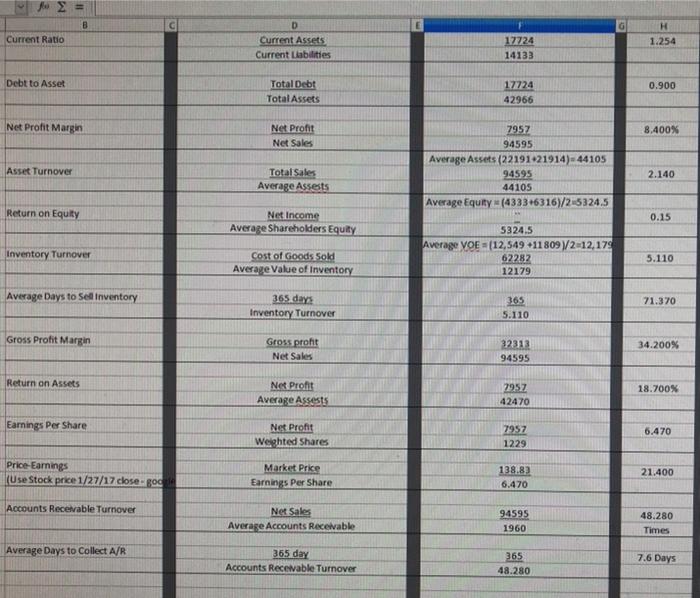

Question: Jo = B Current Ratio G D Current Assets Current Labilities 1.254 17724 14133 Debt to Asset Total Debt Total Assets 0.900 17724 42966 Net

Jo = B Current Ratio G D Current Assets Current Labilities 1.254 17724 14133 Debt to Asset Total Debt Total Assets 0.900 17724 42966 Net Profit Margin Net Profit Net Sales 8.400% Asset Turnover 7957 94595 Average Assets (22191 21914) - 44105 94595 44105 Average Equity (4333+6316)/2-5324.5 Total Sales Average Assets 2.140 Return on Equity 0.15 Net Income Average Shareholders Equity Inventory Turnover Cost of Goods Sold Average Value of Inventory 5324.5 Average VOE = (12,549 +11809\/2-12, 179 62282 12179 5.110 Average Days to Sell inventory 365 days Inventory Turnover 71.370 365 5.110 Gross Profit Margin Gross profit Net Sales 34.200% 32313 94595 Return on Assets 18.700% Net Profit Average Assets 2957 42470 Earnings Per Share Net Profit Weighted Shares 7952 1229 6.470 Price Earnings (Use Stock price 1/27/17 close gode 21.400 Market Price Earnings Per Share 138,82 6.470 Accounts Receivable Turnover Net Sales Average Accounts Receivable 94595 1960 48.280 Times Average Days to Collect A/R 365 day Accounts Recewable Turnover 7.6 Days 365 48.280

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts