Question: Jennifer is looking back at her work from last year, when she allocated the company's key process costs to its three products. She knows that

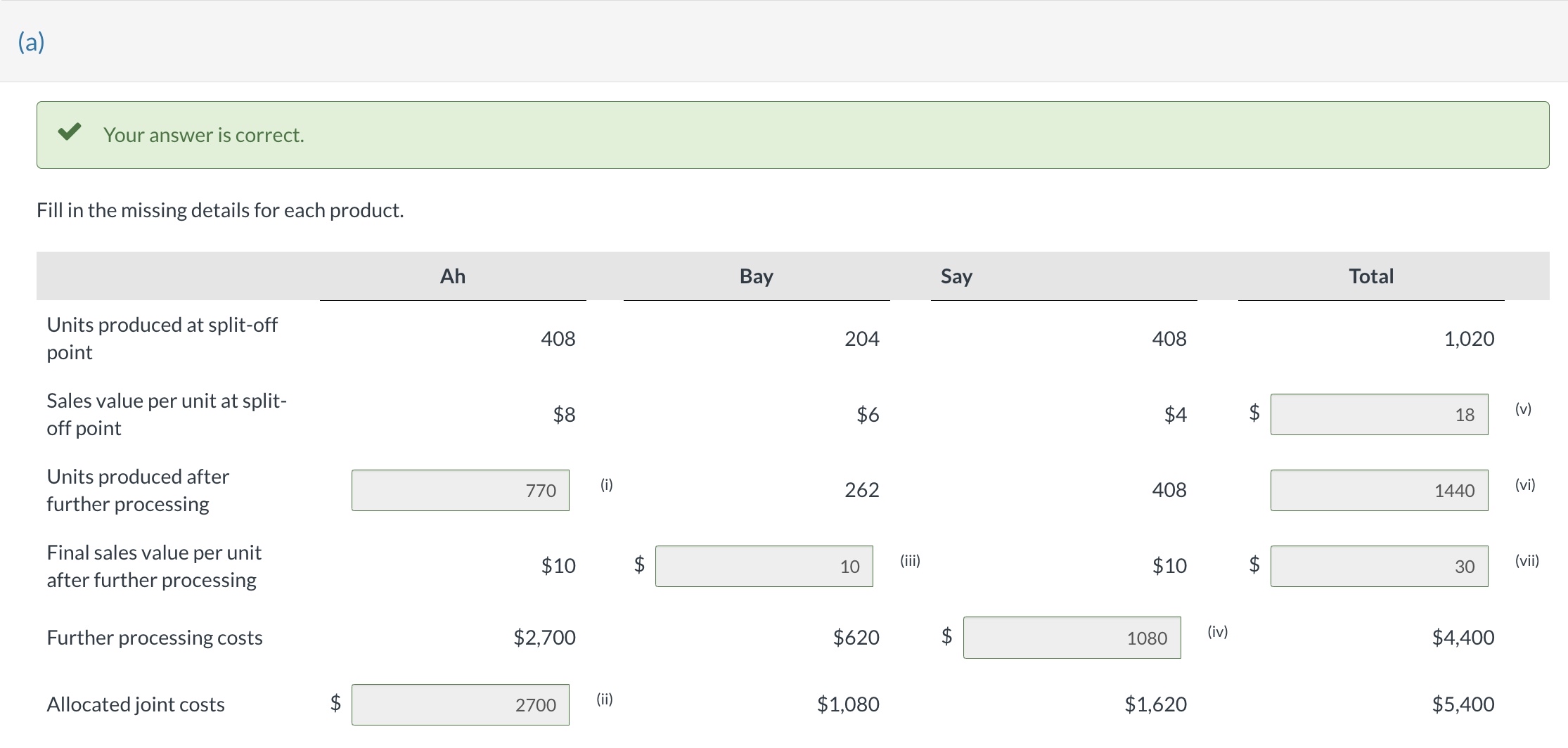

Jennifer is looking back at her work from last year, when she allocated the company's key process costs to its three products. She knows that the company has historically used the NRV method to allocate joint costs. Unfortunately, the printout that she has of the final allocations and supporting detail is only partially legible. You see, David accidently set the sprinklers off in the office last week, and Jennifer's printout was the recipient of most of that water. Here is a replication of what she could see from the printout; she noted missing information with lowercase roman numerals. Ah Bay Say Total Units produced available at splitoff point Sales value per unit at splitoff point $ $ $v Units produced available after further processing ivi Final sales value per unit after further processing $iii $vii Further processing costs $ $iv $ Allocated joint costs ii $ $ $ A Fill in the missing details for each product. See Excel worksheet. B If Jennifer's company had instead used the physical quantities method for allocating joint costs, how different would the allocated costs have been for each product? Round proportion to decimal places, eg and final answers to decimal places, eg Enter negative amounts using either a negative sign preceding the number eg or parentheses eg Do not leave any answer field blank. Enter for amounts. Allocated joint cost physical quantity Total physical quantities of all products x Joint costs Allocated Joint Cost per UnitTotal allocated joint costs# of units produced at splitoff $ per unit Allocated joint costs Ah Bay Say Units produced at splitoff point Allocated joint cost $ $ $ Allocated joint cost $ $ $ Difference in Allocated Joint Costs Ah Bay Say NRV Method $ $ $ Physical Quantities Method $ $ $ Difference in Allocated Joint Costs $ $$ C Under the existing NRV method, which product has the highest gross margin percentage assuming all quantities available after further processing are sold for the given price? Round answers to decimal places, eg If the physical quantities method is used, which product has the highest gross margin percentage again assuming all quantities available are sold for the given price after further processing?

Please answer part C

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock