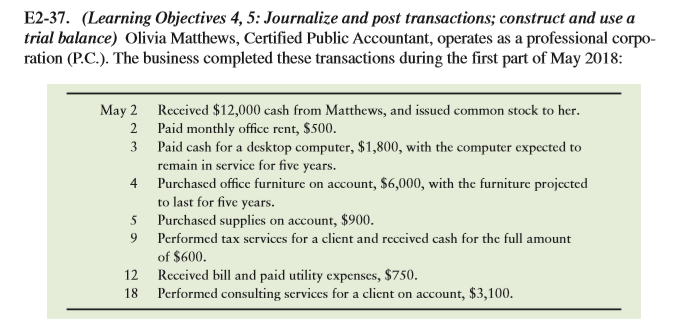

Question: E2-37. (Learning Objectives 4, 5: Journalize and post transactions; construct and use a trial balance) Olivia Matthews, Certified Public Accountant, operates as a professional corpo-

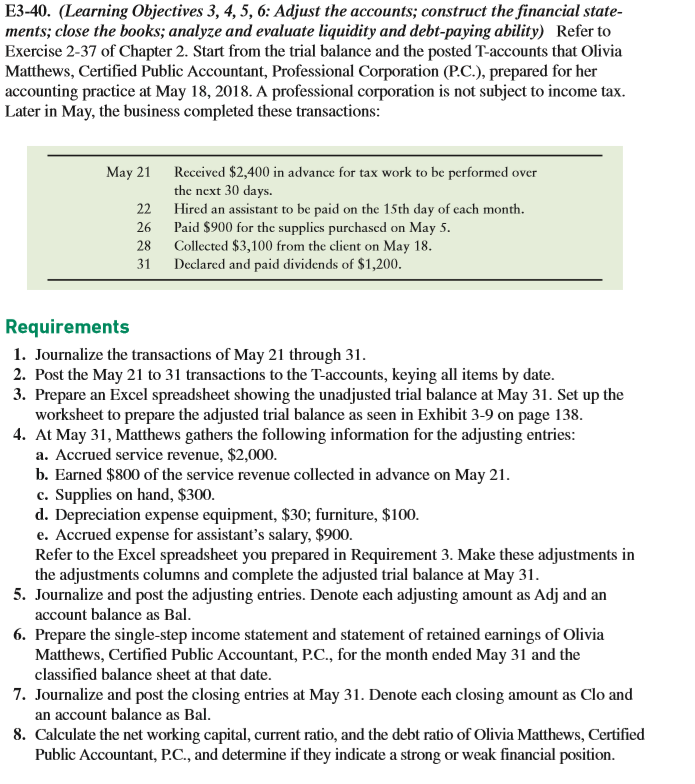

E2-37. (Learning Objectives 4, 5: Journalize and post transactions; construct and use a trial balance) Olivia Matthews, Certified Public Accountant, operates as a professional corpo- ration (P.C.). The business completed these transactions during the first part of May 2018: May 2 Received $12,000 cash from Matthews, and issued common stock to her. 2 Paid monthly office rent, $500. 3 Paid cash for a desktop computer, $1,800, with the computer expected to remain in service for five years. 4 Purchased office furniture on account, $6,000, with the furniture projected to last for five years. 5 Purchased supplies on account, $900. 9 Performed tax services for a client and received cash for the full amount of $600. 12 Received bill and paid utility expenses, $750. Performed consulting services for a client on account, $3,100. 18 E3-40. (Learning Objectives 3, 4, 5, 6: Adjust the accounts; construct the financial state- ments; close the books; analyze and evaluate liquidity and debt-paying ability) Refer to Exercise 2-37 of Chapter 2. Start from the trial balance and the posted T-accounts that Olivia Matthews, Certified Public Accountant, Professional Corporation (P.C.), prepared for her accounting practice at May 18, 2018. A professional corporation is not subject to income tax. Later in May, the business completed these transactions: May 21 Received $2,400 in advance for tax work to be performed over the next 30 days. 22 Hired an assistant to be paid on the 15th day of each month. 26 Paid $900 for the supplies purchased on May 5. 28 Collected $3,100 from the client on May 18. 31 Declared and paid dividends of $1,200. Requirements 1. Journalize the transactions of May 21 through 31. 2. Post the May 21 to 31 transactions to the T-accounts, keying all items by date. 3. Prepare an Excel spreadsheet showing the unadjusted trial balance at May 31. Set up the worksheet to prepare the adjusted trial balance as seen in Exhibit 3-9 on page 138. 4. At May 31, Matthews gathers the following information for the adjusting entries: a. Accrued service revenue, $2,000. b. Earned $800 of the service revenue collected in advance on May 21. c. Supplies on hand, $300. d. Depreciation expense equipment, $30; furniture, $100. e. Accrued expense for assistant's salary, $900. Refer to the Excel spreadsheet you prepared in Requirement 3. Make these adjustments in the adjustments columns and complete the adjusted trial balance at May 31. 5. Journalize and post the adjusting entries. Denote each adjusting amount as Adj and an account balance as Bal. 6. Prepare the single-step income statement and statement of retained earnings of Olivia Matthews, Certified Public Accountant, P.C., for the month ended May 31 and the classified balance sheet at that date. 7. Journalize and post the closing entries at May 31. Denote each closing amount as Clo and an account balance as Bal. 8. Calculate the net working capital, current ratio, and the debt ratio of Olivia Matthews, Certified Public Accountant, P.C., and determine if they indicate a strong or weak financial position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts