Question: Self - Study Problem 7 . 9 Saver's Credit. Enter all amounts as positive numbers. Round your answers to one decimal place, if necessary. If

SelfStudy Problem Saver's Credit. Enter all amounts as positive numbers. Round your answers to one decimal place, if necessary. If your answer is zero, enter

tableForm Credit for Qualified Retirement Savings Contributions,OMB NoDepartment of the Treasury,Attach to Form SR or NR Go to wwwirs.govForm for the latest information.,,AttachmentInternal Revenue Service,,Sequence NoNames shown on return,Your social security numberRobin and Steve Harrington,,

CAUIION

You cannot take this credit if either of the following applies.

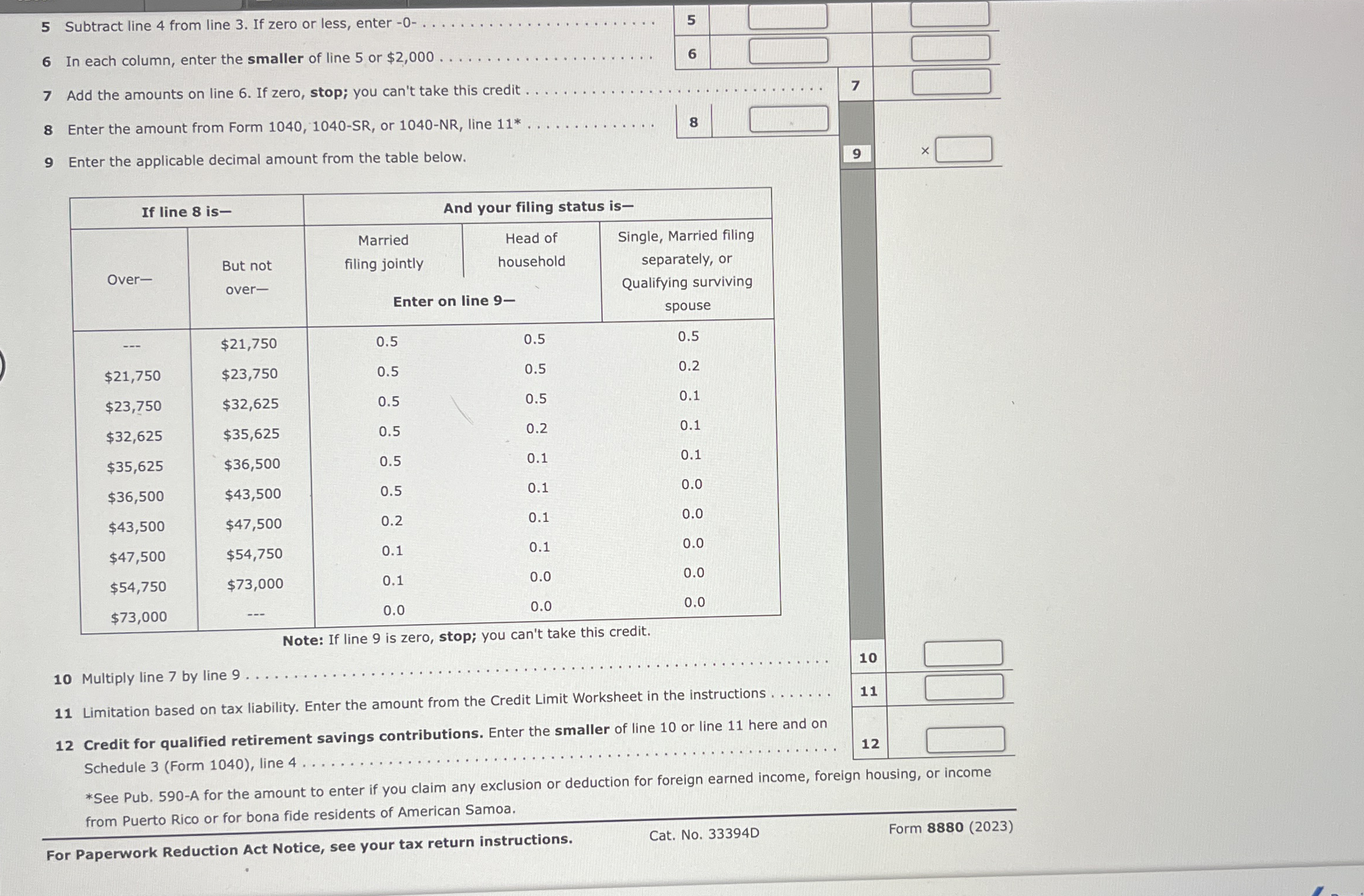

The amount on Form SR or NR line is more than $ $ if head of household; $ if married, filing jointly

The persons who made the qualified contribution or elective deferral a was born after January ; b is claimed as a dependent on someone else's tax return; or c was a student see instructions

Traditional and Roth IRA contributions, and ABLE account contributions by the designated beneficiary for Do not include rollover contributions

Elective deferrals to a k or other qualified employer plan, voluntary employee contributions, and cD plan contributions for see instructions

Add lines and

Certain distributions received after and before the due date including extensions of your tax return see instructions If married filing jointly, include both spouses' amounts in both columns. See instructions for an exception.

Subtract line from line If zero or less, enter

In each column, enter the smaller of line or $

Add the amounts on line If zero, stop; you can't take this credit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock