Question: Journalize the transactions. Explinations are not required. Exercise begins an accounting cycle that will be completed in Chapter 3. (Learning Objectives 1,4,5, 6: Explain what

Journalize the transactions. Explinations are not required.

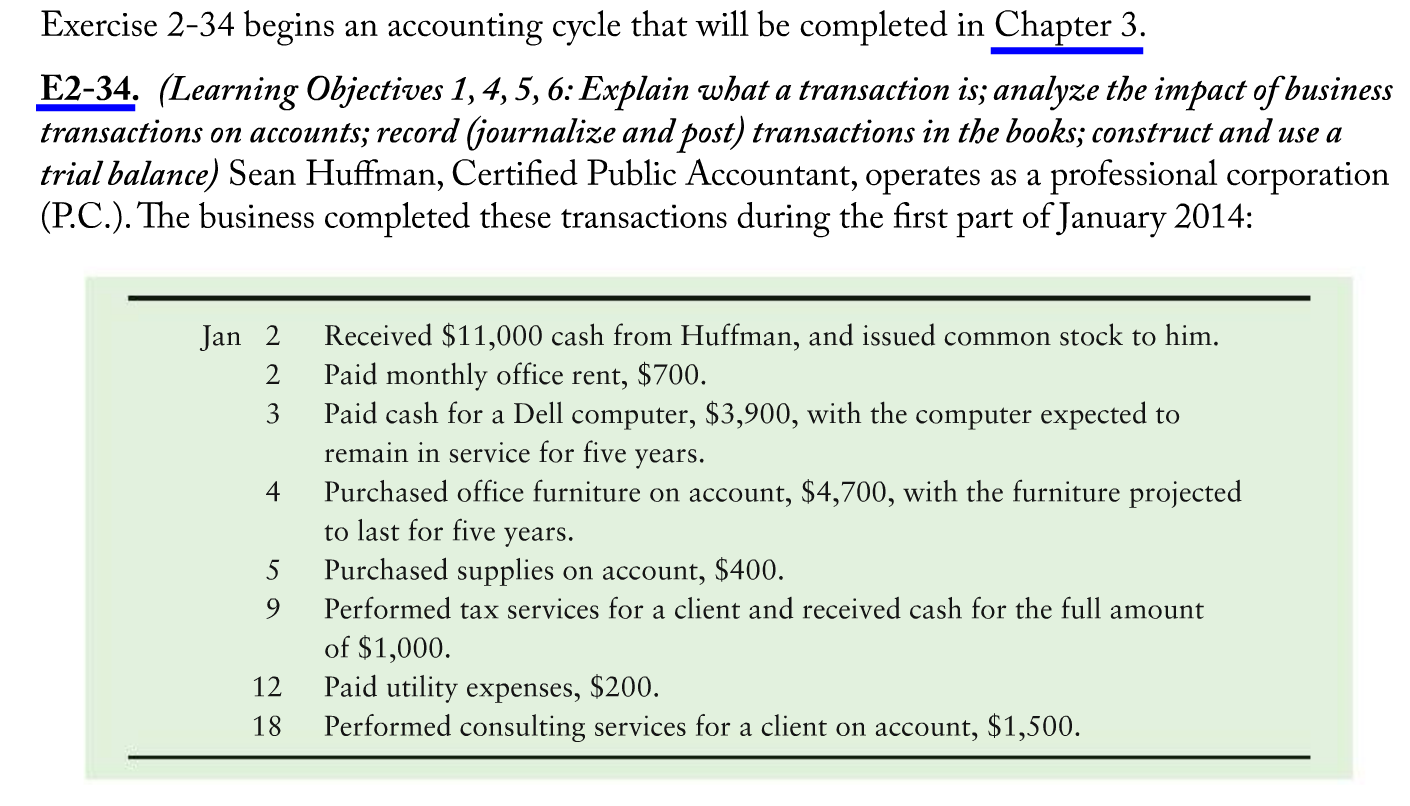

Exercise begins an accounting cycle that will be completed in Chapter 3. (Learning Objectives 1,4,5, 6: Explain what a transaction is; analyze the impact of business transactions on accounts; record (journalize and post) transactions in the books; construct and use a trial balance) Sean Huffman, Certified Public Accountant, operates as a professional corporation (P.C.). The business completed these transactions during the first part of January 2014: Jan 2 Received $11,000 cash from Huffman, and issued common stock to him. 2 Paid monthly office rent, $700. 3 Paid cash for a Dell computer, $3,900, with the computer expected to remain in service for five years. 4 Purchased office furniture on account, $4,700, with the furniture projected to last for five years. 5 Purchased supplies on account, $400. 9 Performed tax services for a client and received cash for the full amount of $1,000. 12 Paid utility expenses, $200. 18 Performed consulting services for a client on account, $1,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts