Question: Jones Co. started the year with no inventory. During the year, it purchased two identical inventory items at different times The first purchase cost $1,060

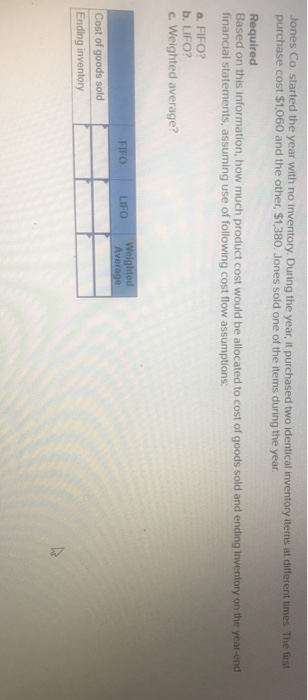

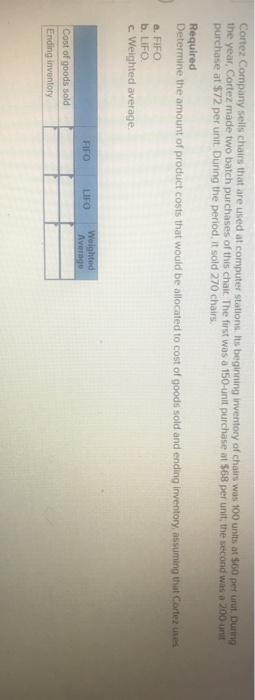

Jones Co. started the year with no inventory. During the year, it purchased two identical inventory items at different times The first purchase cost $1,060 and the other, $1,380. Jones sold one of the items during the year Required Based on this information, how much product cost would be allocated to cost of goods sold and ending inventory on the year-end financial statements, assuming use of following cost flow assumptions a FIFO? b. LIFO? c. Weighted average? FIFO LIFO Weight Cost of goods sold Cortez Company sells chairs that are used at computer statio the year, Cortez made two batch purchases of this chair. The first was a 150-unit purchase at $68 per unit, the second was a 200 unit purchase at $72 per unit. During the period, it sold 270 chairs. ns. Its beginning inventory of chairs was 100 units at $60 per unit During Required Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses a. FIFO b. LIFO c. Weighted average. FIFO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts