Question: Jay's Current Portfolio. Use to answer question below. Please explain answer as best as possible. Your investment research department is currently recommending any of the

Jay's Current Portfolio. Use to answer question below. Please explain answer as best as possible.

Your investment research department is currently recommending any of the following securities for purchase by firm clients, assuming each is suitable for client objectives:

Investment Current FMV Current Yield Correlation Coefficient

Fund A $32.875 1.25% 0.95

Fund B $25.500 3.22% 0.89

Fund C $12.625 5.63% 0.78

Fund D $18.375 2.10% -0.26

From the perspective of total risk reduction, which fund would you be inclined to recommend to Jay for consideration at your next client meeting?

| Fund A, because it has the highest price per share and its correlation coefficient would raise the correlation coefficient of Jay's portfolio. |

| Fund B, because it pays a reasonable current return and is closest to the correlation coefficient of Jay's portfolio. |

| Fund C, because it is the least costly and the highest yielding, which reduces risk |

| Fund D, because it would be expected to reduce the portfolio's overall correlation coefficient with the market |

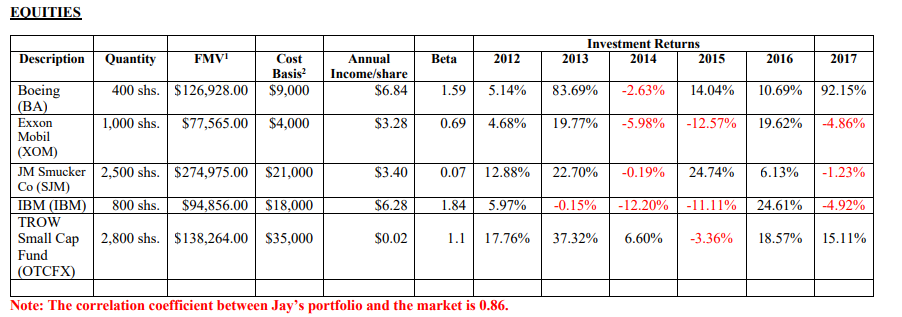

EOUITES Investment Returns 2014 FMV 400 shs. $126,928.00$9,000 1,000 shs.$77,565.00 $4,000 DescriptionQuantit Cost Basis2Income/share Annual Beta 2012 2013 2015 2016 2017 Boeing BA Exxon Mobil (XOM) $6.84| 1.59| 5.14% | 83.69% | -2.63% | 14.04% | 10.69% | 92.15% $3.28 | 0.69| 4.68% | 19.77%| -5.98% | -12.57% | 19.62% |-4.86% M Smucker 2,500 shs.$274,975.00 $21,000 Co (SJM) IBM (IBM 800 shs. $94,856.00 S18,000 TROW Small Cap2,800 shs. $138,264.00 $35,000 Fund OTC $3.40 | 0.07 | 12.88% | 22.70% | -0.19% | 24.74% | 6.13% | -1.23% $6.28 1.8 $0.02 20 1.11 17.76% | 37.32% | 6.60% | -3.36% | 18.57% | 15.11% Note: The correlation coefficient between Jay's portfolio and the market is 0.86

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts