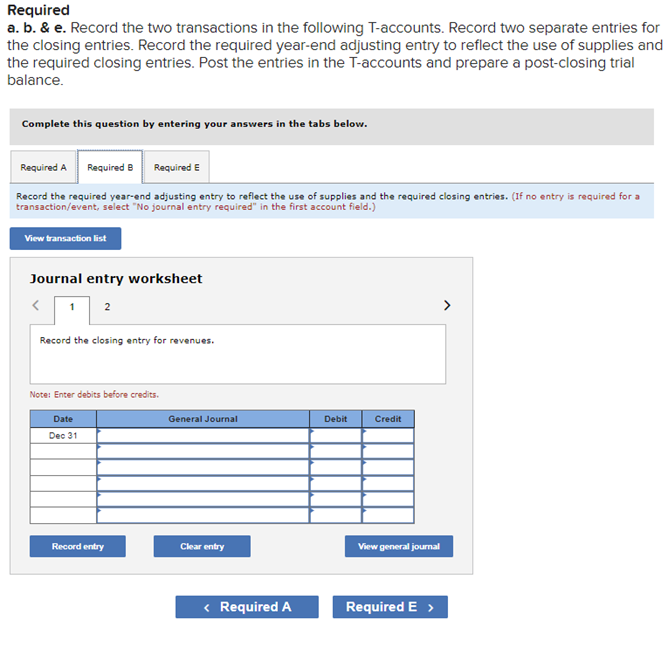

Question: Journal entry worksheet Record the closing entry for expenses. I forgot to add that tab. 1 question 3 parts. Thanks for the help! Required information

![Required information [The following information applies to the questions displayed below.] Sye](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6717cd7926c79_1766717cd787a68d.jpg)

Journal entry worksheet

Record the closing entry for expenses. I forgot to add that tab.

1 question 3 parts.

Thanks for the help!

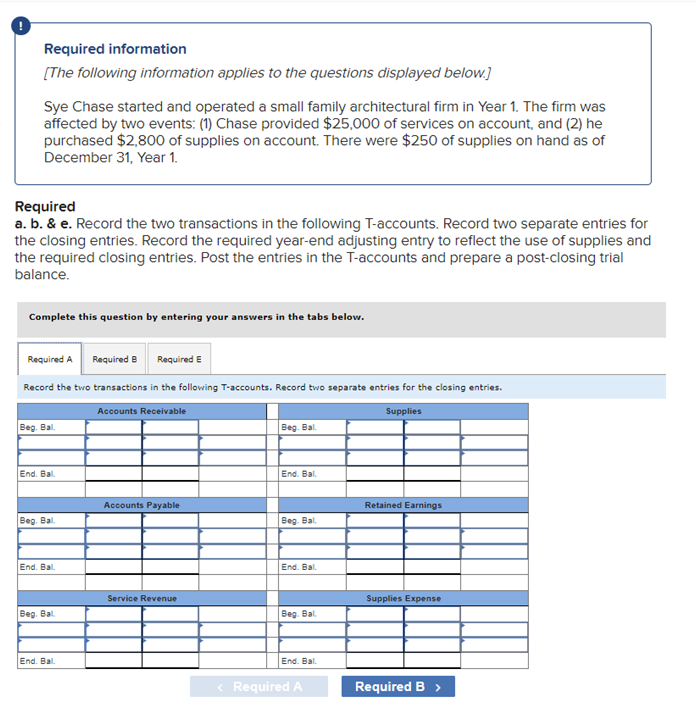

Required information [The following information applies to the questions displayed below.] Sye Chase started and operated a small family architectural firm in Year 1 . The firm was affected by two events: (1) Chase provided $25,000 of services on account, and (2) he purchased $2,800 of supplies on account. There were $250 of supplies on hand as of December 31, Year 1. Required a. b. \& e. Record the two transactions in the following T-accounts. Record two separate entries for the closing entries. Record the required year-end adjusting entry to reflect the use of supplies and the required closing entries. Post the entries in the T-accounts and prepare a post-closing trial balance. Complete this question by entering your answers in the tabs below. Record the two transactions in the following T-accounts. Record two separate entries for the closing entries. Required a. b. \& e. Record the two transactions in the following T-accounts. Record two separate entries for the closing entries. Record the required year-end adjusting entry to reflect the use of supplies and the required closing entries. Post the entries in the T-accounts and prepare a post-closing trial balance. Complete this question by entering your answers in the tabs below. Record the required year-end adjusting entry to reflect the use of supplies and the required closing entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. Required a. b. \& e. Record the two transactions in the following T-accounts. Record two separate entries for the closing entries. Record the required year-end adjusting entry to reflect the use of supplies and the required closing entries. Post the entries in the T-accounts and prepare a post-closing trial balance. Complete this question by entering your answers in the tabs below. Post the entries in the T-accounts and prepare a post-closing trial balance. Required information [The following information applies to the questions displayed below.] Sye Chase started and operated a small family architectural firm in Year 1 . The firm was affected by two events: (1) Chase provided $25,000 of services on account, and (2) he purchased $2,800 of supplies on account. There were $250 of supplies on hand as of December 31, Year 1. Required a. b. \& e. Record the two transactions in the following T-accounts. Record two separate entries for the closing entries. Record the required year-end adjusting entry to reflect the use of supplies and the required closing entries. Post the entries in the T-accounts and prepare a post-closing trial balance. Complete this question by entering your answers in the tabs below. Record the two transactions in the following T-accounts. Record two separate entries for the closing entries. Required a. b. \& e. Record the two transactions in the following T-accounts. Record two separate entries for the closing entries. Record the required year-end adjusting entry to reflect the use of supplies and the required closing entries. Post the entries in the T-accounts and prepare a post-closing trial balance. Complete this question by entering your answers in the tabs below. Record the required year-end adjusting entry to reflect the use of supplies and the required closing entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. Required a. b. \& e. Record the two transactions in the following T-accounts. Record two separate entries for the closing entries. Record the required year-end adjusting entry to reflect the use of supplies and the required closing entries. Post the entries in the T-accounts and prepare a post-closing trial balance. Complete this question by entering your answers in the tabs below. Post the entries in the T-accounts and prepare a post-closing trial balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts