Question: Joumalze the adjusting entry neoded at Decomber 31 for each of the folowing indopandent situations (1) (Click the icon to view the situations.) nalize the

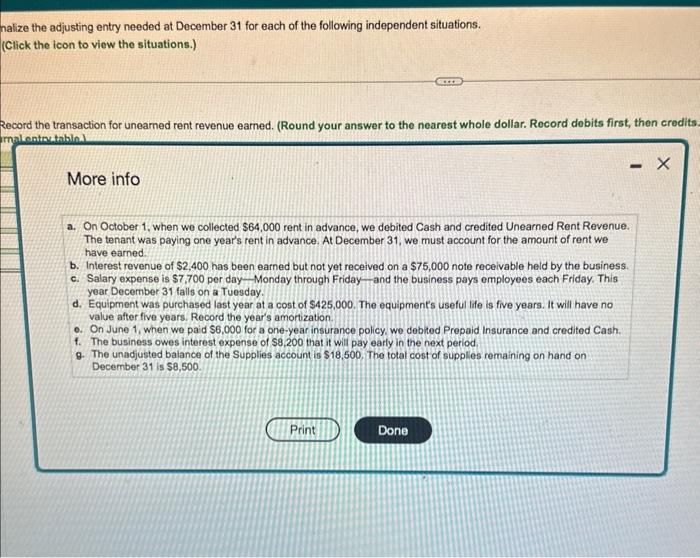

Joumalze the adjusting entry neoded at Decomber 31 for each of the folowing indopandent situations (1) (Click the icon to view the situations.) nalize the adjusting entry needed at December 31 for each of the following independent situations. (Click the icon to view the situations.) 2ecord the transaction for uneamed rent revenue earned. (Round your answer to the nearest whole dollar. Record dobits first, then credits malentmitabini More info a. On October 1, when we collected $64,000 rent in advance, we debited Cash and credited Unearned Rent Revenue. The tenant was paying one year's rent in advance. At December 31, we must account for the amount of rent we have earned. b. Interest revenue of $2,400 has been earned but not yet received on a $75,000 note receivable held by the business. c. Salary expense is $7,700 per day-Monday through Friday - and the business pays employees each Friday. This year December 31 falls on a Tuesday. d. Equipment was purchased last year at a cost of $425,000. The equipments useful life is five years. it will have no value after five years. Record the year's amortization. c. On June 1, when we paid S6,000 for a one-year insurance policy, we debited Prepaid Insurance and credited Cash. f. The business owes interest expense of 58,200 that it will pay early in the next period 9. The unadjusted balance of the Supplies account is $18,500. The total cost of supplles remaining on hand on December 31 is $8,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts