Question: Problem 1: Johnson & Johnson is considering a new project with a needed capital of $1,800,000. The company is using only debt and common equity

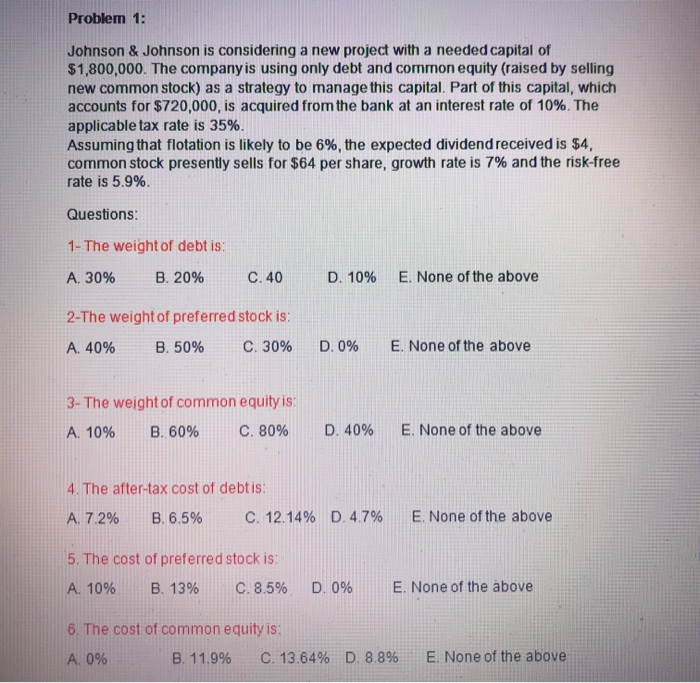

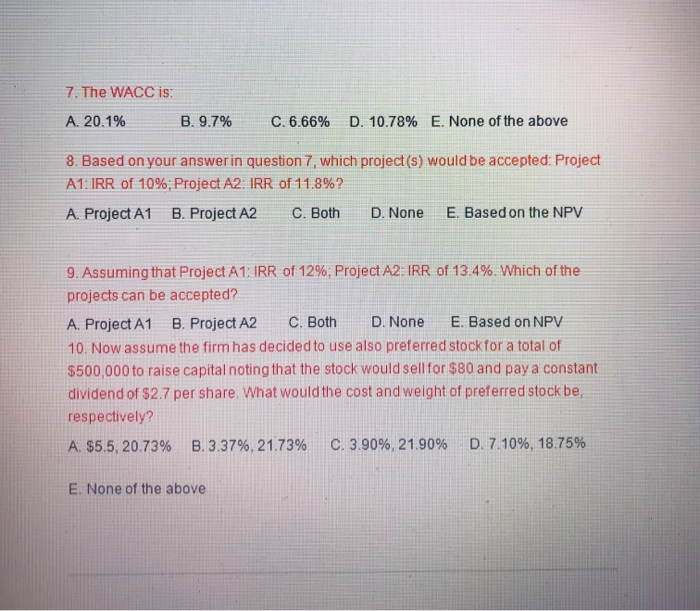

Problem 1: Johnson & Johnson is considering a new project with a needed capital of $1,800,000. The company is using only debt and common equity (raised by selling new common stock) as a strategy to manage this capital. Part of this capital, which accounts for $720,000, is acquired from the bank at an interest rate of 10%. The applicable tax rate is 35%. Assuming that flotation is likely to be 6%, the expected dividend received is $4, common stock presently sells for $64 per share, growth rate is 7% and the risk-free rate is 5.9% Questions: 1- The weight of debt is: A. 30% B. 20% C.40 D. 10% E. None of the above 2-The weight of preferred stock is: A. 40% B. 50% C. 30% D. 0% E. None of the above 3- The weight of common equity is: A. 10% B. 60% C. 80% D. 40% E. None of the above 4. The after-tax cost of debtis: A. 7.2% B. 6.5% C. 12.14% D.4.7% E. None of the above 5. The cost of preferred stock is: A. 10% B. 13% C. 8.5% D. 0% E. None of the above 6. The cost of common equity is: A 0% B. 11.9% C. 13.64% D. 8.8% E. None of the above 7. The WACC is: A. 20.1% B. 9.7% C. 6.66% D. 10.78% E. None of the above 8. Based on your answer in question 7, which project(s) would be accepted: Project A1: IRR of 10%; Project A2: IRR of 11.8%? A. Project A1 B. Project A2 C. Both D. None E. Based on the NPV 9. Assuming that Project A1: IRR of 12%, Project A2. IRR of 13.4%. Which of the projects can be accepted? A. Project A1 B. Project A2 C. Both D. None E. Based on NPV 10. Now assume the firm has decided to use also preferred stockfor a total of $500,000 to raise capital noting that the stock would sell for $80 and pay a constant dividend of $2.7 per share. What would the cost and weight of preferred stockbe, respectively? A. $5.5, 20.73% B.3.37%, 21.73% C. 3.90%, 21.90% D. 7.10%, 18.75% E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts