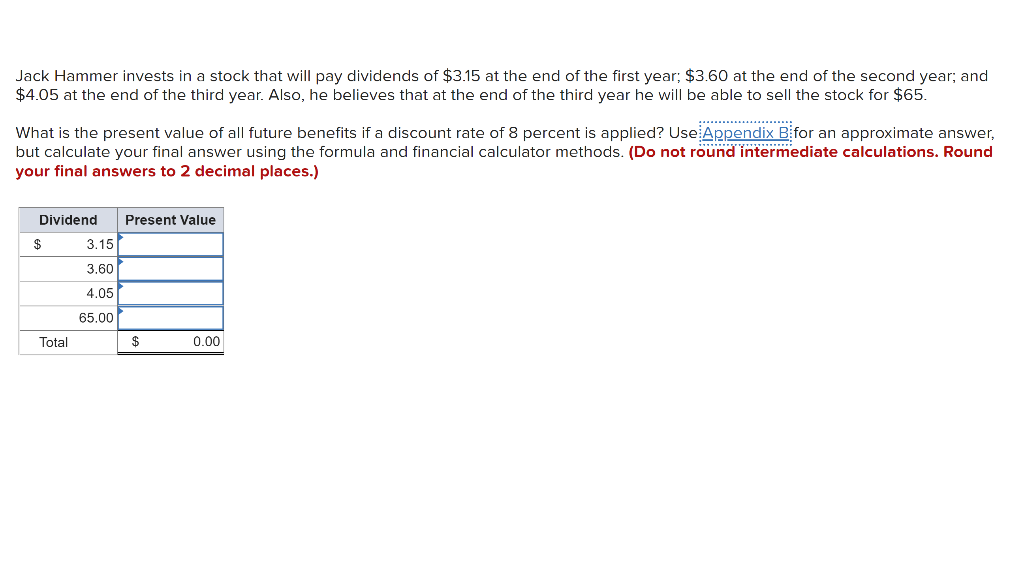

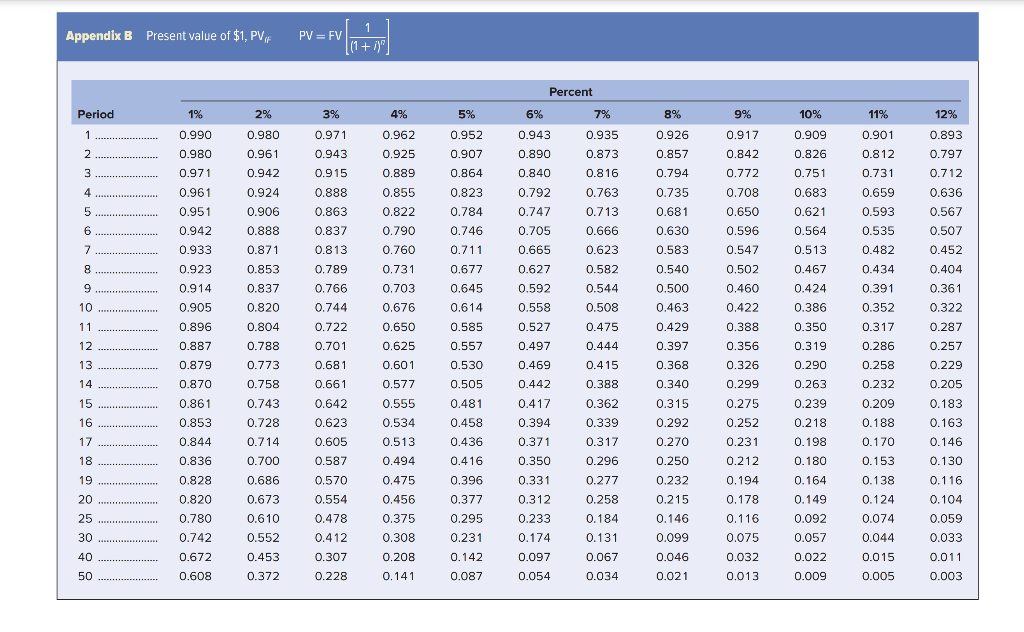

Jack Hammer invests in a stock that will pay dividends of $3.15 at the end of the first year; $3.60 at the end of the second year; and $4.05 at the end of the third year. Also, he believes that at the end of the third year he will be able to sell the stock for $65. What is the present value of all future benefits if a discount rate of 8 percent is applied? Use Appendix Bfor an approximate answer, but calculate your final answer using the formula and financial calculator methods. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Dividend Present Value $ 3.15 T 3.60 4.05 65.00 Total 0.00 Appendix B Present value of $1, PVF 1% 2% Period 1 0.990 0.980 2 0.980 0.961 3 0.971 0.942 4 0.961 0.924 5 0.951 0.906 6 0.942 0.888 7 0.933 0.871 8 0.923 0.853 9 0.914 0.837 10 0.905 0.820 11 0.896 0.804 12 0.887 0.788 13 0.879 0.773 14 0.870 0.758 15 0.861 0.743 16 0.853 0.728 17 0.844 0.714 18 0.836 0.700 19 0.828 0.686 20 0.820 0.673 25 0.780 0.610 30 0.742 0.552 40 0.672 0.453 50 0.608 0.372 1 |(1 + i)" PV=FV = FV 3% 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.623 0.605 0.587 0.570 0.554 0.478 0.412 0.307 0.228 4% 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0.513 0.494 0.475 0.456 0.375 0.308 0.208 0.141 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 0.377 0.295 0.231 0.142 0.087 Percent 6% 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0.331 0.312 0.233 0.174 0.097 0.054 7% 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.362 0.339 0.317 0.296 0.277 0.258 0.184 0.131 0.067 0.034 8% 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.146 0.099 0.046 0.021 9% 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0.116 0.075 0.032 0.013 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.092 0.057 0.022 0.009 11% 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.074 0.044 0.015 0.005 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.059 0.033 0.011 0.003

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts