Question: Jsing the legend provided below, classify each statement as to the taxpayer for dependency exemption purposes. Legend Could be a qualifying child QC Could be

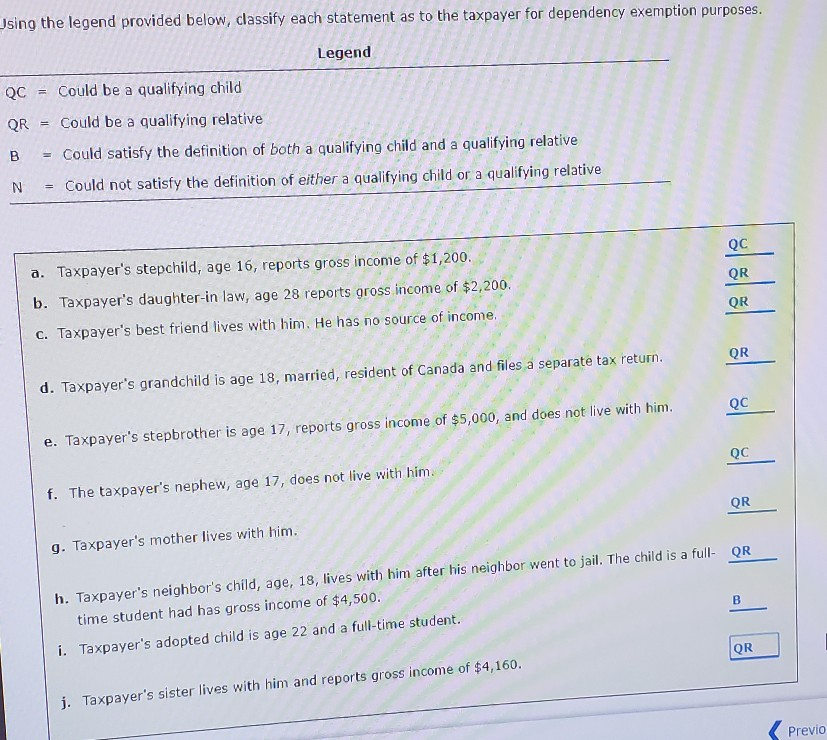

Jsing the legend provided below, classify each statement as to the taxpayer for dependency exemption purposes. Legend Could be a qualifying child QC Could be a qualifying relative QR Could satisfy the definition of both a qualifying child and a qualifying relative Could not satisfy the definition of either a qualifying child or a N qualifying relative Taxpayer's stepchild, age 16, reports gross income of $1,200. QC a. b. Taxpayer's daughter-in law, age 28 reports gross income of $2,200. QR QR c. Taxpayer's best friend lives with him. He has no source of income. QR d. Taxpayer's grandchild is age 18, married, resident of Canada and files a separate tax return. QC Taxpayer's stepbrother is age 17, reports gross income of $5,000, and does not live with him. e. QC f. The taxpayer's nephew, age 17, does not live with him. QR g. Taxpayer's mother lives with him. h. Taxpayer's neighbor's child, age, 18, lives with him after his neighbor went to jail. The child is a full- QR time student had has gross income of $4,500. i. Taxpayer's adopted child is age 22 and a full-time student. QR j. Taxpayer's sister lives with him and reports gross income of $4,160. Previo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts