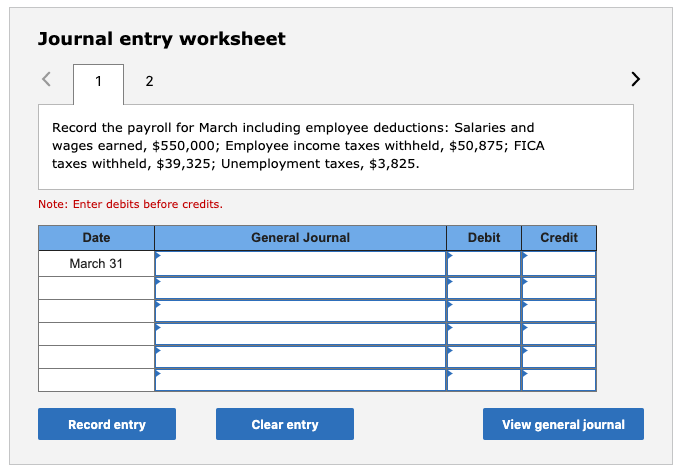

Question: Journal entry worksheet 2 Record the payroll for March including employee deductions: Salaries and wages earned, $550,000; Employee income taxes withheld, $50,875; FICA taxes withheld,

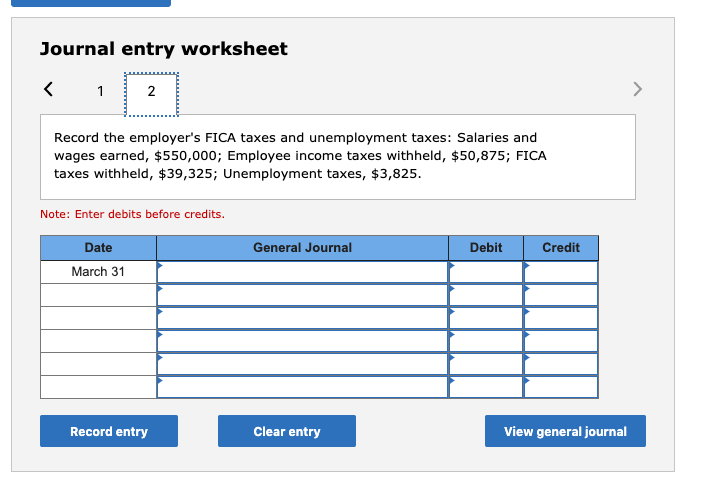

Journal entry worksheet 2 Record the payroll for March including employee deductions: Salaries and wages earned, $550,000; Employee income taxes withheld, $50,875; FICA taxes withheld, $39,325; Unemployment taxes, $3,825. Note: Enter debits before credits. Credit Date General Journal Debit March 31 Record entry Clear entry View general journal Journal entry worksheet Record the employer's FICA taxes and unemployment taxes: Salaries and wages earned, $550,000; Employee income taxes withheld, $50,875; FICA taxes withheld, $39,325; Unemployment taxes, $3,825 Note: Enter debits before credits. Date Debit General Journal Credit March 31 Clear entry View general journal Record entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts