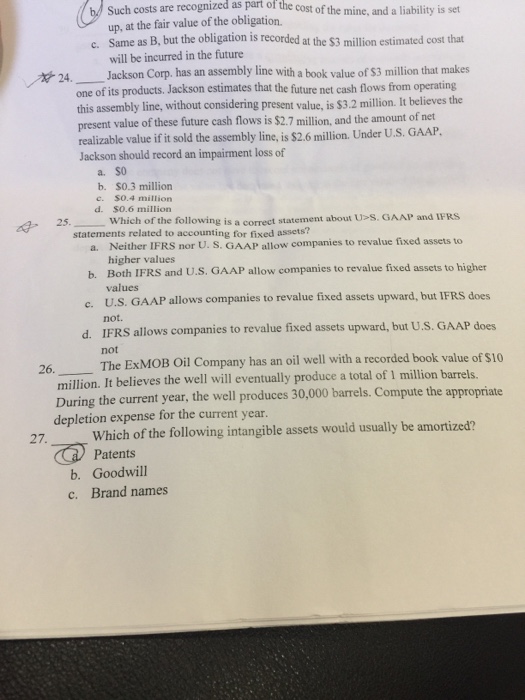

Question: ______ Jackson Corp. has an assembly line with a book value of $3 million that makes one of its products. Jackson estimates that the future

______ Jackson Corp. has an assembly line with a book value of $3 million that makes one of its products. Jackson estimates that the future net cash flows from operating this assembly line, without considering present value 3.2 million. It believes the present value of these future cash flows is $2.7 million, and the amount of net realizable value if it sold the assembly line, is S2.6 million. Under U.S. GAAP. Jackson should record an impairment loss of $0 $0.3 million $0.4 million $0.6 million which of the following is a correct statement related to accounting for fixed assets? Neither IFRS nor U. S. GAAP allow companies to revalue fixed assets to higher values to higher Both IFRS and U.S. GAAP allow companies to revalue fixed assets values IFRS does U.S. GAAP allows companies to revalue fixed assets upward, but not. assets Us. GAAP does IFRS allows companies to revalue fixed upward, but not recorded book value of $10 The MOB Oil Company has an oil well with a 26 million. It believes the well will eventually produce a total of 1 million barrels. During the current year, the well produces 30,000 barrels. Compute the appropriate depletion expense for the current year. Which of the following intangible assets would Patents Goodwill Brand names

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts