Answered step by step

Verified Expert Solution

Question

1 Approved Answer

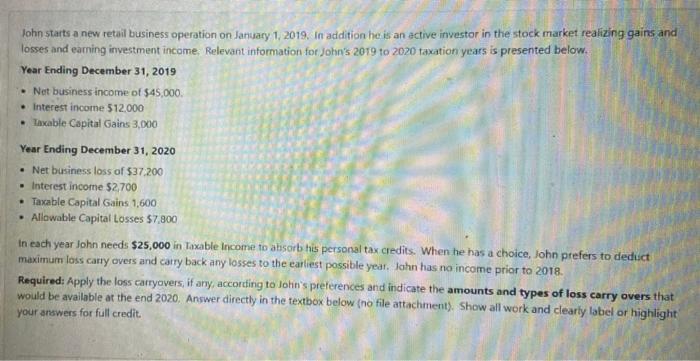

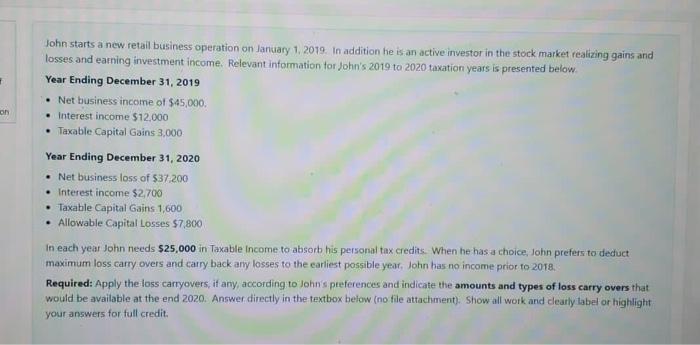

John starts a new retail business operation on January 1, 2019. In addition he is an active investor in the stock market realizing gains

John starts a new retail business operation on January 1, 2019. In addition he is an active investor in the stock market realizing gains and losses and earning investment income Relevant information for John's 2019 to 2020 taxation years is presented below. Year Ending December 31, 2019 Net business income of $45,000. Interest income $12.000 Taxable Capital Gains 3,000 Year Ending December 31, 2020 Net business loss of $37,200 Interest income $2,700 Taxable Capital Gains 1,600 Allowable Capital Losses $7,800 In each year John needs $25,000 in Taxable Income to absorb his personal tax credits. When he has a choice, John prefers to deduct maximum loss carry overs and carry back any losses to the earliest possible year. John has no income prior to 2018. Required: Apply the loss carryavers, if any, according to John's preferences and indicate the amounts and types of loss carry overs that would be available at the end 2020. Answer directly in the textbox below (no file attachment). Show all work and clearly label or highlight your answers for full credit. John starts a new retail business operation on January 1, 2019. In addition he is an active investor in the stock market realizing gains and losses and earning investment income. Relevant information tor John's 2019 to 2020 taxation years is presented below. Year Ending December 31, 2019 Net business income of $45,000. Interest income $12,000 Taxable Capital Gains 3,000 Year Ending December 31, 2020 Net business loss of $37.200 Interest income $2,700 Taxable Capital Gains 1,600 Allowable Capital Losses $7,800 In each year John needs $25,000 in Taxable Income to absorb his personal tax credits. When he has a choice, John prefers to deduct maximum loss carry overs and carry back any losses to the earliest possible year, John has no income prior to 2018. Required: Apply the loss carryovers, if any, according to John's preferences and indicate the amounts and types of loss carry overs that would be available at the end 2020. Answer directly in the textbox below (no file attachment). Show all work and clearly label or highlight your answers for full credit.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started