Jamie Lee Jackson, age 26, is in her last semester of college and is waiting for...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

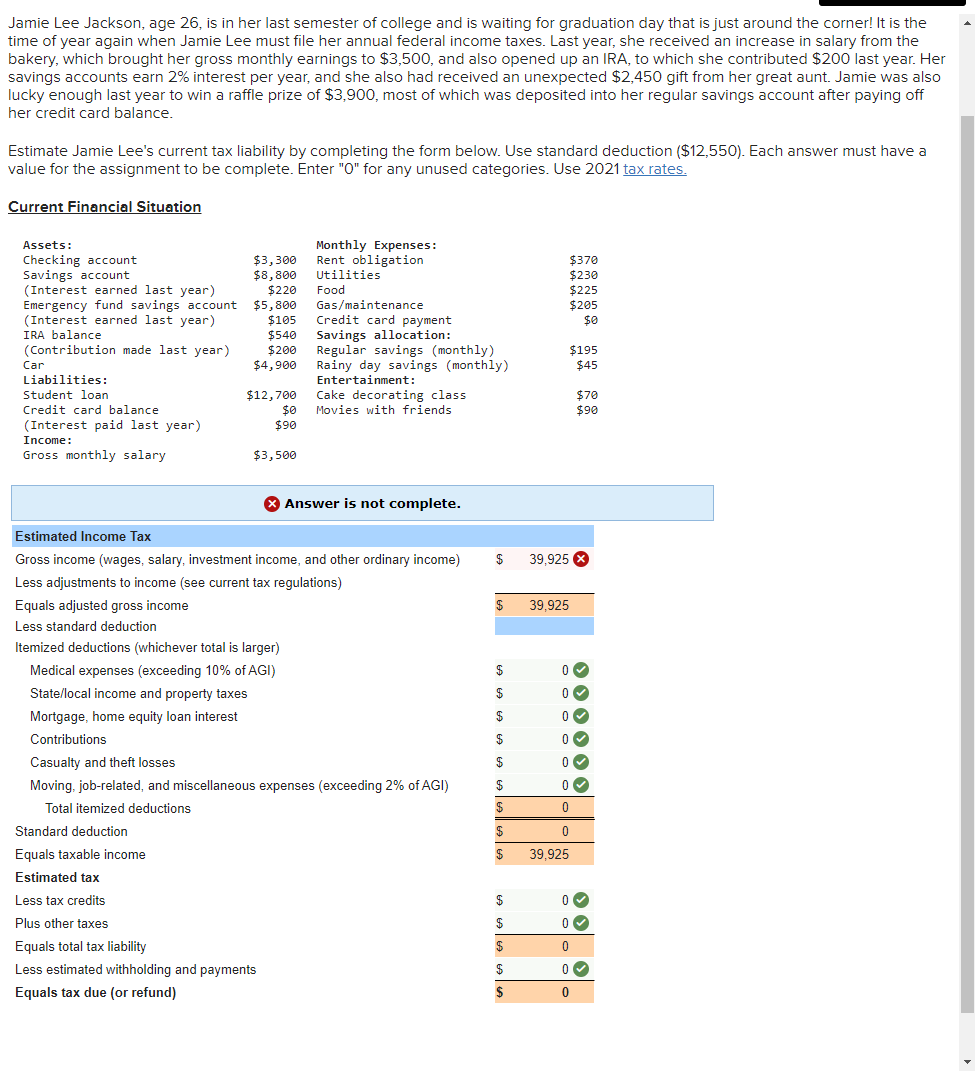

Jamie Lee Jackson, age 26, is in her last semester of college and is waiting for graduation day that is just around the corner! It is the time of year again when Jamie Lee must file her annual federal income taxes. Last year, she received an increase in salary from the bakery, which brought her gross monthly earnings to $3,500, and also opened up an IRA, to which she contributed $200 last year. Her savings accounts earn 2% interest per year, and she also had received an unexpected $2,450 gift from her great aunt. Jamie was also lucky enough last year to win a raffle prize of $3,900, most of which was deposited into her regular savings account after paying off her credit card balance. Estimate Jamie Lee's current tax liability by completing the form below. Use standard deduction ($12,550). Each answer must have a value for the assignment to be complete. Enter "O" for any unused categories. Use 2021 tax rates. Current Financial Situation Assets: Monthly Expenses: Checking account $3,300 Rent obligation $370 Savings account $8,800 (Interest earned last year) $220 Food Emergency fund savings account $5,800 Utilities Gas/maintenance $230 $225 $205 (Interest earned last year) $105 Credit card payment $0 IRA balance $540 Savings allocation: (Contribution made last year) $200 Regular savings (monthly) $195 Car $4,900 Rainy day savings (monthly) $45 Liabilities: Entertainment: Student loan $12,700 Cake decorating class $70 Credit card balance $0 Movies with friends $90 (Interest paid last year) $90 Income: Gross monthly salary $3,500 Estimated Income Tax Answer is not complete. Gross income (wages, salary, investment income, and other ordinary income) Less adjustments to income (see current tax regulations) 39,925 Equals adjusted gross income 39,925 Less standard deduction Itemized deductions (whichever total is larger) Medical expenses (exceeding 10% of AGI) State/local income and property taxes 0 0 Mortgage, home equity loan interest 0 Contributions $ 0 Casualty and theft losses 0 Moving, job-related, and miscellaneous expenses (exceeding 2% of AGI) $ 0 Total itemized deductions $ 0 Standard deduction $ 0 Equals taxable income $ 39,925 Estimated tax Less tax credits 0 Plus other taxes $ 0 Equals total tax liability $ 0 Less estimated withholding and payments $ 0 Equals tax due (or refund) $ 0 Jamie Lee Jackson, age 26, is in her last semester of college and is waiting for graduation day that is just around the corner! It is the time of year again when Jamie Lee must file her annual federal income taxes. Last year, she received an increase in salary from the bakery, which brought her gross monthly earnings to $3,500, and also opened up an IRA, to which she contributed $200 last year. Her savings accounts earn 2% interest per year, and she also had received an unexpected $2,450 gift from her great aunt. Jamie was also lucky enough last year to win a raffle prize of $3,900, most of which was deposited into her regular savings account after paying off her credit card balance. Estimate Jamie Lee's current tax liability by completing the form below. Use standard deduction ($12,550). Each answer must have a value for the assignment to be complete. Enter "O" for any unused categories. Use 2021 tax rates. Current Financial Situation Assets: Monthly Expenses: Checking account $3,300 Rent obligation $370 Savings account $8,800 (Interest earned last year) $220 Food Emergency fund savings account $5,800 Utilities Gas/maintenance $230 $225 $205 (Interest earned last year) $105 Credit card payment $0 IRA balance $540 Savings allocation: (Contribution made last year) $200 Regular savings (monthly) $195 Car $4,900 Rainy day savings (monthly) $45 Liabilities: Entertainment: Student loan $12,700 Cake decorating class $70 Credit card balance $0 Movies with friends $90 (Interest paid last year) $90 Income: Gross monthly salary $3,500 Estimated Income Tax Answer is not complete. Gross income (wages, salary, investment income, and other ordinary income) Less adjustments to income (see current tax regulations) 39,925 Equals adjusted gross income 39,925 Less standard deduction Itemized deductions (whichever total is larger) Medical expenses (exceeding 10% of AGI) State/local income and property taxes 0 0 Mortgage, home equity loan interest 0 Contributions $ 0 Casualty and theft losses 0 Moving, job-related, and miscellaneous expenses (exceeding 2% of AGI) $ 0 Total itemized deductions $ 0 Standard deduction $ 0 Equals taxable income $ 39,925 Estimated tax Less tax credits 0 Plus other taxes $ 0 Equals total tax liability $ 0 Less estimated withholding and payments $ 0 Equals tax due (or refund) $ 0

Expert Answer:

Related Book For

Personal Finance

ISBN: 9781264101597

14th Edition

Authors: Jack Kapoor, Les Dlabay, Robert Hughes, Melissa Hart

Posted Date:

Students also viewed these accounting questions

-

Jamie Lee Jackson, age 26, is in her last semester of college and is waiting for graduation day that is just around the corner! It is the time of year again when Jamie Lee must file her annual...

-

Jamie Lee Jackson, age 26, is in her last semester of college and is waiting for graduation day, just around the corner! It is the time of year again when Jamie Lee must file her annual federal...

-

3) Sauseda Corporation has two operating divisions-an Inland Division and a Coast Division. The company's Customer Service Department provides services to both divisions. The variable costs of the...

-

A compound A, C8H8O, when treated with Zn amalgam and HCl, gives a xylene (dimethylbenzene) isomer that in turn gives only one ring monobromination product with Br2 and Fe. Propose a structure for A.

-

Using only the periodic table, rank the following elements in order of increasing size: Fe, K, Rb, S, and Se. Strategy We want to arrange the elements from smallest to largest. Begin by finding each...

-

Minoli, Melinda and Matthew are partners. The partnership agreement provides that partners will receive interest of 8% of their average capital balance and a salary allowance as follows: Required (a)...

-

Sarah Beth's Art Supply Company produces various types of paints. Actual direct manufacturing labor hours in the factory that produces paint have been higher than budgeted hours for the last few...

-

1. Identify the product which represents the solid state in the above reaction. a) Barium chloride b) Barium sulphate c) Sodium chloride d) Sodium sulphate 2. The colour of the solution observed...

-

Company Z was engaged by a large client in May Year 1. The parties contracted for monthly consulting services valued at $20,000 starting on September 1, Year 1. [This contract provides for monthly...

-

In a competitive labor market, an increase in the minimum wage results in a(n) __________ in the quantity of labor supplied and a(n) __________ in the quantity of labor demanded. a. increase;...

-

In your opinion, in which industries could the UK, Italy and Australia be considered key countries?

-

The money stock includes all of the following EXCEPT a. metal coins. b. paper currency. c. lines of credit accessible with credit cards. d. bank balances accessible with debit cards.

-

A lower-level manager discovers that his boss has made a wrong decision that could affect the company negatively. Looking at the various cultural norms described in the chapter, how would you expect...

-

What are the major problems associated with licensing?

-

Dell & Acer are United States computer manufacturers Companies. Compare the following items: a) Computer mode b) Price c) Delivery charges d) Financing options e) Discounts f) Coupons g)...

-

Without solving, determine the character of the solutions of each equation in the complex number system. 3x 2 3x + 4 = 0

-

Three devices are attached to a microprocessor: Device 1 has highest priority and device 3 has lowest priority. Each devices interrupt handler takes 5 time units to execute. Show what interrupt...

-

Provide examples of how each of the following can occur in a typical program: a. compulsory miss b. capacity miss c. conflict miss

-

Draw a UML sequence diagram for an interrupt-driven write of a device. The diagram should include the background program, the handler, and the device.

Study smarter with the SolutionInn App