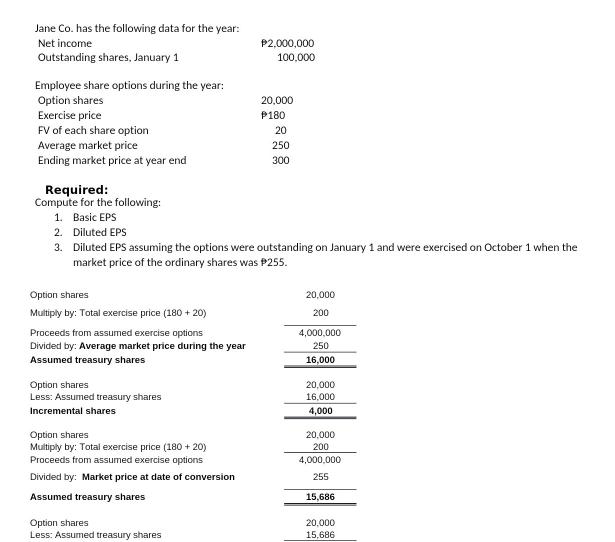

Question: Jane Co. has the following data for the year: Net income Outstanding shares, January 1 Employee share options during the year: Option shares Exercise

Jane Co. has the following data for the year: Net income Outstanding shares, January 1 Employee share options during the year: Option shares Exercise price FV of each share option Average market price Ending market price at year end Required: Compute for the following: 1. Basic EPS Option shares Multiply by: Total exercise price (180 + 20) Proceeds from assumed exercise options Divided by: Average market price during the year Assumed treasury shares Option shares Less: Assumed treasury shares Incremental shares 2. Diluted EPS 3. Diluted EPS assuming the options were outstanding on January 1 and were exercised on October 1 when the market price of the ordinary shares was $255. Option shares Multiply by: Total exercise price (180 +20) Proceeds from assumed exercise options Divided by: Market price at date of conversion Assumed treasury shares $2,000,000 100,000 Option shares Less: Assumed treasury shares 20,000 P180 20 250 300 20,000 200 4,000,000 250 16,000 20,000 16,000 4,000 20,000 200 4,000,000 255 15,686 20,000 15,686

Step by Step Solution

3.54 Rating (144 Votes )

There are 3 Steps involved in it

I see an image of a document that contains financial information for a company named Jane Co and calculations for basic and diluted earnings per share EPS However I notice that the results of the calc... View full answer

Get step-by-step solutions from verified subject matter experts