Question: Journal Entrees Step 5: Which option do you think the controller should select and why? Effect of Estimates of Useful Life and Salvage Value on

Journal Entrees

Step 5: Which option do you think the controller should select and why?

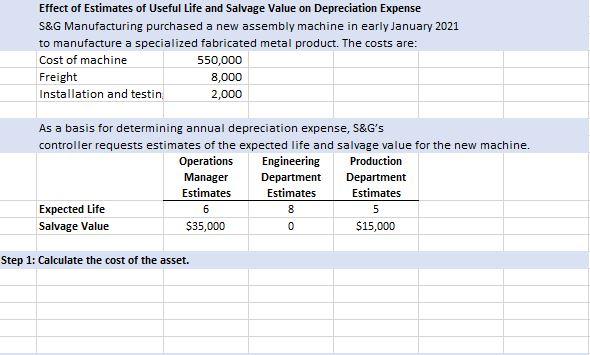

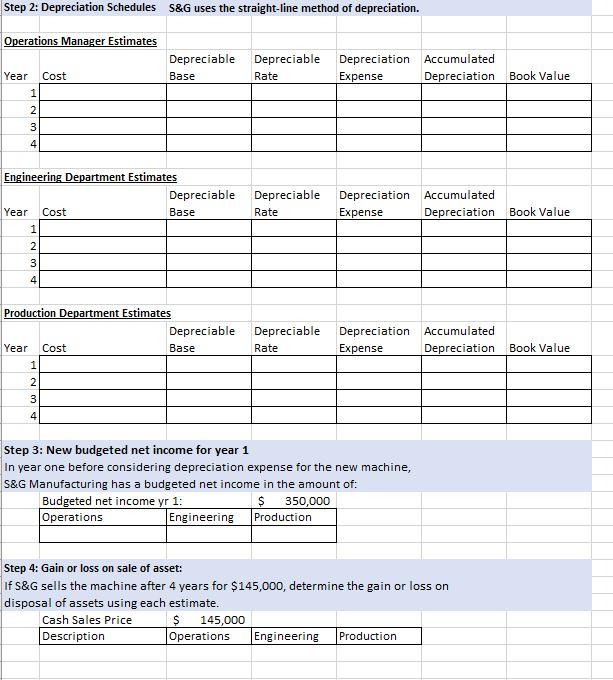

Effect of Estimates of Useful Life and Salvage Value on Depreciation Expense S&G Manufacturing purchased a new assembly machine in early January 2021 to manufacture a specialized fabricated metal product. The costs are: Cost of machine 550,000 Freight 8,000 Installation and testin 2,000 As a basis for determining annual depreciation expense, S&G's controller requests estimates of the expected life and salvage value for the new machine. Operations Engineering Production Manager Department Department Estimates Estimates Estimates Expected Life 5 Salvage Value $35,000 $15,000 6 8 0 Step 1: Calculate the cost of the asset. Step 2: Depreciation Schedules S&G uses the straight-line method of depreciation. Operations Manager Estimates Depreciable Base Depreciable Rate Depreciation Accumulated Expense Depreciation Book Value Year Cost 1 2 3 4 Depreciable Rate Engineering Department Estimates Depreciable Year Cost Base 1 2 3 Depreciation Accumulated Expense Depreciation Book Value AN 4 Production Department Estimates Depreciable Year Cost Base 1 Depreciable Rate Depreciation Accumulated Expense Depreciation Book Value 2 AWN 3 4 Step 3: New budgeted net income for year 1 In year one before considering depreciation expense for the new machine, S&G Manufacturing has a budgeted net income in the amount of: Budgeted net income yr 1: $ 350,000 Operations Engineering Production Step 4: Gain or loss on sale of asset: If S&G sells the machine after 4 years for $145,000, determine the gain or loss on disposal of assets using each estimate. Cash Sales Price $ 145,000 Description Operations Engineering Production

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts