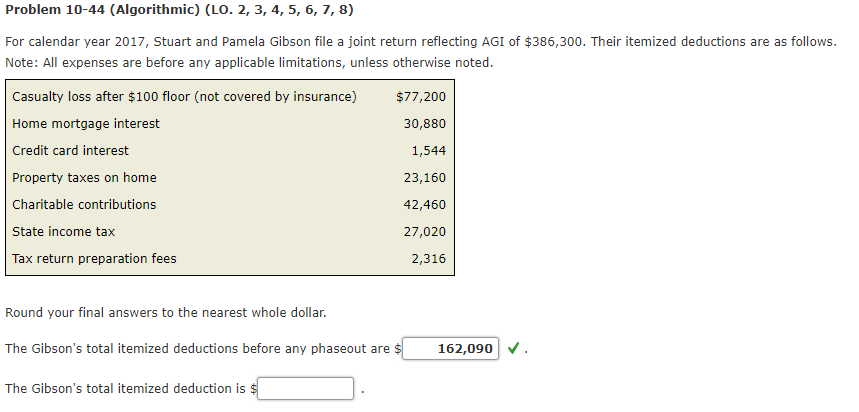

Question: Problem 10-44 (Algorithmic) (LO. 2, 3, 4, 5, 6, 7, 8) For calendar year 2017, Stuart and Pamela Gibson file a joint return reflecting AGI

Problem 10-44 (Algorithmic) (LO. 2, 3, 4, 5, 6, 7, 8) For calendar year 2017, Stuart and Pamela Gibson file a joint return reflecting AGI of $386,300. Their itemized deductions are as follows. Note: All expenses are before any applicable limitations, unless otherwise noted Casualty loss after $100 floor (not covered by insurance) Home mortgage interest Credit card interest Property taxes on home Charitable contributions State income tax Tax return preparation fees $77,200 30,880 1,544 23,160 42,460 27,020 2,316 Round your final answers to the nearest whole dollar. The Gibson's total itemized deductions before any phaseout are The Gibson's total itemized deduction is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts