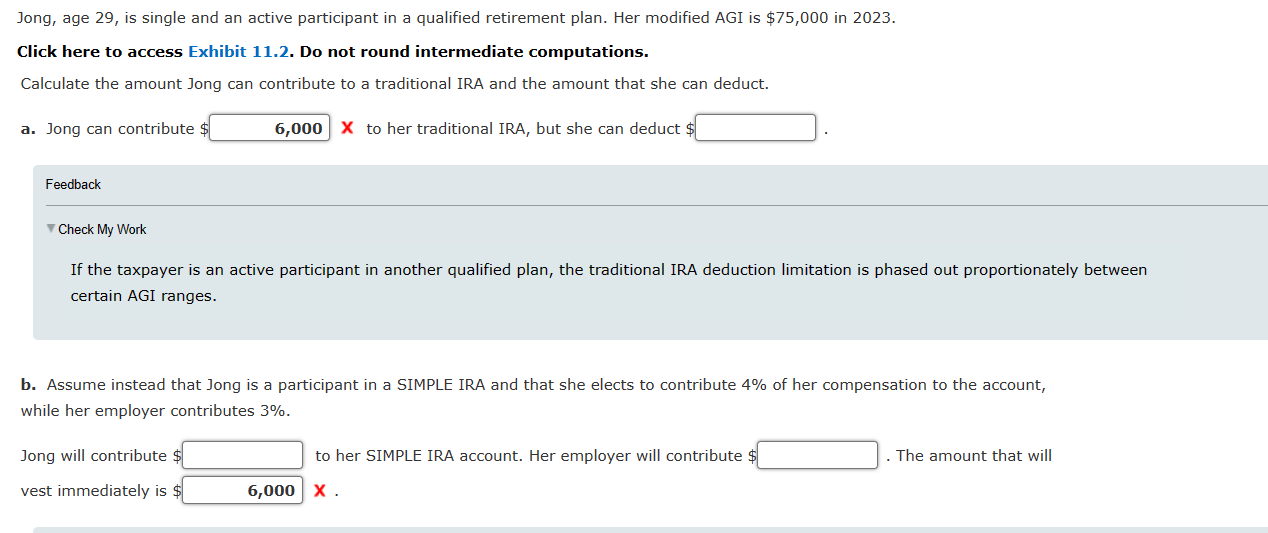

Question: Jong, age 2 9 , is single and an active participant in a qualified retirement plan. Her modified AGI is $ 7 5 , 0

Jong, age is single and an active participant in a qualified retirement plan. Her modified AGI is $ in

Click here to access Exhibit Do not round intermediate computations.

Calculate the amount Jong can contribute to a traditional IRA and the amount that she can deduct.

a Jong can contribute $

X to her traditional IRA, but she can deduct $

Feedback

Check My Work

If the taxpayer is an active participant in another qualified plan, the traditional IRA deduction limitation is phased out proportionately between

certain AGI ranges.

b Assume instead that Jong is a participant in a SIMPLE IRA and that she elects to contribute of her compensation to the account,

while her employer contributes

Jong will contribute $

to her SIMPLE IRA account. Her employer will contribute $

The amount that will

vest immediately is $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock