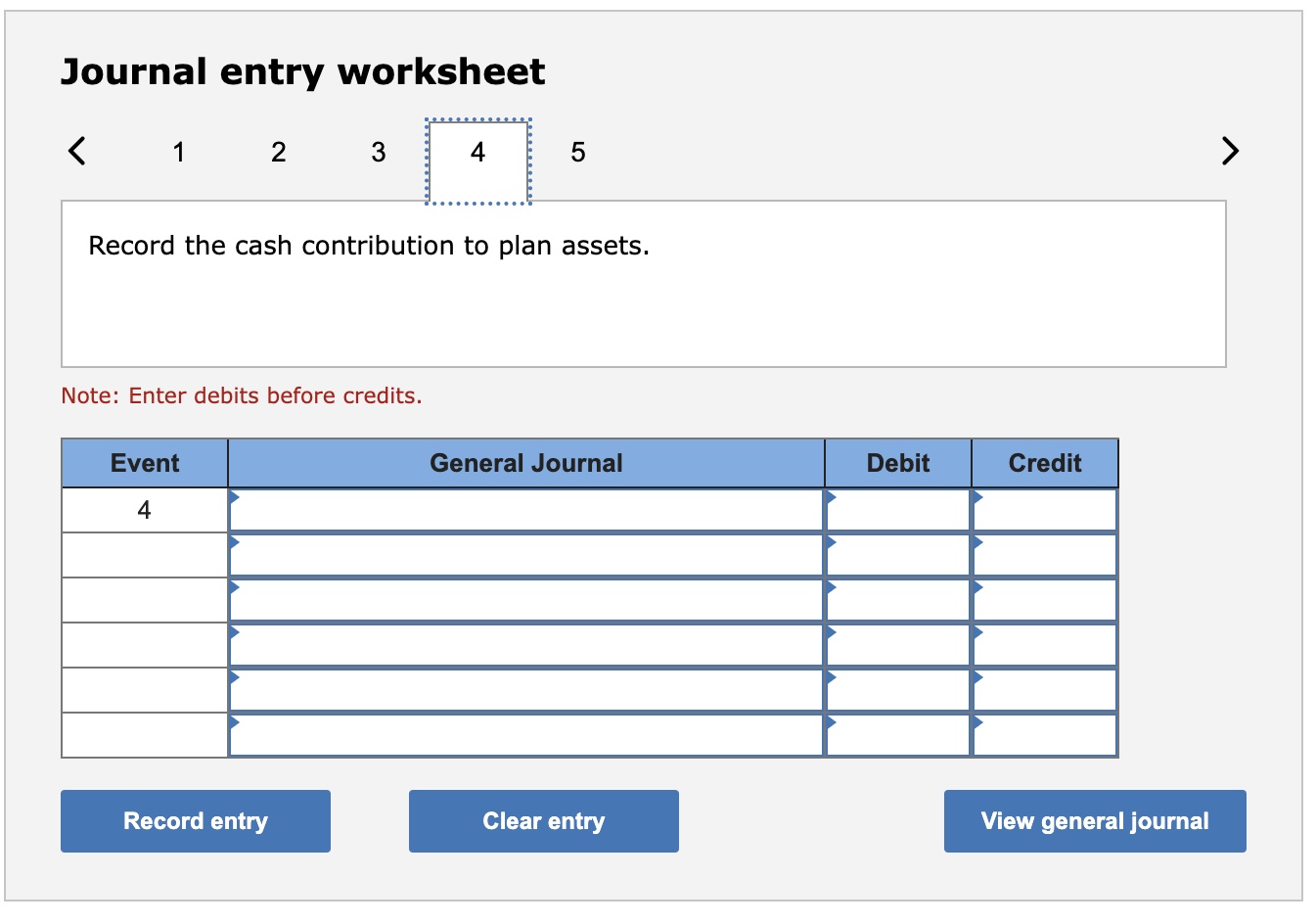

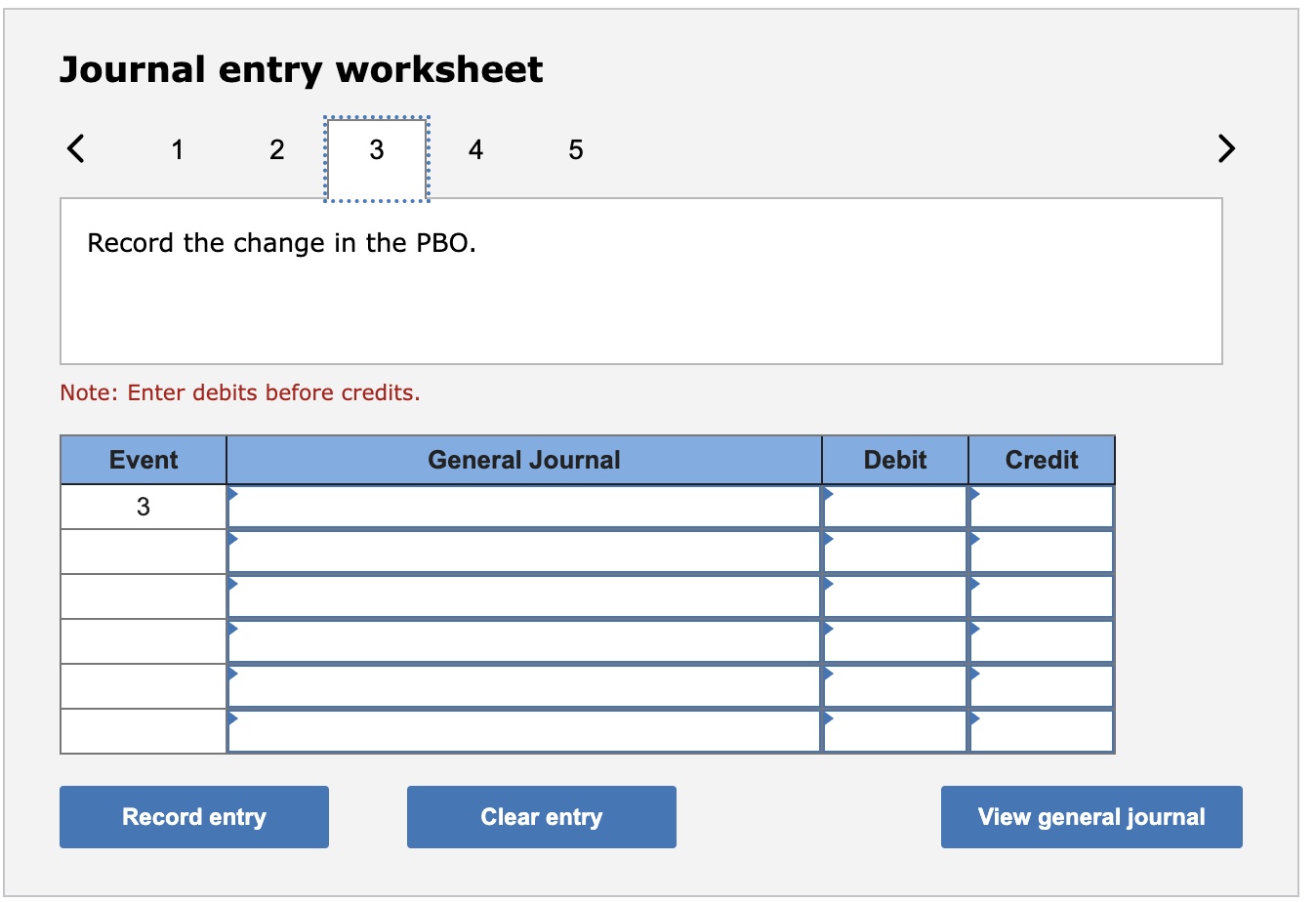

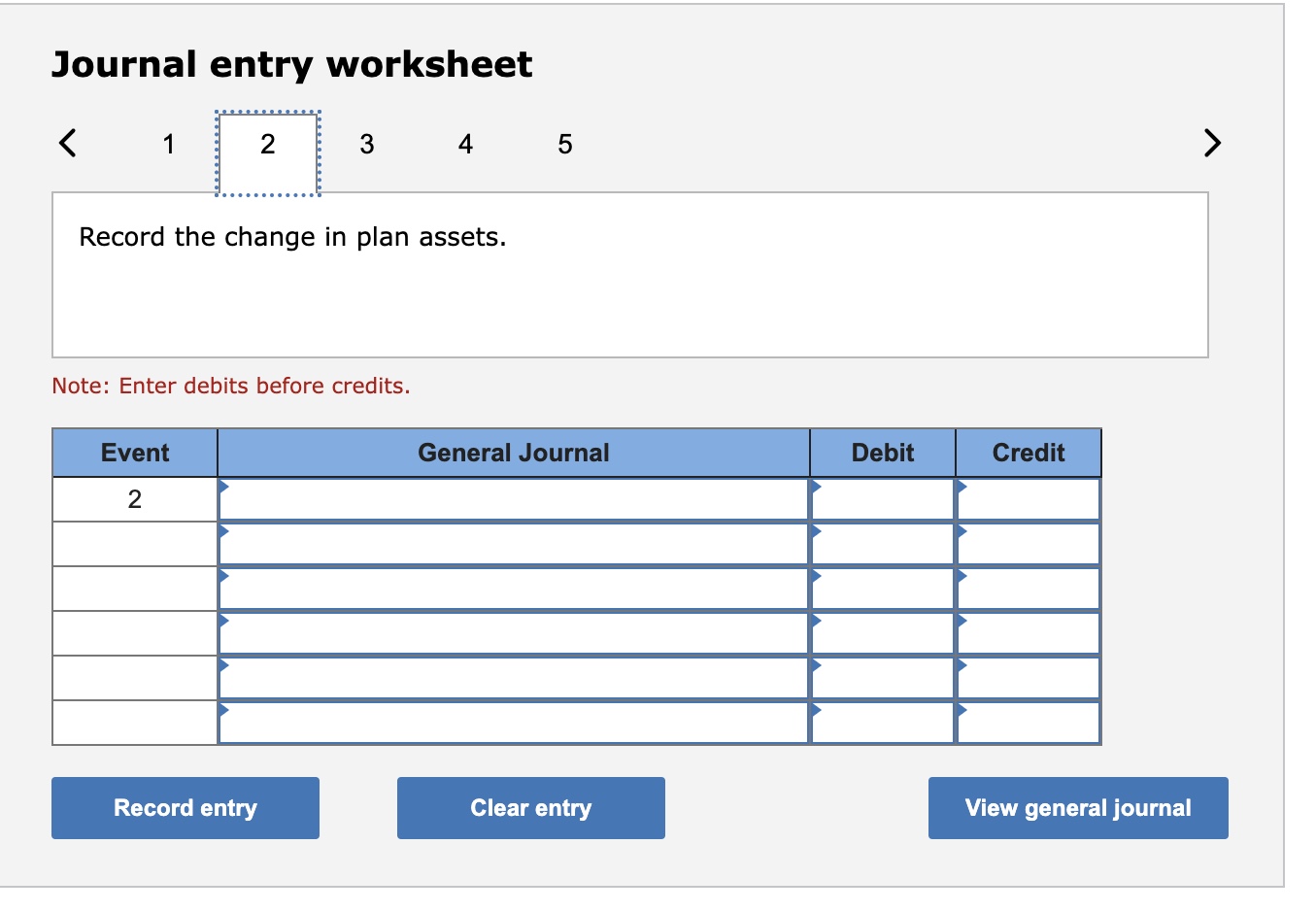

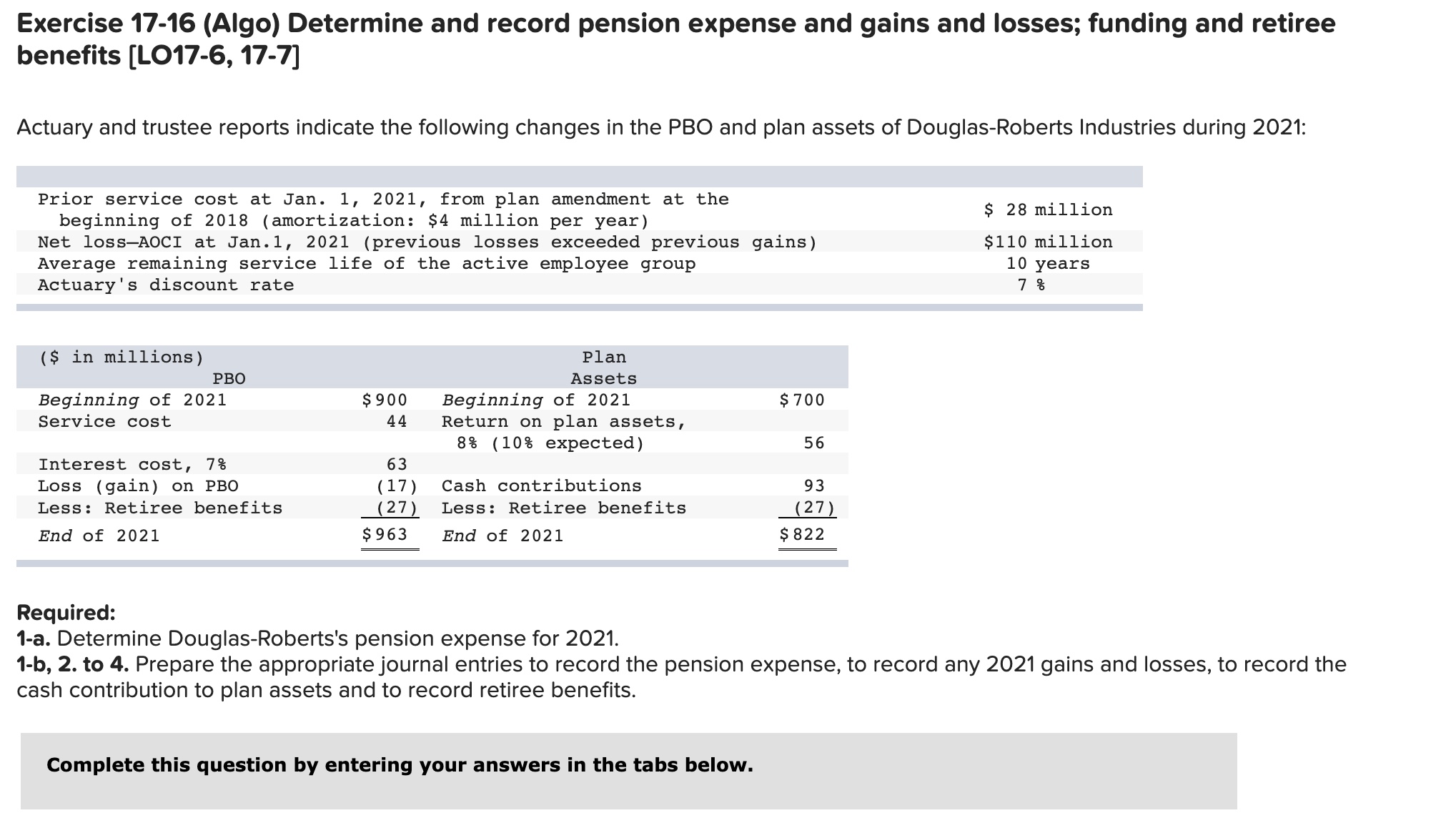

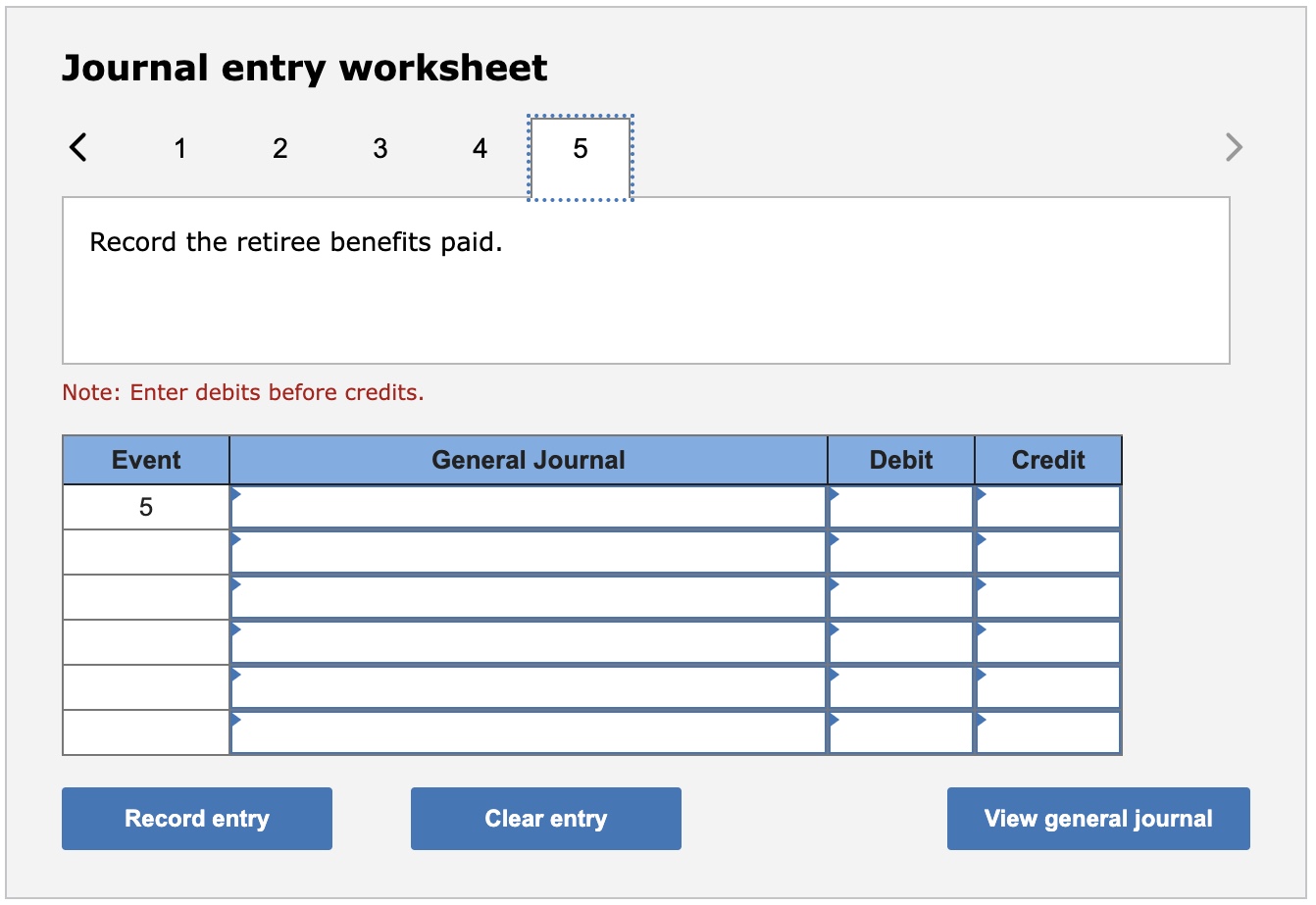

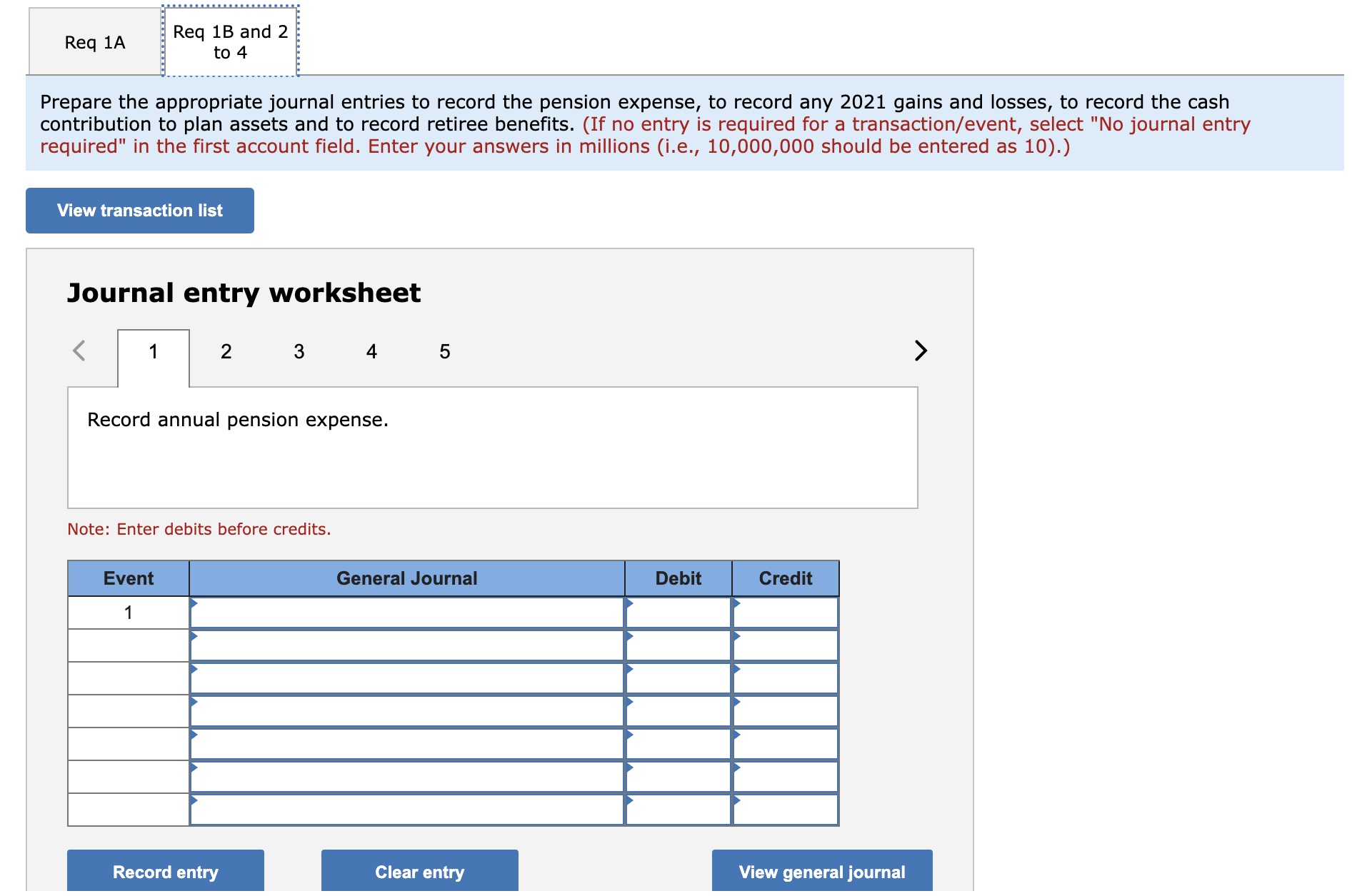

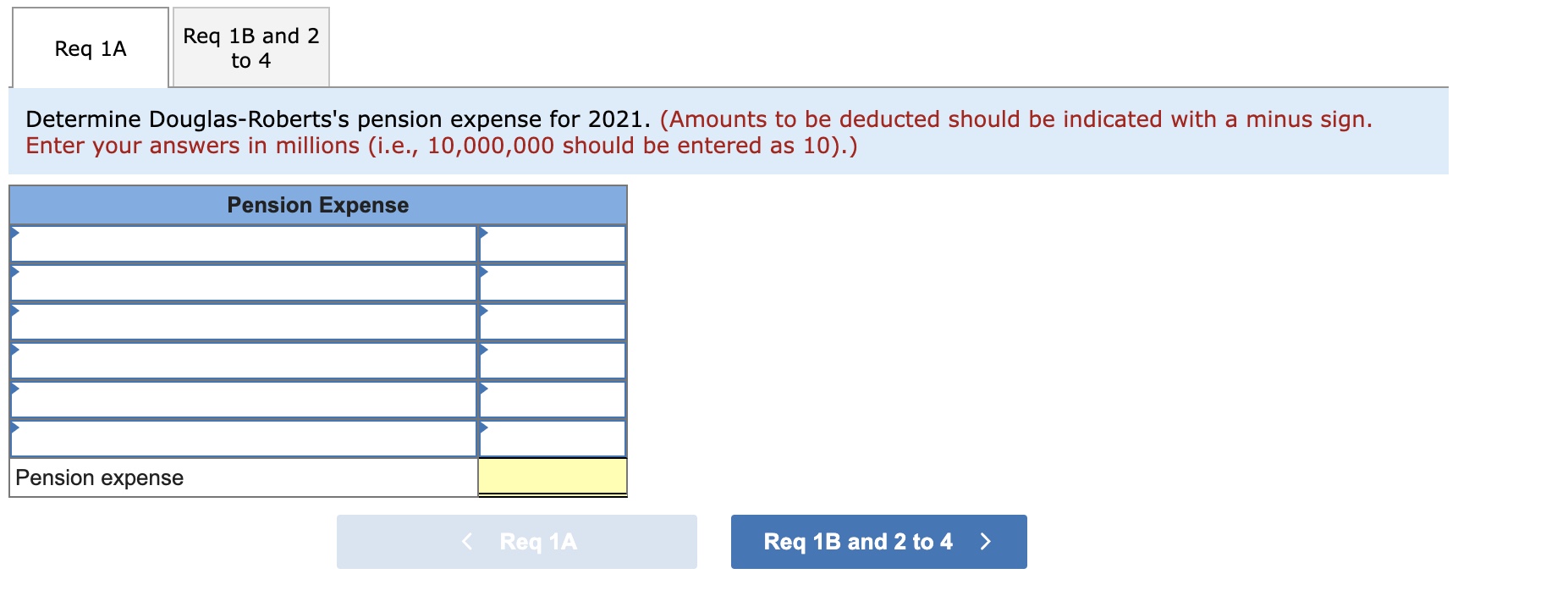

Question: Journal entry worksheet Record the cash contribution to plan assets. Note: Enter debits before credits. Record entry m View general journal Journal entry worksheet Record

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock