Question: John A. Smith is a married 45 year old (Social Security #123-45-6789) residing at 123 Main Street, Naples, FL 34109. John's wife is Lisa

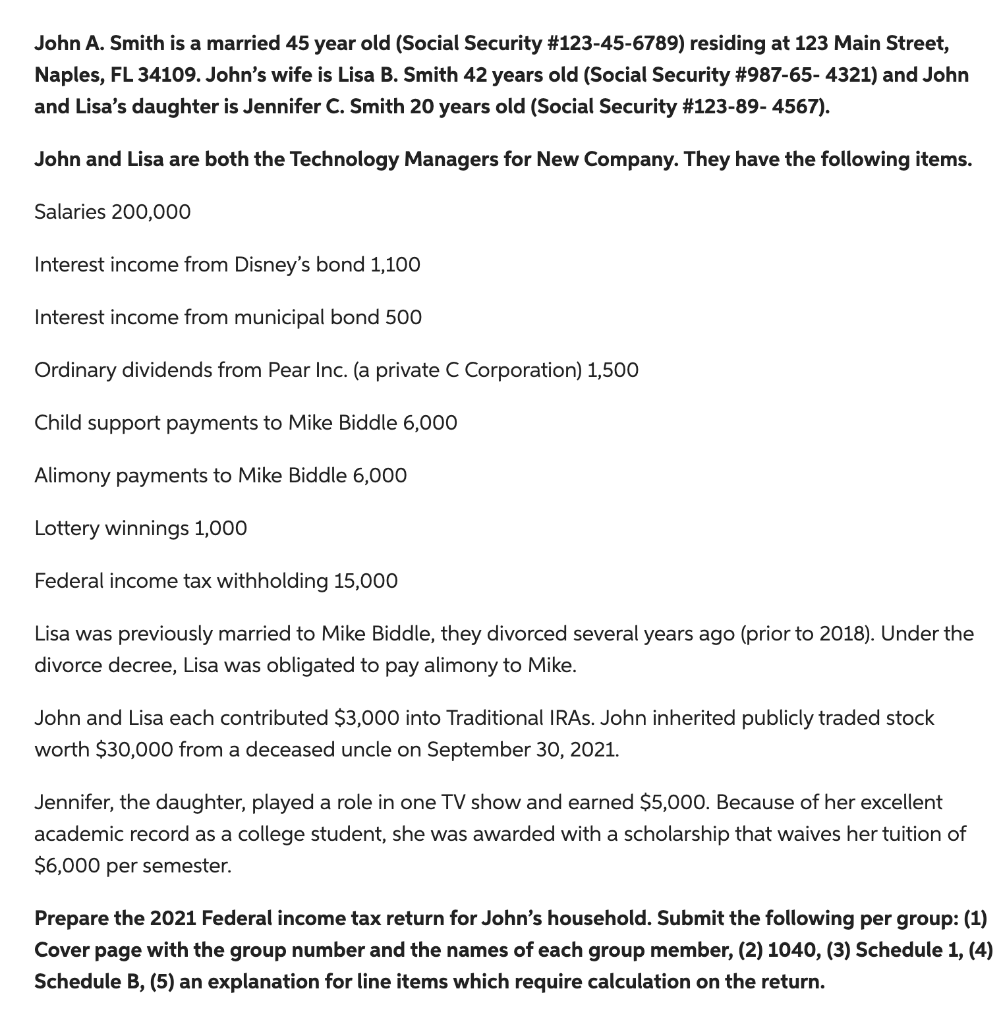

John A. Smith is a married 45 year old (Social Security #123-45-6789) residing at 123 Main Street, Naples, FL 34109. John's wife is Lisa B. Smith 42 years old (Social Security #987-65-4321) and John and Lisa's daughter is Jennifer C. Smith 20 years old (Social Security #123-89-4567). John and Lisa are both the Technology Managers for New Company. They have the following items. Salaries 200,000 Interest income from Disney's bond 1,100 Interest income from municipal bond 500 Ordinary dividends from Pear Inc. (a private C Corporation) 1,500 Child support payments to Mike Biddle 6,000 Alimony payments to Mike Biddle 6,000 Lottery winnings 1,000 Federal income tax withholding 15,000 Lisa was previously married to Mike Biddle, they divorced several years ago (prior to 2018). Under the divorce decree, Lisa was obligated to pay alimony to Mike. John and Lisa each contributed $3,000 into Traditional IRAS. John inherited publicly traded stock worth $30,000 from a deceased uncle on September 30, 2021. Jennifer, the daughter, played a role in one TV show and earned $5,000. Because of her excellent academic record as a college student, she was awarded with a scholarship that waives her tuition of $6,000 per semester. Prepare the 2021 Federal income tax return for John's household. Submit the following per group: (1) Cover page with the group number and the names of each group member, (2) 1040, (3) Schedule 1, (4) Schedule B, (5) an explanation for line items which require calculation on the return.

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Here is the 2021 Federal income tax return for Johns household 1 Cover page Group 49 John Doe Jane Doe John Smith 2 Form 1040 Filing status Married fi... View full answer

Get step-by-step solutions from verified subject matter experts