Question: Johnson & Johnson is considering a new project with a needed capital of $1,800,000. The company is using only debt and common equity (raised by

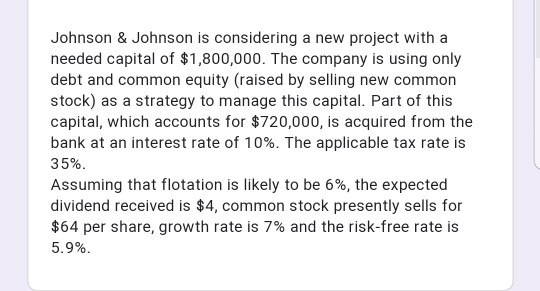

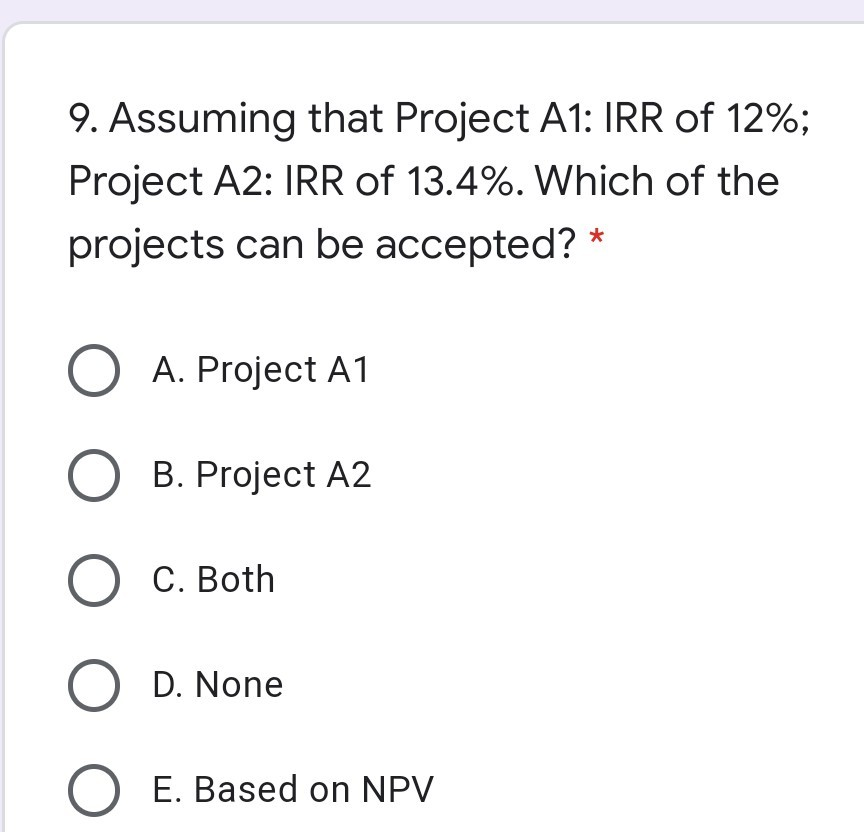

Johnson & Johnson is considering a new project with a needed capital of $1,800,000. The company is using only debt and common equity (raised by selling new common stock) as a strategy to manage this capital. Part of this capital, which accounts for $720,000, is acquired from the bank at an interest rate of 10%. The applicable tax rate is 35%. Assuming that flotation is likely to be 6%, the expected dividend received is $4, common stock presently sells for $64 per share, growth rate is 7% and the risk-free rate is 5.9%. 9. Assuming that Project A1: IRR of 12%; Project A2: IRR of 13.4%. Which of the projects can be accepted? * O A. Project A1 O B. Project A2 O C. Both O D. None O E. Based on NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts