Answered step by step

Verified Expert Solution

Question

1 Approved Answer

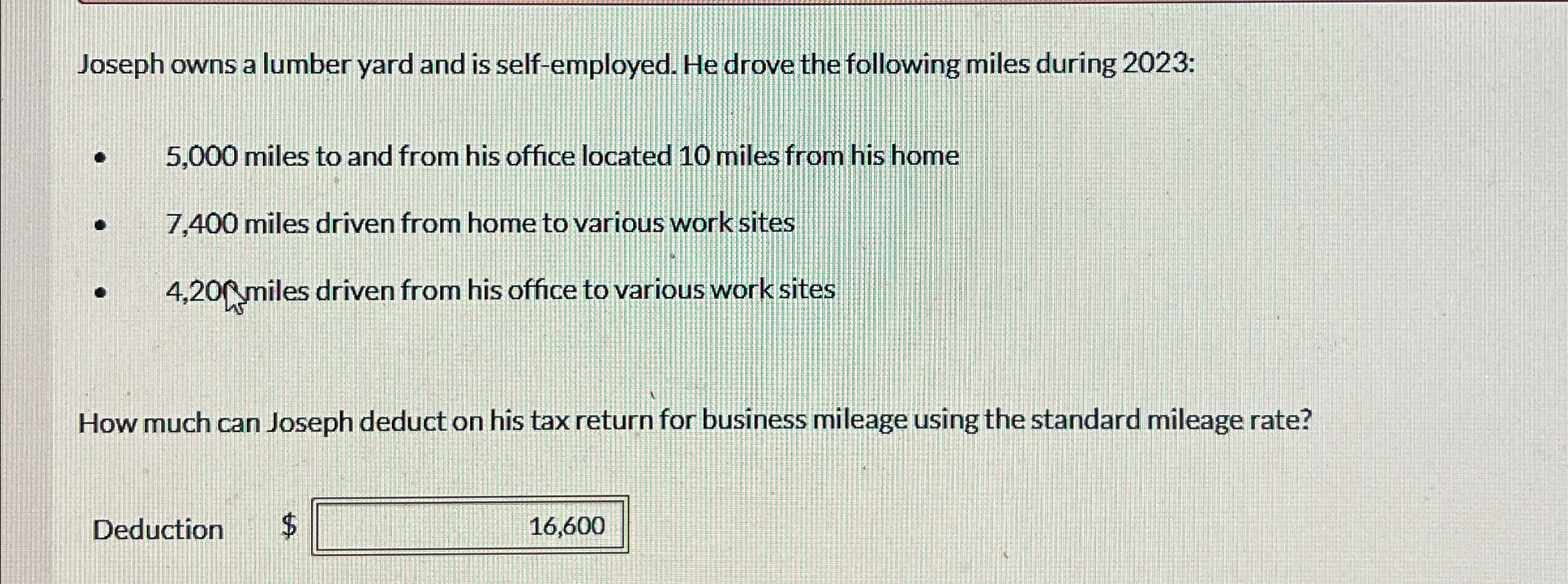

Joseph owns a lumber yard and is self-employed. He drove the following miles during 2023: 5,000 miles to and from his office located 10

Joseph owns a lumber yard and is self-employed. He drove the following miles during 2023: 5,000 miles to and from his office located 10 miles from his home 7,400 miles driven from home to various work sites 4,20 miles driven from his office to various work sites How much can Joseph deduct on his tax return for business mileage using the standard mileage rate? Deduction $ 16,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Josephs deduction for business mileage using the stand...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66425d3291e9f_981776.pdf

180 KBs PDF File

66425d3291e9f_981776.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started