Question: Jerry & Roberta Smith - 2 0 2 3 Tax Returl Family me bers and Dependents: The following is a list of information for Jerry

Jerry & Roberta Smith Tax Returl

Family me bers and Dependents: The following is a list of information for Jerry & Roberta Smith for the tax year Jeny & Robeta are married and have three children Andrew, George, and Terry. They live in New York City. Jerry is an attorney and he is selfemployed in his own law firm: Smith Legal Consultancy in New York, NY Roberta is a Professor of Chemistry PHD at CUNY Manhattan.

Tax Information regarding the Smith's and their dependents are as follows:

Dependents: Assume that all other requirements are met by each potential dependent.NOTE: Jerry's Previous Marriage to Tracy Smith: As per the March, Divorce Agreement, Jerry is obligated to pay Alimony and Child Support to his exwife, Tracy Smith. He is required to make monthly payments of $ Alimony and $ for Child Support. Jerry would like to deduct the Alimony paid $

The Smiths's W information is as follows:

tableJerry,RobertaGross wages,Federal Withholding Taxes,,NYS Withholding Taxes,,NYC Withholding Taxes,,

Interest and Dividends earned by the Smiths' and reported on Form s are as follows:

tableTypes of Interest Dividends,AmountsInterest on year US Treasury Bonds,Interest on NYS General Obligation Bonds,Interest on NJ State Dormitory Bonds,Interest on CD Chase Bank,Interest GE year bonds,Ordinary & Qualified Dividend Income Per Fidelity,Statement

Roberta received a "Debt Forgiveness" Memo from Mastercard company in in the amount of $; this concerned a prior charge from advising the Smith's that the debt has been forgiven.

Estimated Tax Payments:

Mr & Mrs Smith made Estimated Tax Payments as follows:

Federal: $ Total Payments; Paid by

NYS: $ Total Payments; Paid by Jerry is Self Employed in his own private law practiceJ Smith Legal Consultancy, where he specializes in Personal Injury law.

EIN: Business code: Accounting method: Cash Basis located at Greenwich St New York, NY The Revenue and Expenses from his law practice are as follows:

tableGross Revenue Salary Expense Professionals,Rent Tribecca OfficeOffice Salaries,Office Supplies,AdvertisementUtilitiesTelephone InternetAccounting Fees,Health Insurance Employees,Office Maintenance,Office Equipment see Note Travel Expense see Note MiscellaneousPayment AntiTrust Treble Damages seeNote

Note The category office equipment, includes printers, computers, fax machines, percolators, phones, microwave, and office refrigerator. Jerry is unfamiliar with calculating tax depreciation and therefore requires your help. He is greatly concern with the tax benefits available for the costs incurred for office equipment. Hint: Should he capitalize and depreciate the equipment cost, or is there another more beneficial tax treatment?

Note Jerry visited Miami on a legal conference that was specific to his business. He spent a total of three days in Miami. However the conference was only for two days, but since Jerry loved the beach and the warm weather, he decided to stay another day. The total travel expenses incurred on the trip were $

Note Jerry Smith, Attorney, was sued by the US government, regarding a criminal violation of the US Antitrust Laws. He entered a nocontest plea and paid the "Treble Antitrust Damage Fine" of $ to settle the case. How much of the fine can Jerry deduct?Unreimbursed Job Related Expenses Roberta attended a Research Conference at Harvard University during July, Her employer's practice is to reimburse their employees up to $ per conference. Her total expenses incurred were however, she was only reimbursed as of December Roberta would like to deduct the unreimbursed expenses of $ if possible?

Group Term Life Insurance CUNY Manhattan provided $ of group term life insurance to Roberta, age who is not considered a key employee. Hint: Don't forget to consider its effect on gross income

Retirement Contributions During Jerry Smith contributed to his Traditional IRA and Roberta Smith contributed $ to her Roth IRA. They both would like to deduct their contributions.

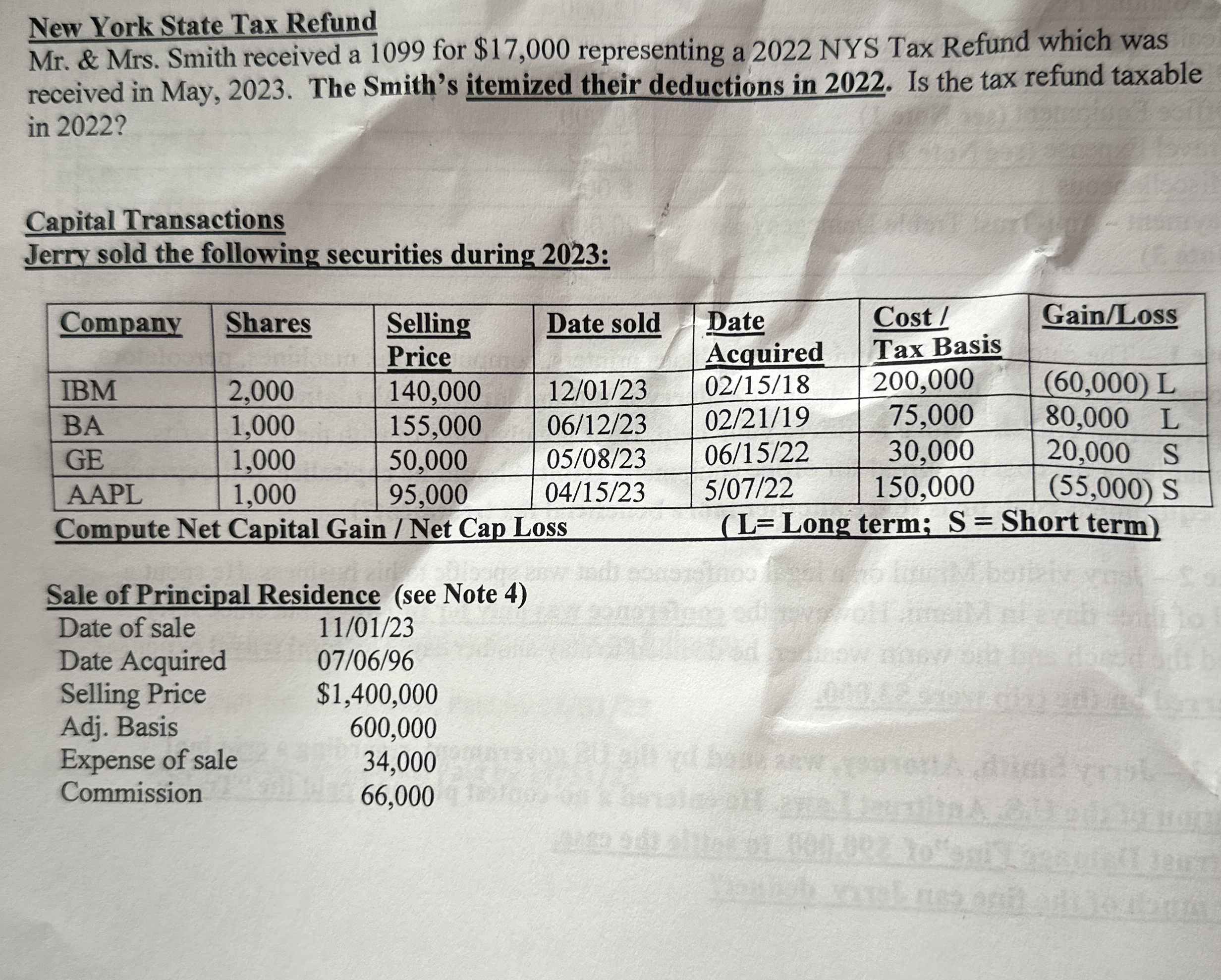

New York State Tax Refund

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock