James Silva is a management accountant at Kleebler - Olson, where he is in charge of...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

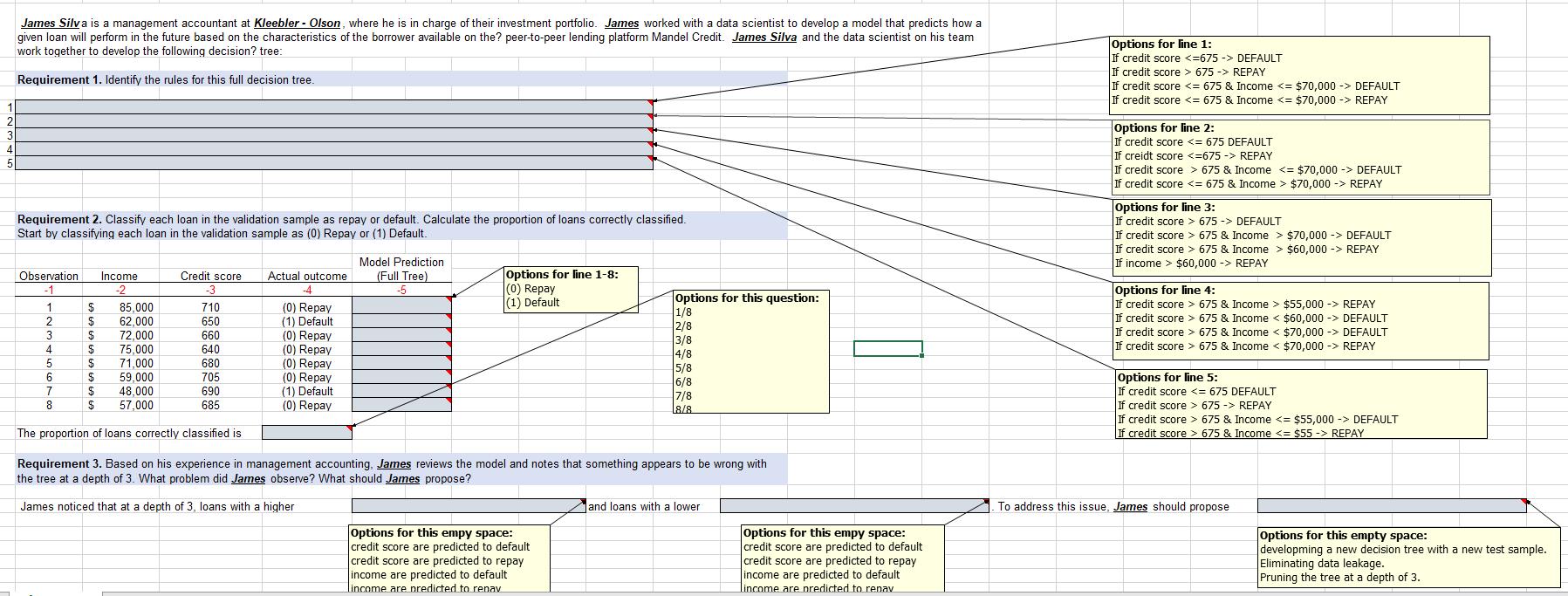

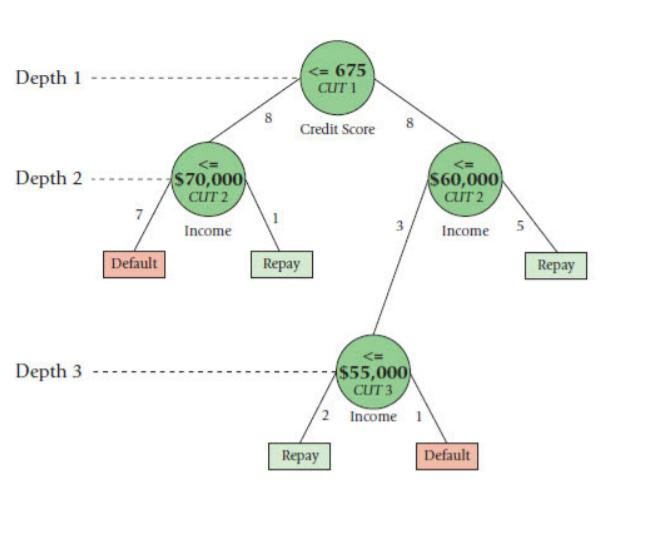

James Silva is a management accountant at Kleebler - Olson, where he is in charge of their investment portfolio. James worked with a data scientist to develop a model that predicts how a given loan will perform in the future based on the characteristics of the borrower available on the? peer-to-peer lending platform Mandel Credit. James Silva and the data scientist on his team work together to develop the following decision? tree: Options for line 1: If credit score <=675 -> DEFAULT If credit score > 675 -> REPAY If credit score <= 675 & Income <= $70,000 -> DEFAULT If credit score <= 675 & Income <= $70,000 -> REPAY Requirement 1. Identify the rules for this full decision tree. Options for line 2: If credit score <= 675 DEFAULT If creidt score <=675 -> REPAY If credit score > 675 & Income <= $70,000 -> DEFAULT If credit score <= 675 & Income > $70,000 -> REPAY 4 Options for line 3: If credit score > 675 -> DEFAULT If credit score > 675 & Income > $70,000 -> DEFAULT If credit score > 675 & Income > $60,000 -> REPAY If income > $60,000 -> REPAY Requirement 2. Classify each loạn in the validation sample as repay or default. Calculate the proportion of loans correctly classified. Start by classifying each loan in the validation sample as (0) Repay or (1) Default. Model Prediction (Full Tree) -5 Options for line 1-8: (0) Repay (1) Default Observation Income Credit score Actual outcome Options for line 4: If credit score > 675 & Income > $55,000 -> REPAY If credit score > 675 & Income < $60,000 -> DEFAULT If credit score > 675 & Income < $70,000 -> DEFAULT If credit score > 675 & Income < $70,000 -> REPAY -1 -2 -3 -4 Options for this question: 1/8 2/8 3/8 4/8 5/8 6/8 7/8 L8/8 1 $ $ 85,000 62,000 72,000 75,000 71,000 59,000 48,000 710 (0) Repay (1) Default (0) Repay (0) Repay (0) Repay (0) Repay (1) Default (0) Repay 650 3 660 4 640 680 Options for line 5: If credit score <= 675 DEFAULT If credit score > 675 -> REPAY If credit score > 675 & Income <= $55,000 -> DEFAULT If credit score > 675 & Income <= $55 -> REPAY 6. 705 690 685 $ 8 57,000 The proportion of loans correctly classified is Requirement 3. Based on his experience in management accounting, James reviews the model and notes that something appears to be wrong with the tree at a depth of 3. What problem did James observe? What should James propose? James noticed that at a depth of 3, loans with a higher and loans with a lower To address this issue, James should propose Options for this empy space: credit score are predicted to default credit score are predicted to repay income are predicted to default lincome are nredicted to renav Options for this empy space: credit score are predicted to default credit score are predicted to repay income are predicted to default lincome are nredicted to renav Options for this empty space: developming a new decision tree with a new test sample. Eliminating data leakage. Pruning the tree at a depth of 3. <= 675 Depth 1 CUT 1 Credit Score 8 $70,000 CUT 2 Depth 2 $60,000 CUIT 2 7 Income 3 Income Default Repay Repay <= $55,000 CUT 3 Depth 3 2 Income 1 Repay Default 5. James Silva is a management accountant at Kleebler - Olson, where he is in charge of their investment portfolio. James worked with a data scientist to develop a model that predicts how a given loan will perform in the future based on the characteristics of the borrower available on the? peer-to-peer lending platform Mandel Credit. James Silva and the data scientist on his team work together to develop the following decision? tree: Options for line 1: If credit score <=675 -> DEFAULT If credit score > 675 -> REPAY If credit score <= 675 & Income <= $70,000 -> DEFAULT If credit score <= 675 & Income <= $70,000 -> REPAY Requirement 1. Identify the rules for this full decision tree. Options for line 2: If credit score <= 675 DEFAULT If creidt score <=675 -> REPAY If credit score > 675 & Income <= $70,000 -> DEFAULT If credit score <= 675 & Income > $70,000 -> REPAY 4 Options for line 3: If credit score > 675 -> DEFAULT If credit score > 675 & Income > $70,000 -> DEFAULT If credit score > 675 & Income > $60,000 -> REPAY If income > $60,000 -> REPAY Requirement 2. Classify each loạn in the validation sample as repay or default. Calculate the proportion of loans correctly classified. Start by classifying each loan in the validation sample as (0) Repay or (1) Default. Model Prediction (Full Tree) -5 Options for line 1-8: (0) Repay (1) Default Observation Income Credit score Actual outcome Options for line 4: If credit score > 675 & Income > $55,000 -> REPAY If credit score > 675 & Income < $60,000 -> DEFAULT If credit score > 675 & Income < $70,000 -> DEFAULT If credit score > 675 & Income < $70,000 -> REPAY -1 -2 -3 -4 Options for this question: 1/8 2/8 3/8 4/8 5/8 6/8 7/8 L8/8 1 $ $ 85,000 62,000 72,000 75,000 71,000 59,000 48,000 710 (0) Repay (1) Default (0) Repay (0) Repay (0) Repay (0) Repay (1) Default (0) Repay 650 3 660 4 640 680 Options for line 5: If credit score <= 675 DEFAULT If credit score > 675 -> REPAY If credit score > 675 & Income <= $55,000 -> DEFAULT If credit score > 675 & Income <= $55 -> REPAY 6. 705 690 685 $ 8 57,000 The proportion of loans correctly classified is Requirement 3. Based on his experience in management accounting, James reviews the model and notes that something appears to be wrong with the tree at a depth of 3. What problem did James observe? What should James propose? James noticed that at a depth of 3, loans with a higher and loans with a lower To address this issue, James should propose Options for this empy space: credit score are predicted to default credit score are predicted to repay income are predicted to default lincome are nredicted to renav Options for this empy space: credit score are predicted to default credit score are predicted to repay income are predicted to default lincome are nredicted to renav Options for this empty space: developming a new decision tree with a new test sample. Eliminating data leakage. Pruning the tree at a depth of 3. <= 675 Depth 1 CUT 1 Credit Score 8 $70,000 CUT 2 Depth 2 $60,000 CUIT 2 7 Income 3 Income Default Repay Repay <= $55,000 CUT 3 Depth 3 2 Income 1 Repay Default 5.

Expert Answer:

Answer rating: 100% (QA)

REQUIREMENT 1 1 Option 3 If Credit score Repay 3 Option 3 If credit score 675 income 60000 Repay ... View the full answer

Related Book For

Statistics Informed Decisions Using Data

ISBN: 978-0134133539

5th edition

Authors: Michael Sullivan III

Posted Date:

Students also viewed these accounting questions

-

Suppose you want to develop a model that predicts the gas mileage of a car. The explanatory variables you are going to utilize are x1: city or highway driving x2: weight of the car x3: tire pressure...

-

Suppose you want to develop a model that predicts the revenue per visit to a company's web site. The explanatory variables you are going to use are x1: household income x2: time spent on the web site...

-

Analyze the attached data and develop a model that predicts math scores from other scores. Use regression analysis in excel and summarize what the different statistics of the summary output mean.

-

How do tax rules affect accounting rules and practice in some countries?

-

People are always complaining about Facebook: It changed the way its news feed works, the privacy settings are awful, there are too many game notifications, and so on. Recognizing dissatisfaction...

-

You have just made your first $5,000 contribution to your individual retirement account. Assuming you earn an 11 percent rate of return and make no additional contributions, what will your account be...

-

Mr. Prestages foot and lower leg were caught in a combine manufactured by defendant SperryNew Holland. He and his wife sued Defendant for damages arising out of the accident. Their first cause of...

-

Bill Beck, Bruce Beck, and Barb Beck formed the BBB Partnership by making capital contributions of $67,500, $262,500, and $420,000, respectively. They predict annual partnership net income of...

-

Question 5 Consider a situation where there are two polluters. The government decides to set up a cap and trade system to regulate pollution. The government would like to allow 100 units of pollution...

-

What insights from the discussion of the Morgan Stanley 2003 report on eBay apply to the 2013 report on Aetna by Jefferies? What insights from the discussion of the Morgan Stanley 2003 report on eBay...

-

President Xi wants to Renminbi to be the global reserve currency. Explain the characteeristics of the reserve currencies and why some countries may be reluctant to make the yuan the currency of...

-

Karen owned a restaurant in Key West, Florida that was destroyed by a hurricane. The restaurant had an adjusted basis of $576,000 when the hurricane hit. Karen had insurance coverage on the...

-

The following are the Greeks associated with three sets of calls and puts, all on the same stock: Set 3 Set 1 Set 2 c1 p1 c2 p2 c3 p3 A .5 -.5 .7 -.3 .4 -.6 r .02 .02 .01 .01 .03 .03 0 1.0 1.0 2.0...

-

Write a function that takes a binary search tree as input and produces a linked list of the entries, with the entries sorted (smallest entries at the front of the list and largest entries at the...

-

Violet Company's third year's gross profit was 125% of its first year's gross profit. If the gross profit in the third year was $125,000, what was the gross profit of Violet Company in the first year?

-

2. A loan is being amortized by means of level monthly payments at an annual effective interest rate of 10%. The amount of principal repaid in payment number 27 is 1,300 and the amount of principal...

-

purpose of this group/individual project is to demonstrate that you can transfer the skills you have learned this semester to a real life scenario. You will fully functional network for a company of...

-

Describe the Operations (+,,*,/) that can cause negligible addition (NA), error magnification (EM), or subtractive cancellation (SC) in calculating ?((x^2)+1) - x . Give the range of where they might...

-

In a least-squares regression model, the residuals are assumed to be random. The following data represent the life expectancy of a male born in the given year. The least-squares regression equation,...

-

A statistics student thinks that an individual's arm span is equal to the individual's height. To test this belief, the student obtained the following data from a random sample of 10 students. Is...

-

According to Nate Silver, the probability of a senate candidate winning his/her election with a 5% lead in an average of polls with a week until the election is 0.89. Interpret this probability.

-

Oxford Corporation began operations in 2015 and reported pretax financial income of 225,000 for the year. Oxfords tax depreciation exceeded its book depreciation by 40,000. Oxfords tax rate for 2015...

-

At December 31, 2015, Suffolk Corporation had an estimated warranty liability of 105,000 for accounting purposes and 0 for tax purposes. (The warranty costs are not deductible until paid.) The...

-

State whether each of the following events will result in a movement along General Motors (GMs) demand curve for labor in their U.S. automobile factories or whether it will cause its demand curve for...

Study smarter with the SolutionInn App