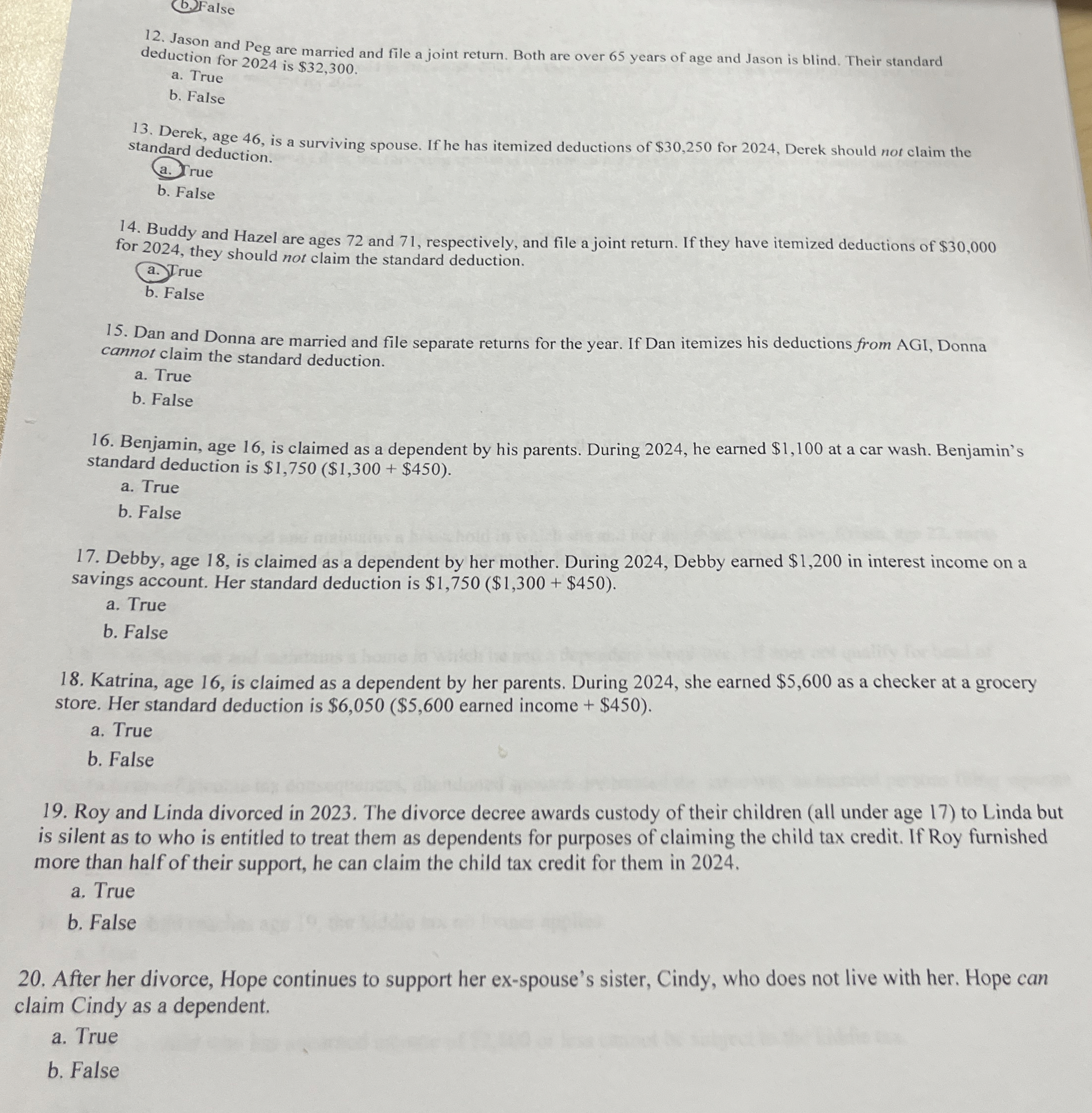

Question: Jason and Peg are married and file a joint return. Both are over 6 5 years of age and Jason is blind. Their standard deduction

Jason and Peg are married and file a joint return. Both are over years of age and Jason is blind. Their standard deduction for is $

a True

b False

Derek, age is a surviving spouse. If he has itemized deductions of $ for Derek should not claim the standard deduction.

a True

b False

Buddy and Hazel are ages and respectively, and file a joint return. If they have itemized deductions of $ for they should not claim the standard deduction.

a True

b False

Dan and Donna are married and file separate returns for the year. If Dan itemizes his deductions from AGI, Donna cannot claim the standard deduction.

a True

b False

Benjamin, age is claimed as a dependent by his parents. During he earned $ at a car wash. Benjamin's standard deduction is $$$

a True

b False

Debby, age is claimed as a dependent by her mother. During Debby earned $ in interest income on a savings account. Her standard deduction is $$$

a True

b False

Katrina, age is claimed as a dependent by her parents. During she earned $ as a checker at a grocery store. Her standard deduction is earned income $

a True

b False

Roy and Linda divorced in The divorce decree awards custody of their children all under age to Linda but is silent as to who is entitled to treat them as dependents for purposes of claiming the child tax credit. If Roy furnished more than half of their support, he can claim the child tax credit for them in

a True

b False

After her divorce, Hope continues to support her exspouse's sister, Cindy, who does not live with her. Hope can claim Cindy as a dependent.

a True

b False

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock