Question: Jack is extremely bullish about the prospects for commodity prices, he estimates that over the next 3 years they will rise by an average of

Jack is extremely bullish about the prospects for commodity prices, he estimates that over the next 3 years they will rise by an average of 12% each year. In an attempt to profit from this view Jack has taken out a 3-year maturity loan of $1m secured on his property at a fixed interest rate of 1.5% per annum. Though Jack can afford to pay the interest out of his other income he will be reliant upon the proceeds of his investment to repay the capital.

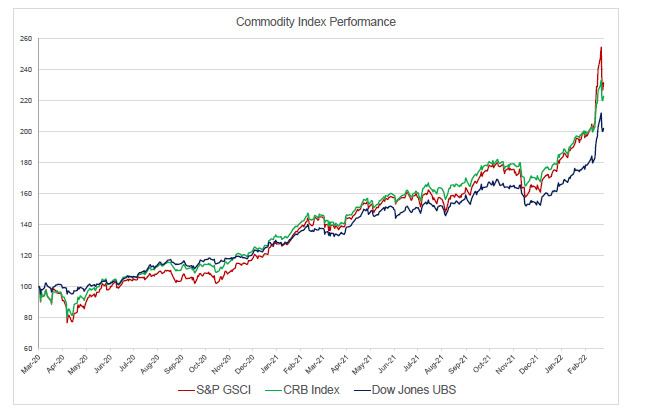

Jack's private banker has proposed a 3-year 100% capital-protected structured note that pays 35% of the appreciation in Gold at the end of the 3-year period. However, Jack does not find this structure attractive because of the low participation rate. a. Assuming that you work for a rival bank, propose 3 significantly different structured notes that would allow Jack to improve the participation rate under the above constraints. Support your answer with graphs and/or payoff formulas. b. Which of these 3 notes would you recommend and why? Take into account different elements including participation, downside risk, upside potential, etc. c. The chart below shows the performance of 3 different commodity indices over the last 2 years. Briefly discuss what might have caused the relative performance dispersion between these 3 indices.

d. Briefly discuss why the S&P GSCI commodity index is so heavily weighted towards energy and also why this might in part help to explain some of its positive historical performance.

e.Explain why the forward curve for Gold will always be in contango while the forward curve for crude oil can be in either contango or backwardation.

260 240 220 200 180 160 140 120 100 80 $ 60 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 02-120 Nov-20 Commodity Index Performance Dec-20 -S&P GSCI Jan-21 Feb-21 Mar-21 -CRB Index Apr-21 May-21 Jun-21 Jul-21 Aug-21 -Dow Jones UBS Sep-21 Od-21 Nov-21 Dec-21 Jan-22 Feb-22 260 240 220 200 180 160 140 120 100 80 $ 60 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 02-120 Nov-20 Commodity Index Performance Dec-20 -S&P GSCI Jan-21 Feb-21 Mar-21 -CRB Index Apr-21 May-21 Jun-21 Jul-21 Aug-21 -Dow Jones UBS Sep-21 Od-21 Nov-21 Dec-21 Jan-22 Feb-22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts