Question: Jonathan, Stuart, and Anna created BBJ, a website design partnership on January 1, 2023. Jonathan invested $2,000 cash and a computer worth $3,000. Stuart

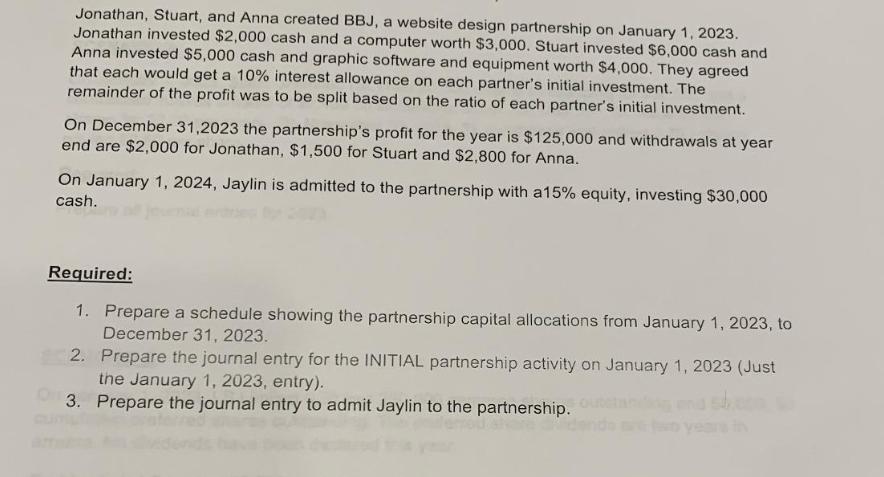

Jonathan, Stuart, and Anna created BBJ, a website design partnership on January 1, 2023. Jonathan invested $2,000 cash and a computer worth $3,000. Stuart invested $6,000 cash and Anna invested $5,000 cash and graphic software and equipment worth $4,000. They agreed that each would get a 10% interest allowance on each partner's initial investment. The remainder of the profit was to be split based on the ratio of each partner's initial investment. On December 31,2023 the partnership's profit for the year is $125,000 and withdrawals at year end are $2,000 for Jonathan, $1,500 for Stuart and $2,800 for Anna. On January 1, 2024, Jaylin is admitted to the partnership with a15% equity, investing $30,000 cash. Required: 1. Prepare a schedule showing the partnership capital allocations from January 1, 2023, to December 31, 2023. 2. Prepare the journal entry for the INITIAL partnership activity on January 1, 2023 (Just the January 1, 2023, entry). 3. Prepare the journal entry to admit Jaylin to the partnership.

Step by Step Solution

There are 3 Steps involved in it

1 Partnership Capital Allocations from Jan 1 2023 to Dec 31 2023 Jonathan Initial Investment Cash 20... View full answer

Get step-by-step solutions from verified subject matter experts