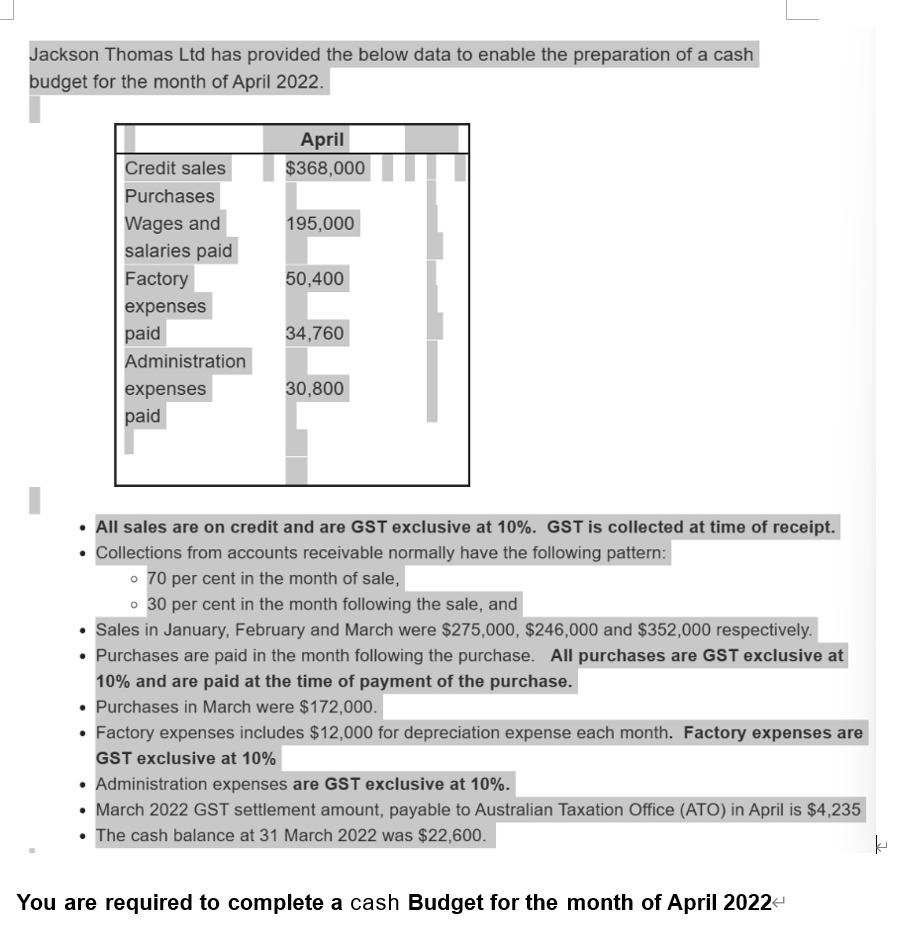

Question: Jackson Thomas Ltd has provided the below data to enable the preparation of a cash budget for the month of April 2022. Credit sales

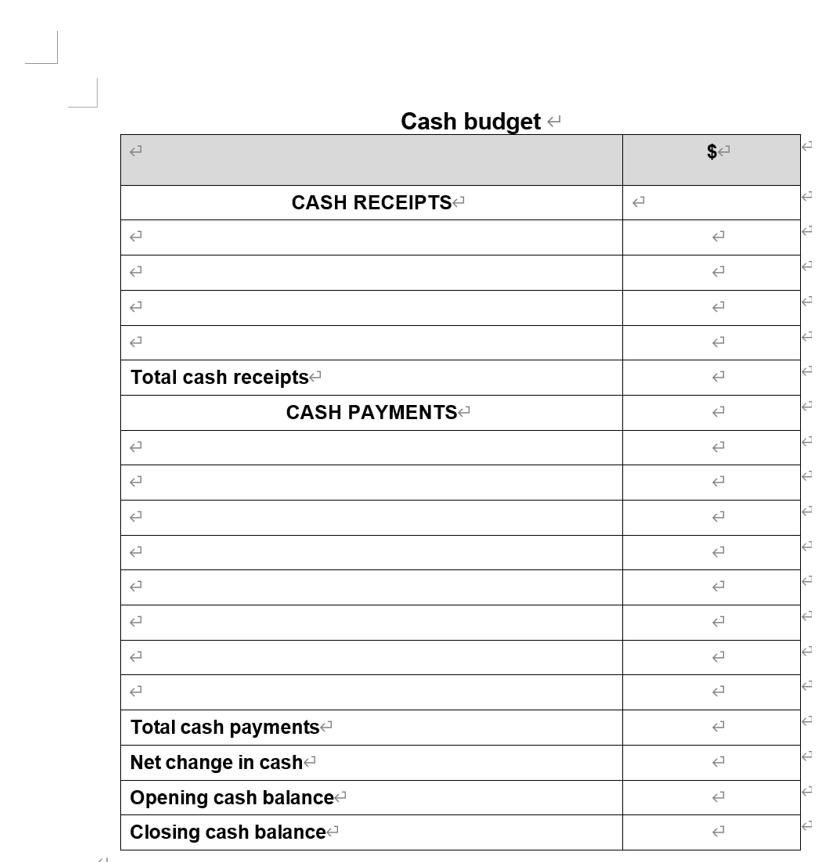

Jackson Thomas Ltd has provided the below data to enable the preparation of a cash budget for the month of April 2022. Credit sales Purchases Wages and salaries paid Factory expenses paid Administration expenses paid April $368,000 195,000 50,400 34,760 30,800 All sales are on credit and are GST exclusive at 10%. GST is collected at time of receipt. Collections from accounts receivable normally have the following pattern: o 70 per cent in the month of sale, o 30 per cent in the month following the sale, and Sales in January, February and March were $275,000, $246,000 and $352,000 respectively. Purchases are paid in the month following the purchase. All purchases are GST exclusive at 10% and are paid at the time of payment of the purchase. Purchases in March were $172,000. Factory expenses includes $12,000 for depreciation expense each month. Factory expenses are GST exclusive at 10% Administration expenses are GST exclusive at 10%. March 2022 GST settlement amount, payable to Australian Taxation Office (ATO) in April is $4,235 The cash balance at 31 March 2022 was $22,600. You are required to complete a cash Budget for the month of April 2022 < k 7 L Total cash receipts 7 7 7 CASH RECEIPTS Cash budget CASH PAYMENTS Total cash payments Net change in cash Opening cash balance Closing cash balance $4 7 7 7 L L 2 L L L 7 7 7 T 7 T 7 7 7 7 7 7 7 T L 7

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts