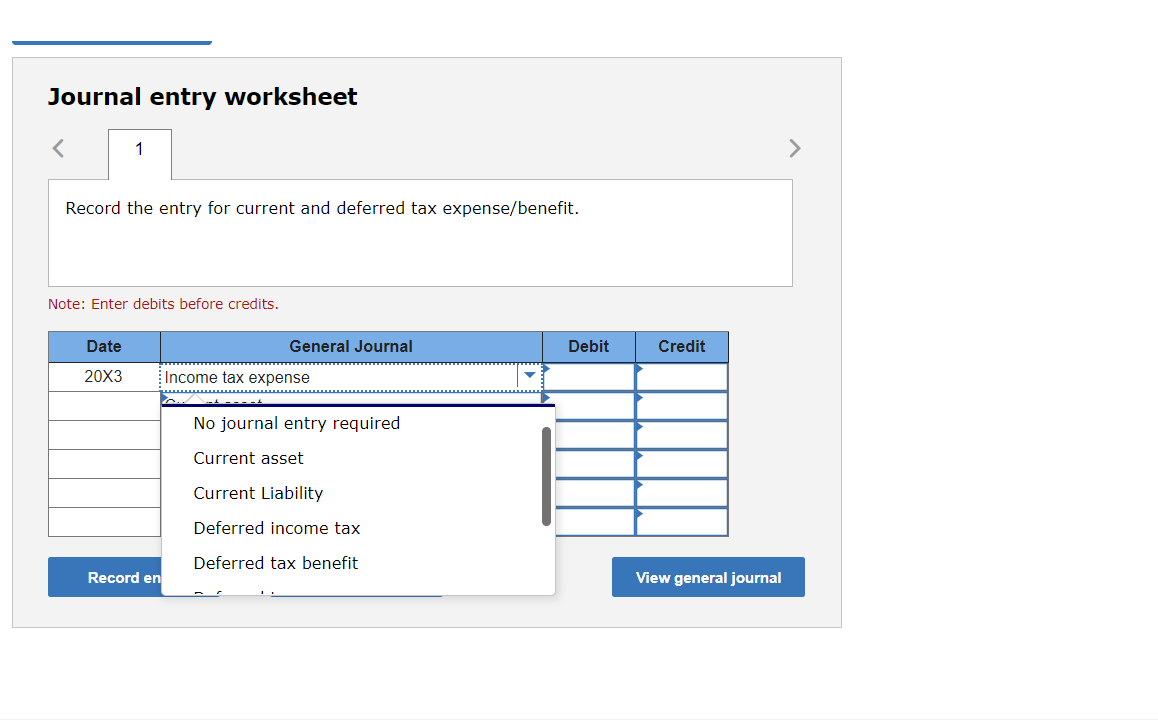

Question: Journal entry worksheet 1 > Record the entry for current and deferred tax expense/benefit. Note: Enter debits before credits. Date General Journal Debit Credit 20X3

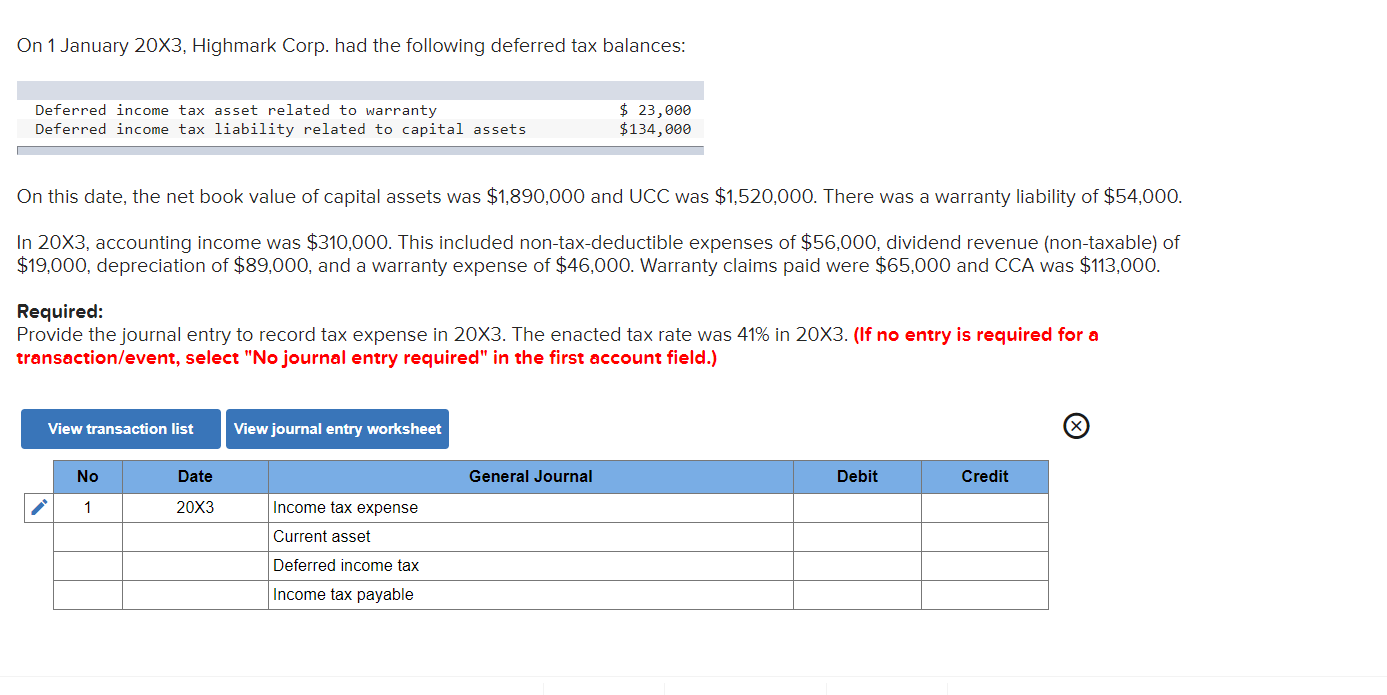

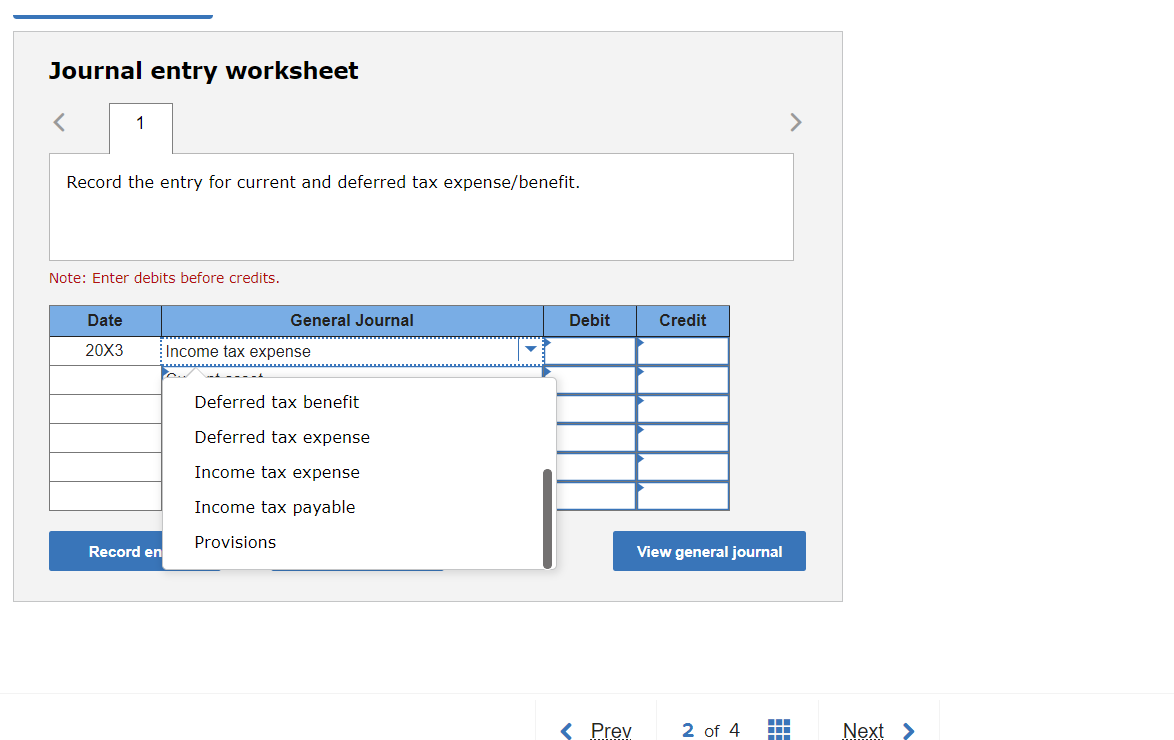

Journal entry worksheet 1 > Record the entry for current and deferred tax expense/benefit. Note: Enter debits before credits. Date General Journal Debit Credit 20X3 Income tax expense ------- No journal entry required Current asset Current Liability Deferred income tax Deferred tax benefit Record en View general journal On 1 January 20X3, Highmark Corp. had the following deferred tax balances: Deferred income tax asset related to warranty Deferred income tax liability related to capital assets $ 23,000 $134,000 On this date, the net book value of capital assets was $1,890,000 and UCC was $1,520,000. There was a warranty liability of $54,000. In 20X3, accounting income was $310,000. This included non-tax-deductible expenses of $56,000, dividend revenue (non-taxable) of $19,000, depreciation of $89,000, and a warranty expense of $46,000. Warranty claims paid were $65,000 and CCA was $113,000. Required: Provide the journal entry to record tax expense in 20X3. The enacted tax rate was 41% in 20X3. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 20X3 Income tax expense Current asset Deferred income tax Income tax payable Journal entry worksheet Record the entry for current and deferred tax expense/benefit. Note: Enter debits before credits. Date General Journal Debit Credit 20X3 Income tax expense Deferred tax benefit Deferred tax expense Income tax expense Income tax payable Provisions Record en View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts