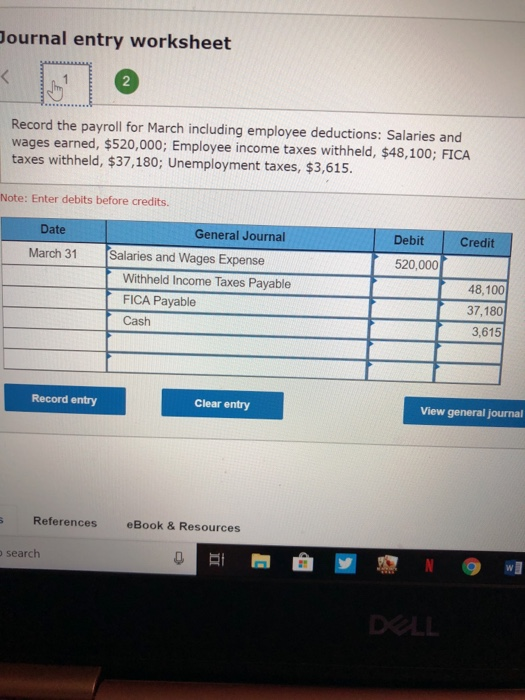

Question: ournal entry worksheet 2 Record the payroll for March including employee deductions: Salaries and wages earned, $520,000; Employee income taxes withheld, $48,100; FICA taxes withheld,

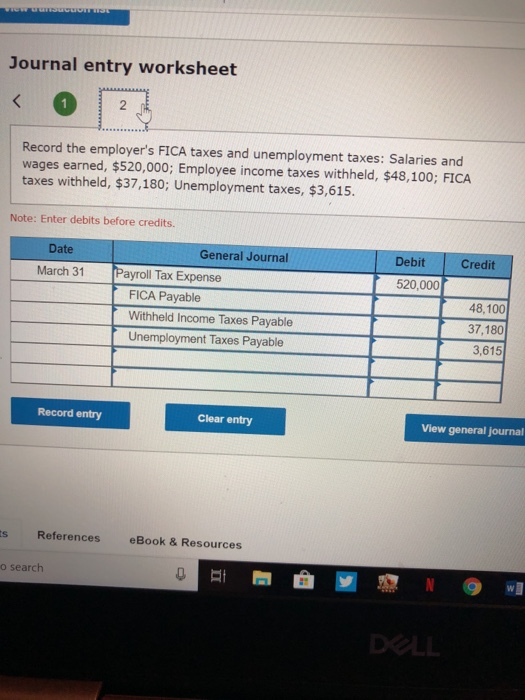

ournal entry worksheet 2 Record the payroll for March including employee deductions: Salaries and wages earned, $520,000; Employee income taxes withheld, $48,100; FICA taxes withheld, $37,180; Unemployment taxes, $3,615. Note: Enter debits before credits. Credit Debit General Journal Date 520,000 Salaries and Wages Expense March 31 48,100 37,180 3,615 Withheld Income Taxes Payable FICA Payable Cash View general journal Clear entry Record entry eBook & Resources References search Journal entry worksheet 2 Record the employer's FICA taxes and unemployment taxes: Salaries and wages earned, $520,000; Employee income taxes withheld, $48,100; FICA taxes withheld, $37,180; Unemployment taxes, $3,615 Note: Enter debits before credits. Credit Debit 520,000 Dale General Journal March 31 ayroll Tax Expense 48,100 37,180 3,615 FICA Payable Withheld Income Taxes Payable Unemployment Taxes Payable Clear entry View general journal Record entry s References eBook & Resources WB o search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts