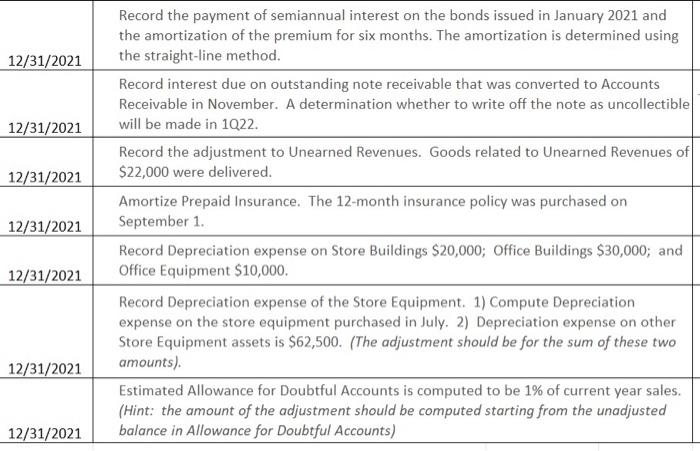

Question: Journalize the following adjustments in proper journal entry form. Please and thank you. begin{tabular}{l|l|} hline 12/31/2021 & begin{tabular}{l} Record the payment of semiannual interest on

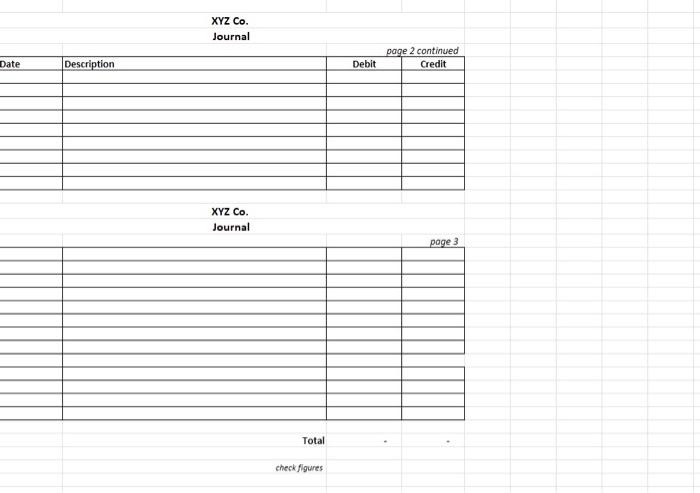

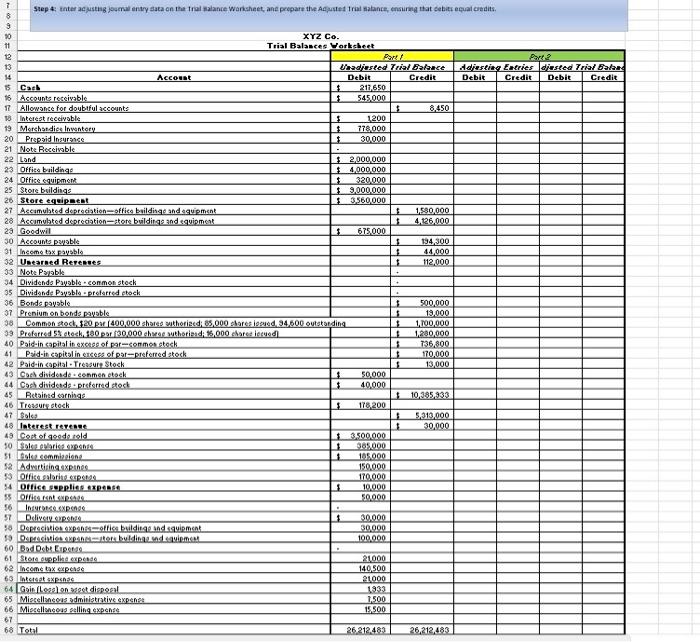

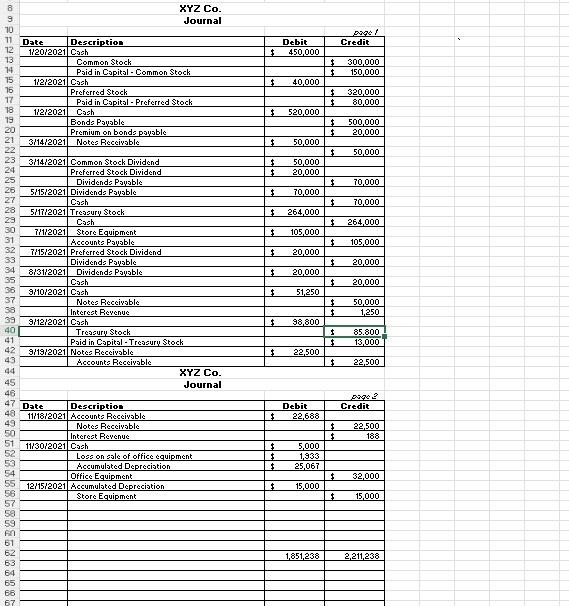

\begin{tabular}{l|l|} \hline 12/31/2021 & \begin{tabular}{l} Record the payment of semiannual interest on the bonds issued in January 2021 and \\ the amortization of the premium for six months. The amortization is determined using \\ the straight-line method. \end{tabular} \\ \hline 12/31/2021 & \begin{tabular}{l} Record interest due on outstanding note receivable that was converted to Accounts \\ Receivable in November. A determination whether to write off the note as uncollectible \\ will be made in 1Q22. \end{tabular} \\ \hline 12/31/2021 & \begin{tabular}{l} Record the adjustment to Unearned Revenues. Goods related to Unearned Revenues of \\ $22,000 were delivered. \end{tabular} \\ \hline 12/31/2021 & \begin{tabular}{l} Amortize Prepaid Insurance. The 12-month insurance policy was purchased on \\ September 1. \end{tabular} \\ \hline 12/31/2021 & \begin{tabular}{l} Record Depreciation expense on Store Buildings $20,000; Office Buildings $30,000; and \\ Office Equipment $10,000. \end{tabular} \\ \hline 12/31/2021 & \begin{tabular}{l} Record Depreciation expense of the Store Equipment. 1) Compute Depreciation \\ expense on the store equipment purchased in July. 2) Depreciation expense on other \\ Store Equipment assets is $62,500. (The adjustment should be for the sum of these two \\ amounts). \end{tabular} \\ \hline 12/31/2021 & \begin{tabular}{l} Estimated Allowance for Doubtful Accounts is computed to be 1\% of current year sales. \\ (Hint: the amount of the adjustment should be computed starting from the unadjusted \\ balance in Allowance for Doubtful Accounts) \end{tabular} \\ \hline \end{tabular} XYZ Co. Journal page 2 continued \begin{tabular}{|l|l|l|l|} \hline Date & Description & \multicolumn{3}{c|}{ Debit } & Coge 2 continued \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} XYZ Co. Journal poge 3 \begin{tabular}{|l|l|l|l|} \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Total check figures x rz co. Trial Balaeces Yorksheet \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow[b]{3}{*}{ Account } & \multicolumn{2}{|c|}{ Bart } & \multicolumn{4}{|c|}{ Part? } \\ \hline & \multicolumn{2}{|c|}{ Shadiested Friol Broloce } & \multicolumn{2}{|c|}{ deliesting Entries } & \multicolumn{2}{|c|}{ diested Triol Exher. } \\ \hline & Debit & Credit & Debit & Credit & Debit & Credit \\ \hline Cath & 211,650 & & & & & \\ \hline Accounte rescivable & 545,000 & & & & & \\ \hline Allowance for doubtful accounts & & 8,450 & & & & \\ \hline laterest receivoble & 1200 & & & & & \\ \hline Morehotdice Inwentory & 8,000 & & & & & \\ \hline Prepsid Inauronse & 30000 & & & & & \\ \hline Note Receivable & & & & & & \\ \hline Lond & $2,000000 & & & & & \\ \hline Offiso bailding & $4,000,000 & & & & & \\ \hline Office equipment & $320000 & & & & & \\ \hline Store bsildinge & $9,000000 & & & & & \\ \hline Stort equipetet & $3.560000 & & & & & \\ \hline Accamulated depreciation - office baildingo and equipment & & 1,580,000 & & & & \\ \hline Accumulated depreciation - tore buildinge and squipmeas & & 4,126,000 & & & & \\ \hline Goodwil & 675000 & & & & & \\ \hline Accounts pewsble & & 194,300 & & & & \\ \hline Income tax paysblo & & 44,000 & & & & \\ \hline Unearned Repentes & & 112,000 & & & & \\ \hline Note Priable & & + & & & & \\ \hline Dividenda Paysble-sonmon stesk & & + & & & & \\ \hline Dividande Paysble = preforred ctock & & + & & & & \\ \hline Bonde payoble & & 500,000 & & & & \\ \hline Prenium on bends paysble & & 19,000 & & & & \\ \hline & 1,100,000 & & & & \\ \hline & & 1,230,000 & & & & \\ \hline Paid-in sapital in excese of par-sommes stesk. & & 736,800 & & & & \\ \hline Prid-in sopirolin eseses of par-preterred stock & & 170,000 & & & & \\ \hline Paid-in capital-Treasure Stosk & & 13,000 & & & & \\ \hline Cash disidende - cenmen ctock & 50,000 & & & & & \\ \hline Cosb dividesde - prefermed steck & 40,000 & & & & & \\ \hline Retoifos sarnings. & & 10,385,333 & & & & \\ \hline Trossury stosk & 178,200 & & & & & \\ \hline Sales & & 5,313,000 & & & & \\ \hline Interest revenge & & 30,000 & & & & \\ \hline Cest of qoode teld & i 3.500000 & & & & & \\ \hline Sales elarice expeches & 1305000 & & & & & \\ \hline Salse eommisaine & 165000 & & & & & \\ \hline Adwetising exptnes & 150000 & & & & & \\ \hline Offict eatarits expets & 170.000 & & & & & \\ \hline Ditice sepplies expeste & 10.000 & & & & & \\ \hline Orfite rent expesas & 50,000 & & & & & \\ \hline Insuroses expende & & & & & & \\ \hline Delivety eipestes & 30,000 & & & & & \\ \hline Deptecistion expenst = office bulditeqe and squipment & 30,000 & & & & & \\ \hline & 100000 & & & & & \\ \hline BadDebe Eiperas & & & & & & \\ \hline Stote ouplikd expende & 21000 & & & & & \\ \hline Ineofie tax experse & 140,500 & & & & & \\ \hline Inteteat sxpesise & 21000 & & & & & \\ \hline Gris flesgl on sect disposal & 1933 & & & & & \\ \hline Miecellanecos administrakive expenes & 1,500 & & & & & \\ \hline Miscellinceas aslling expechse & 15,500 & & & & & \\ \hline Total & 26.212,483 & 26,212,483 & & & & \\ \hline \end{tabular} XYZ Co. Journal \begin{tabular}{|c|c|c|c|} \hline Date & Description & Debit & avas \\ \hline 1/20/2021 & & \begin{tabular}{|l|l|} & Deblt \\ $450,000 \\ \end{tabular} & \\ \hline & Common Stock & & $300,000 \\ \hline & Paid in Capital - Common Stock & & $150,000 \\ \hline 1/2/2021 & Cosh & $40,000 & \\ \hline & Preferred Stock & & $320,000 \\ \hline & Paid in Copital - Preferred Stock & & $80,000 \\ \hline 1/212021 & Cash & 520,000 & \\ \hline & Bonds Pausbles & & 500000 \\ \hline & Premium on bonds pausble & & 20,000 \\ \hline 3/14/2021 & Notes Reccivabls & $50,000 & \\ \hline & & & 50,000 \\ \hline 3/14/2021 & Common Stock Dividend & $50,000 & \\ \hline & Preferred Stock Dividend & +20,000 & \\ \hline & & & 70000 \\ \hline 5/15/2021 & Dividende Pavabls & 70,000 & \\ \hline & Cash & & 70,000 \\ \hline 5/17/2021 & Tresaury Stock & $264,000 & \\ \hline & Coth & & $264,000 \\ \hline 7112021 & Store Equipment & 105,000 & \\ \hline & Accounte Pousbles & & 105,000 \\ \hline 7/15/2021 & Preferred Stock Dividend & 20,000 & \\ \hline & Dividende Pawable & & 20,000 \\ \hline 8/31/2021 & Dividende Pavables & 20,000 & \\ \hline & Cash & & 20,000 \\ \hline 9/10/2021 & Cash & 51,250 & \\ \hline & Note Reccimable & & 50,000 \\ \hline & Interest Revenus & & 1,250 \\ \hline 9/12/2021 & Cash & 98,800 & \\ \hline & Tresaury Stock & & 85.800 \\ \hline & Psid in Copital - Tresauru Stock & & 13,000 \\ \hline 9/19/2021 & Notes Reccivable & 22,500 & \\ \hline & Accounte Reccivables & & 22,500 \\ \hline \end{tabular} XYZ Co. Journal sin2 \begin{tabular}{|c|c|c|c|} \hline & & & sin2 \\ \hline Dakt & Description & Debit & Credit \\ \hline \multirow[t]{3}{*}{ 11/18/2021 } & Accounte Reccivable & 22,688 & \\ \hline & Note Receivable & & $22,500 \\ \hline & Intereat Revenus & & 188 \\ \hline \multirow[t]{4}{*}{11/30/2021} & Cosh & 5,000 & \\ \hline & Loes on asle of office equipment & 1,933 & \\ \hline & Accumulated Depreciation & $25,067 & \\ \hline & Office Equipment & & 32,000 \\ \hline \multirow[t]{9}{*}{12/15/2021} & Accumulated Depreciation & 15,000 & \\ \hline & Store Equipment & & $15,000 \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & 1,851,238 & 2211238 \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts