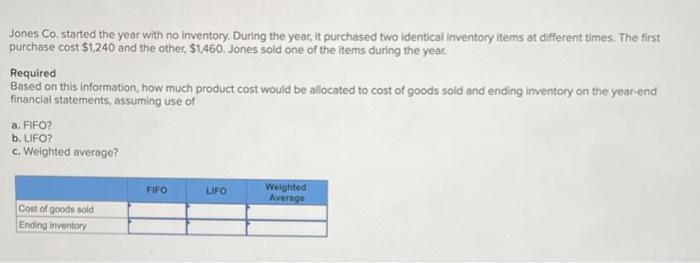

Question: Jones Co. started the year with no inventory. During the year, it purchased two identical inventory items at different times. The first purchase cost $1.240

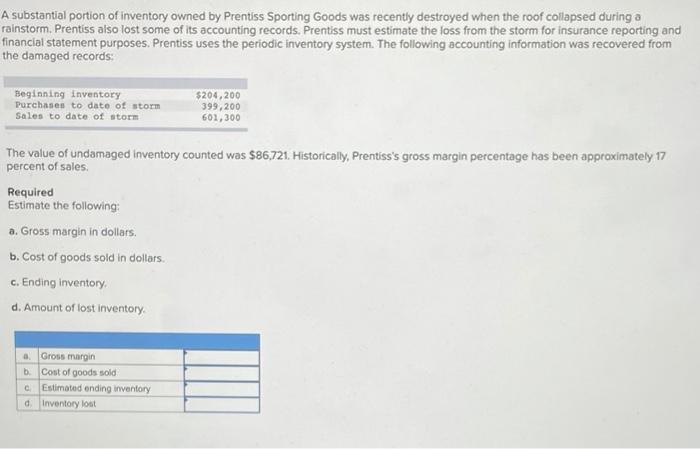

Jones Co. started the year with no inventory. During the year, it purchased two identical inventory items at different times. The first purchase cost $1.240 and the other, $1,460. Jones sold one of the items during the year, Required Based on this information, how much product cost would be allocated to cost of goods sold and ending inventory on the year-end financial statements, assuming use of a. FIFO? b. LIFO? c. Weighted average? FIFO LIFO Weighted Average Cost of goods sold Ending inventory A substantial portion of inventory owned by Prentiss Sporting Goods was recently destroyed when the roof collapsed during a rainstorm. Prentiss also lost some of its accounting records. Prentiss must estimate the loss from the storm for insurance reporting and financial statement purposes. Prentiss uses the periodic inventory system. The following accounting information was recovered from the damaged records: Beginning Inventory Purchases to date of storm Sales to date of storm $204,200 399,200 601,300 The value of undamaged inventory counted was $86,721. Historically, Prentiss's gross margin percentage has been approximately 17 percent of sales Required Estimate the following: a. Gross margin in dollars b. Cost of goods sold in dollars. c. Ending inventory d. Amount of lost inventory a. Gross margin b. Cost of goods sold c Estimated ending inventory d Inventory lost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts