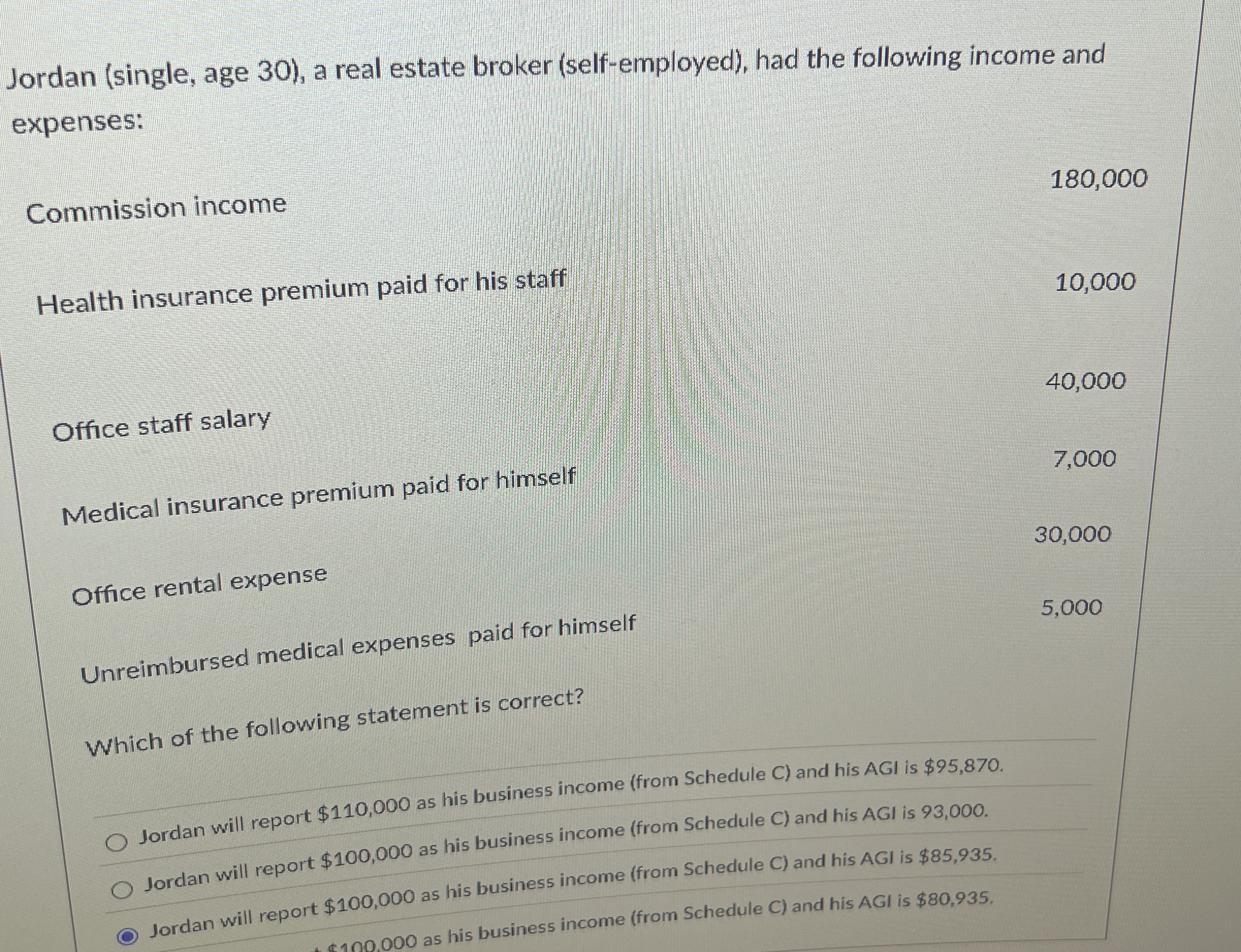

Question: Jordan ( single , age 3 0 ) , a real estate broker ( self - employed ) , had the following income and expenses:

Jordan single age a real estate broker selfemployed had the following income and expenses:

Commission income

Health insurance premium paid for his staff

Office staff salary

Medical insurance premium paid for himself

Office rental expense

Unreimbursed medical expenses paid for himself

Which of the following statement is correct?

Jordan will report $ as his business income from Schedule C and his AGI is $

Jordan will report $ as his business income from Schedule C and his AGI is

Jordan will report $ as his business income from Schedule C and his AGI is $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock